Question: Ariana Kerantzasv ? tivity: Evaluating risk and return PM EDT Excel Online Structured Activity: Evaluating risk and return Stock has a 10.0% expected return, a

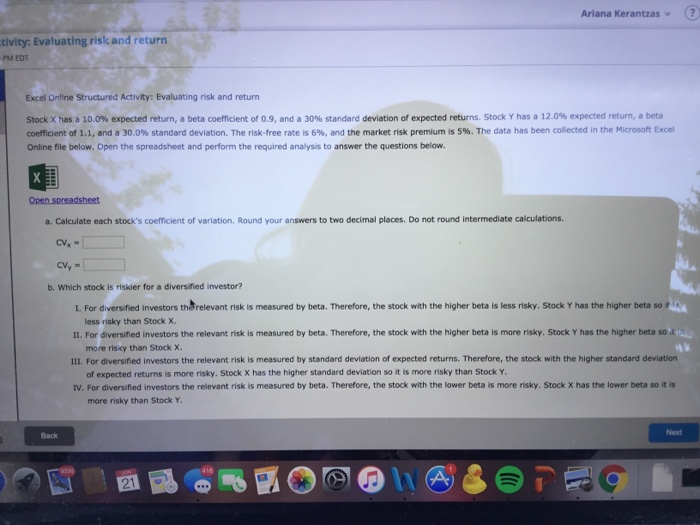

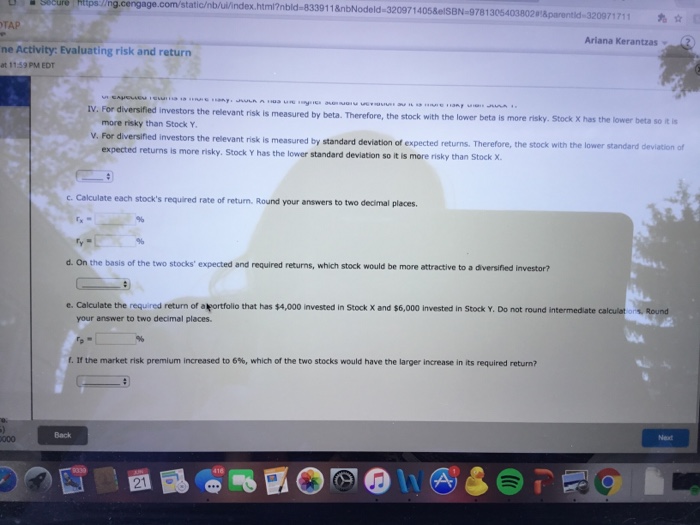

Ariana Kerantzasv ? tivity: Evaluating risk and return PM EDT Excel Online Structured Activity: Evaluating risk and return Stock has a 10.0% expected return, a beta coefficient of 0.9, and a 30% standard deviation of expected returns. Stock Y has a 12.0% expected return, a beta coefficient of 1.1, and a 30.0% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. The data has been collected in the Microsoft Excel Online file below, Open the spreadsheet and perform the required analysis to answer the questions below. a. Calculate each stock's coefficient of variation, Round your answers to two decimal places. Do not round intermediate calculations b. Which stock is riskier for a diversified investor? L For diversified investors th relevant risk is measured by beta. Therefore, the stock with the higher beta is less risky. Stock Y has the higher beta so Il. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is more risky. Stock Y has the higher beta so t 11. Fordiversified investors the relevant risk is measured by standard deviation o expected returns. Therefore, the stock with the higher standard deviation IV. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is more risky. Stock X has the lower beta so it is less risky than Stock X. more risky than Stock x. of expected returns is more risky. Stock X has the higher standard deviation so it is more risky than Stock Y more risky than Stock Y Next Back

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts