Question: answers: a) expected return = 19.25% B) 15.48% C) 4.14% D) 1.89 The answers are provided but I don't know the steps to get these

answers:

a) expected return = 19.25% B) 15.48% C) 4.14% D) 1.89

The answers are provided but I don't know the steps to get these answers. please show all steps so I can fully understand how to solve. thank you!

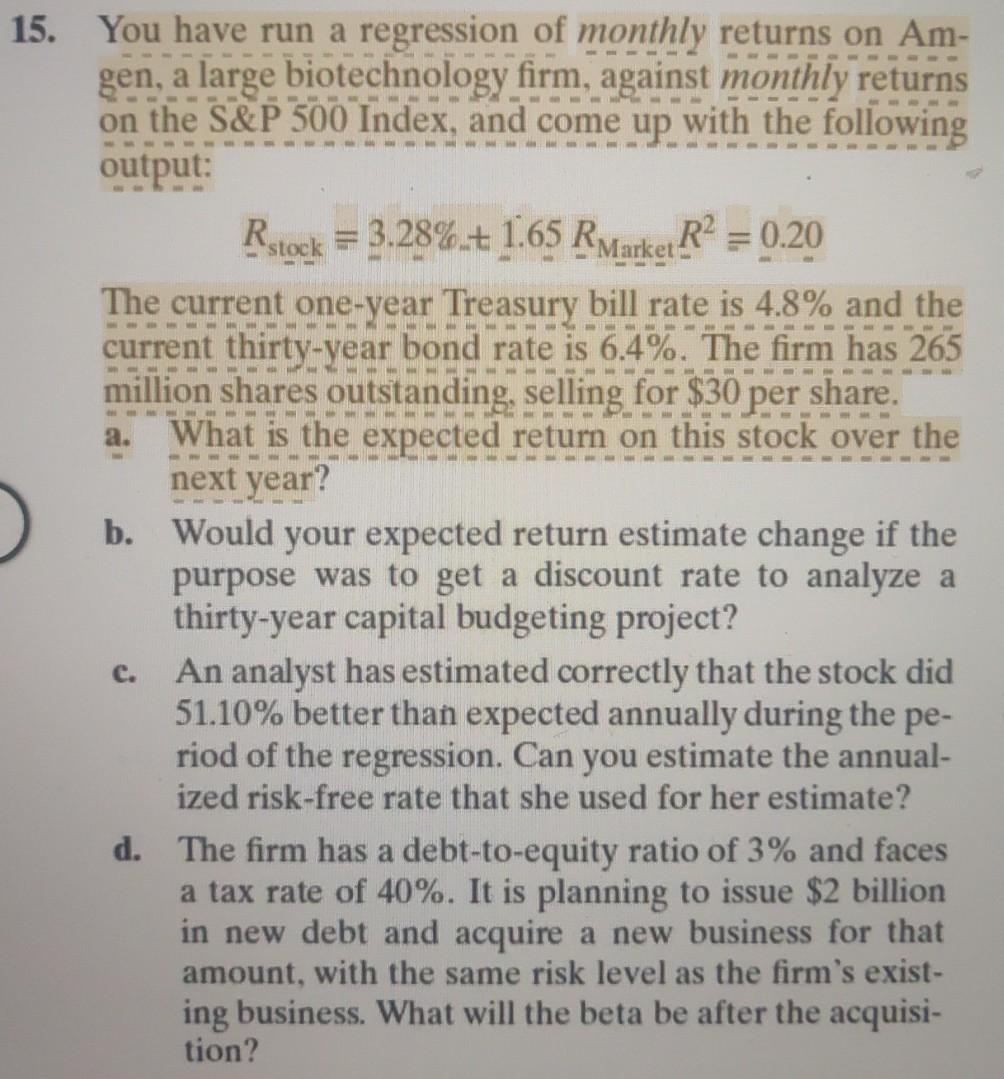

a. 15. You have run a regression of monthly returns on Am- gen, a large biotechnology firm, against monthly returns on the S&P 500 Index, and come up with the following output: Rstock = 3.28%.+ 1.65 RMarket R2 = 0.20 The current one-year Treasury bill rate is 4.8% and the current thirty-year bond rate is 6.4%. The firm has 265 million shares outstanding, selling for $30 per share. What is the s the expected return on this stock over the next year? b. Would your expected return estimate change if the purpose was to get a discount rate to analyze a thirty-year capital budgeting project? An analyst has estimated correctly that the stock did 51.10% better than expected annually during the pe- riod of the regression. Can you estimate the annual- ized risk-free rate that she used for her estimate? d. The firm has a debt-to-equity ratio of 3% and faces a tax rate of 40%. It is planning to issue $2 billion in new debt and acquire a new business for that amount, with the same risk level as the firm's exist- ing business. What will the beta be after the acquisi- tion? c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts