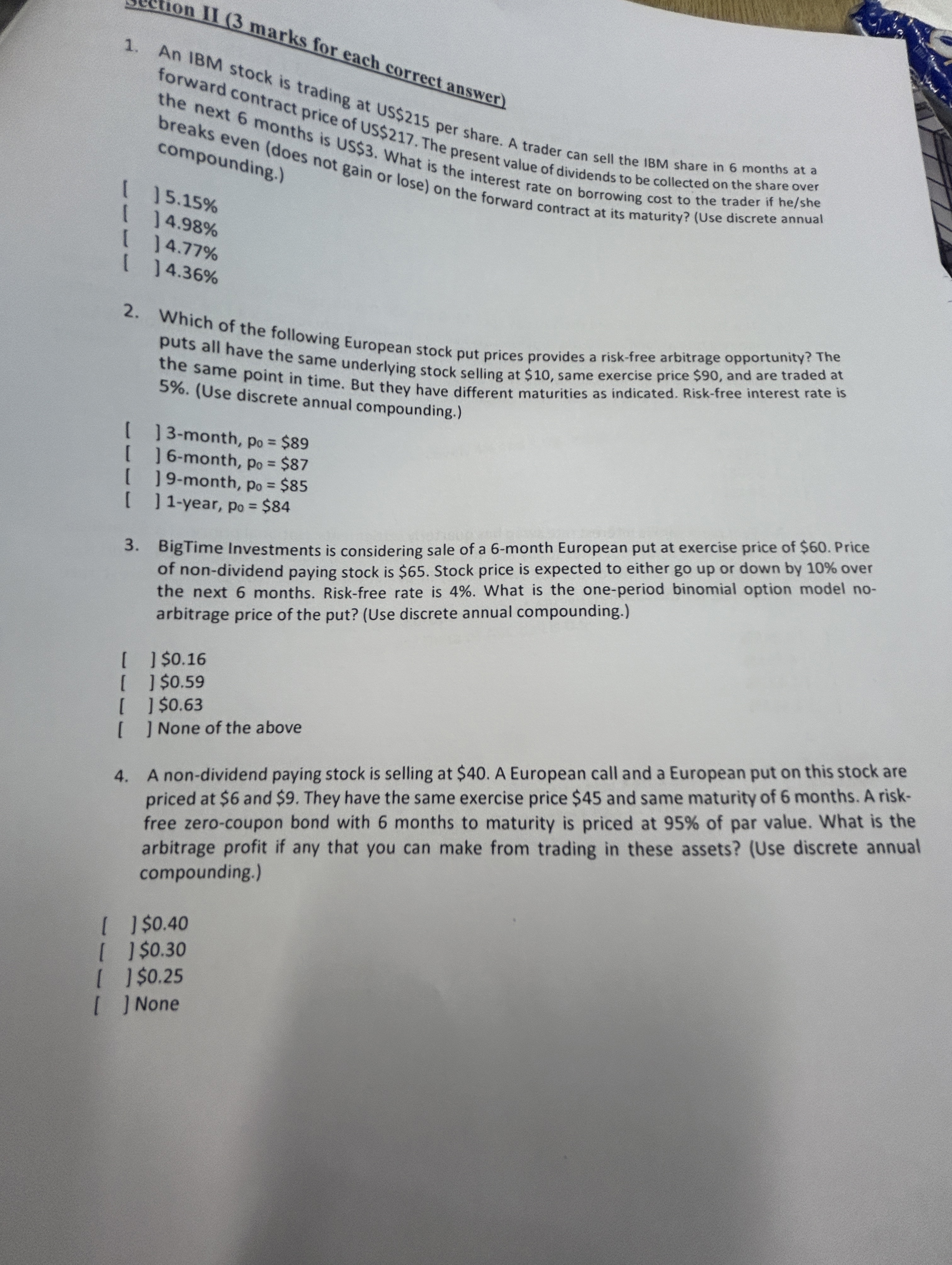

Question: arks for each correct answer ) forward contract is trading at US $ 2 1 5 per share. A trader can sell the IBM share

arks for each correct answer

forward contract is trading at US $ per share. A trader can sell the IBM share in months at a

the next mont price of US $ The present value of dividends to be collected on the share over

breaks even does is US$ What is the interest rate on borrowing cost to the trader if heshe

compounding. not gain or lose on the forward contract at its maturity? Use discrete annual

Which of the following European stock put prices provides a riskfree arbitrage opportunity? The

puts all have the same underlying stock selling at $ same exercise price $ and are traded at

the same point in time. But they have different maturities as indicated. Riskfree interest rate is

Use discrete annual compounding.

month, $

month, $

month, $

year, $

BigTime Investments is considering sale of a month European put at exercise price of $ Price

of nondividend paying stock is $ Stock price is expected to either go up or down by over

the next months. Riskfree rate is What is the oneperiod binomial option model no

arbitrage price of the put? Use discrete annual compounding.

$

$

$

None of the above

A nondividend paying stock is selling at $ A European call and a European put on this stock are

priced at $ and $ They have the same exercise price $ and same maturity of months. A risk

free zerocoupon bond with months to maturity is priced at of par value. What is the

arbitrage profit if any that you can make from trading in these assets? Use discrete annual

compounding.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock