Question: Any help with the steps would be highly appreciated! Katie and Todd have adjusted gross incomes of $48,300 and $33,800, respectively. Assume that each person

Any help with the steps would be highly appreciated!

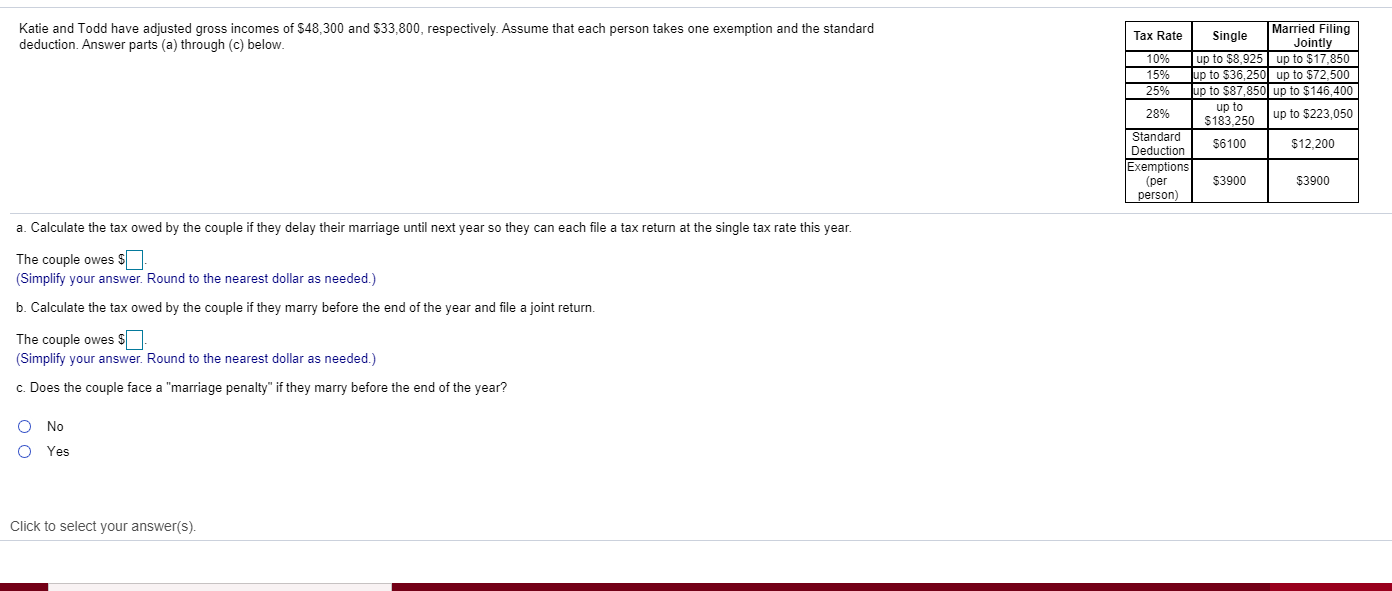

Katie and Todd have adjusted gross incomes of $48,300 and $33,800, respectively. Assume that each person takes one exemption and the standard deduction. Answer parts (a) through (c) below. Tax Rate Single Married Filing Jointly 10% up to $8,925 up to $17,850 15% up to $36,250 up to $72,500 25% up to $87,850 up to $146,400 28% up to $183,250 up to $223,050 Standard Deduction $6100 $12,200 Exemptions (per $3900 $3900 person) a. Calculate the tax owed by the couple if they delay their marriage until next year so they can each file a tax return at the single tax rate this year. The couple owes $ (Simplify your answer. Round to the nearest dollar as needed.) b. Calculate the tax owed by the couple if they marry before the end of the year and file a joint return. The couple owes $ (Simplify your answer. Round to the nearest dollar as needed.) c. Does the couple face a "marriage penalty" if they marry before the end of the year? O No O Yes Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts