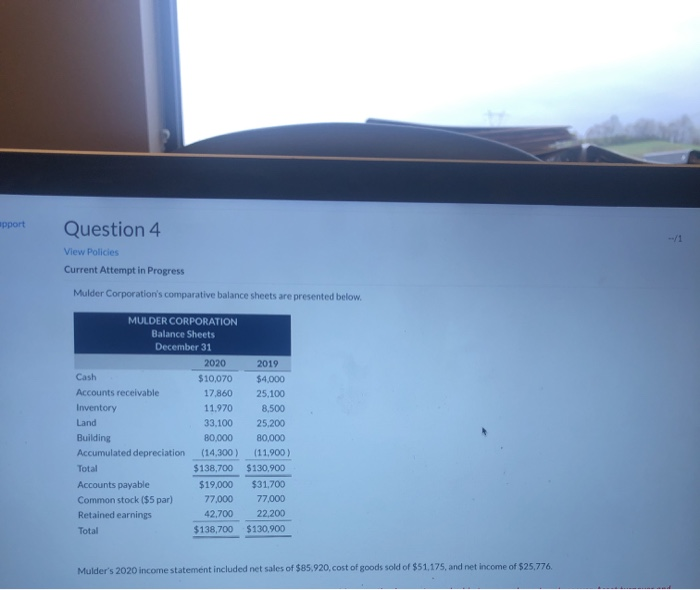

Question: apport Question 4 View Policies Current Attempt in Progress Mulder Corporation's comparative balance sheets are presented below. MULDER CORPORATION Balance Sheets December 31 2020 Cash

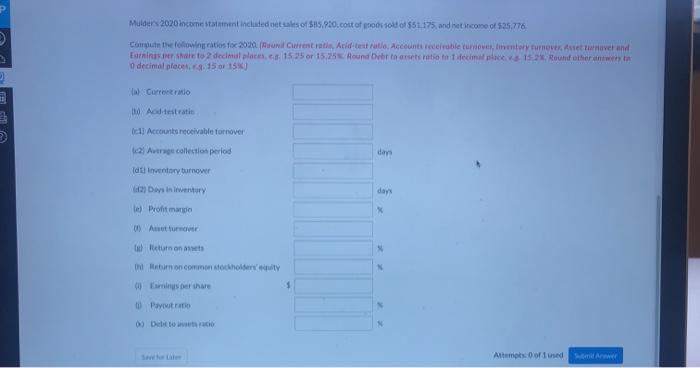

apport Question 4 View Policies Current Attempt in Progress Mulder Corporation's comparative balance sheets are presented below. MULDER CORPORATION Balance Sheets December 31 2020 Cash $10,070 Accounts receivable 17,860 Inventory 11.970 Land 33.100 Building 80,000 Accumulated depreciation (14,300) Total $138,700 Accounts payable $19.000 Common stock ($5 par) 77.000 Retained earnings 42,700 Total $138,700 2019 $4,000 25.100 8,500 25,200 80,000 (11.900) $130,900 $31.700 77.000 22,200 $130,900 Mulder's 2020 income statement included net sales of $85.920, cost of goods sold of $51,175, and net income of $25,776 Mulder's 2020 income statement included net sales of $85.920, cost of goods sold of $51.175. and net income of $25,776 Compute the following ratios for 2020. Round Current ratio. Acid-test ratio, Accounts receivable turnover, inventory turnover, Asset turnover and Earnings per share to 2 decimal places. 15.25 or 15.25% Round Debt to set ratio to I decimal place 15 Round other answers to O decimal places, s. 15 or 15%) La Current ratio lei) Accounts receivable turnover 2) Average collection period (dt) Inventory turnover (12) Days in Inventory e) Profit margin Asset over 0 Return an assets Return on common stockholders' equity to Earnings per share Payout ratio De toasts ratio Attempts: 0 of 1 used S itroner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts