Question: any answers will be rated inmediately :) Question 3 (5+5+2= 12 marks) Ramsay Ford works for Auric Enterprises which smelts gold into one kilogram bars

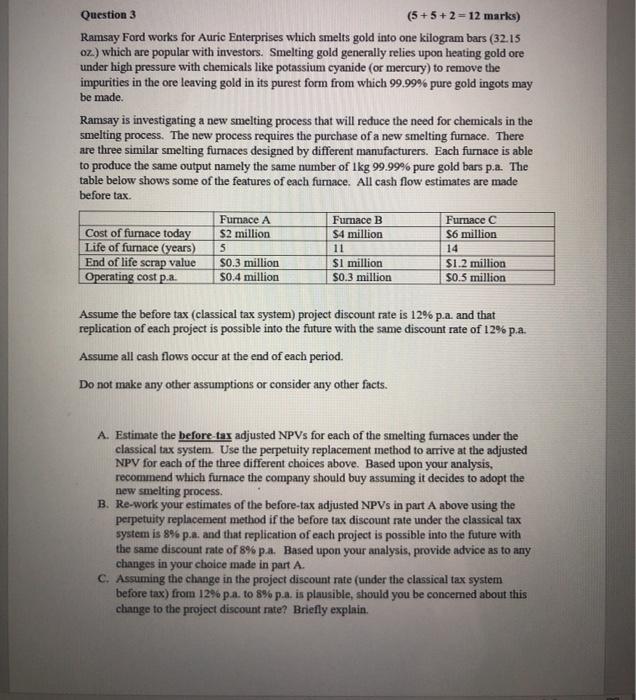

Question 3 (5+5+2= 12 marks) Ramsay Ford works for Auric Enterprises which smelts gold into one kilogram bars (32.15 oz.) which are popular with investors. Smelting gold generally relies upon heating gold ore under high pressure with chemicals like potassium cyanide (or mercury) to remove the impurities in the ore leaving gold in its purest form from which 99.99% pure gold ingots may be made. Ramsay is investigating a new smelting process that will reduce the need for chemicals in the smelting process. The new process requires the purchase of a new smelting fumace. There are three similar smelting fumaces designed by different manufacturers. Each furnace is able to produce the same output namely the same number of 1kg 99.99% pure gold bars p.a. The table below shows some of the features of each fumace. All cash flow estimates are made before tax. Furnace A Fumace B Fumace C Cost of furnace today $2 million S4 million $6 million Life of furnace (years) 11 End of life scrap value 50.3 million $1 million $1.2 million Operating cost p.a. $0.4 million 50.3 million 50.5 million 5 14 Assume the before tax (classical tax system) project discount rate is 12% p.a. and that replication of each project is possible into the future with the same discount rate of 12% p.a. Assume all cash flows occur at the end of each period. Do not make any other assumptions or consider any other facts. A. Estimate the before tax adjusted NPVs for each of the smelting fumaces under the classical tax system. Use the perpetuity replacement method to arrive at the adjusted NPV for each of the three different choices above. Based upon your analysis, recommend which furnace the company should buy assuming it decides to adopt the new smelting process B. Re-work your estimates of the before-tax adjusted NPVs in part A above using the perpetuity replacement method if the before tax discount rate under the classical tax system is 8% p.a. and that replication of each project is possible into the future with the same discount rate of 8% pa. Based upon your analysis, provide advice as to any changes in your choice made in part A. C. Assuming the change in the project discount rate (under the classical tax system before tax) from 12% pa. to 8% p.a. is plausible, should you be concemed about this change to the project discount rate? Briefly explain. Question 3 (5+5+2= 12 marks) Ramsay Ford works for Auric Enterprises which smelts gold into one kilogram bars (32.15 oz.) which are popular with investors. Smelting gold generally relies upon heating gold ore under high pressure with chemicals like potassium cyanide (or mercury) to remove the impurities in the ore leaving gold in its purest form from which 99.99% pure gold ingots may be made. Ramsay is investigating a new smelting process that will reduce the need for chemicals in the smelting process. The new process requires the purchase of a new smelting fumace. There are three similar smelting fumaces designed by different manufacturers. Each furnace is able to produce the same output namely the same number of 1kg 99.99% pure gold bars p.a. The table below shows some of the features of each fumace. All cash flow estimates are made before tax. Furnace A Fumace B Fumace C Cost of furnace today $2 million S4 million $6 million Life of furnace (years) 11 End of life scrap value 50.3 million $1 million $1.2 million Operating cost p.a. $0.4 million 50.3 million 50.5 million 5 14 Assume the before tax (classical tax system) project discount rate is 12% p.a. and that replication of each project is possible into the future with the same discount rate of 12% p.a. Assume all cash flows occur at the end of each period. Do not make any other assumptions or consider any other facts. A. Estimate the before tax adjusted NPVs for each of the smelting fumaces under the classical tax system. Use the perpetuity replacement method to arrive at the adjusted NPV for each of the three different choices above. Based upon your analysis, recommend which furnace the company should buy assuming it decides to adopt the new smelting process B. Re-work your estimates of the before-tax adjusted NPVs in part A above using the perpetuity replacement method if the before tax discount rate under the classical tax system is 8% p.a. and that replication of each project is possible into the future with the same discount rate of 8% pa. Based upon your analysis, provide advice as to any changes in your choice made in part A. C. Assuming the change in the project discount rate (under the classical tax system before tax) from 12% pa. to 8% p.a. is plausible, should you be concemed about this change to the project discount rate? Briefly explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts