Question: As I was going through this problem to help a student I realized that the author did not state what the requirements should be for

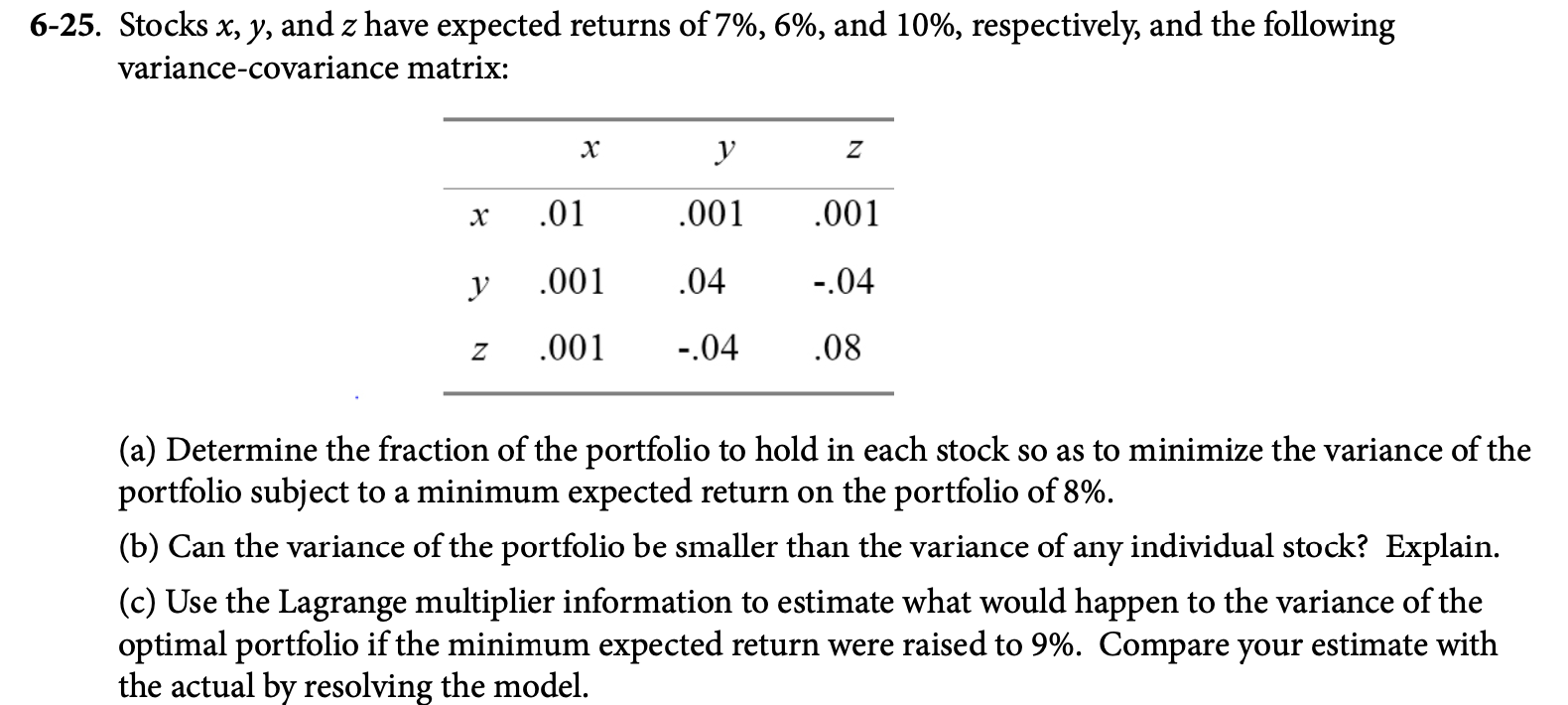

As I was going through this problem to help a student I realized that the author did not state what the requirements should be for each stock. So let's make it 6-25. Stocks x, y, and z have expected returns of 7%, 6%, and 10%, respectively, and the following variance-covariance matrix: X y z X .01 .001 .001 y .001 .04 -.04 Z .001 -.04 .08 (a) Determine the fraction of the portfolio to hold in each stock so as to minimize the variance of the portfolio subject to a minimum expected return on the portfolio of 8%. (b) Can the variance of the portfolio be smaller than the variance of any individual stock? Explain. (c) Use the Lagrange multiplier information to estimate what would happen to the variance of the optimal portfolio if the minimum expected return were raised to 9%. Compare your estimate with the actual by resolving the model

As I was going through this problem to help a student I realized that the author did not state what the requirements should be for each stock. So let's make it 6-25. Stocks x, y, and z have expected returns of 7%, 6%, and 10%, respectively, and the following variance-covariance matrix: X y z X .01 .001 .001 y .001 .04 -.04 Z .001 -.04 .08 (a) Determine the fraction of the portfolio to hold in each stock so as to minimize the variance of the portfolio subject to a minimum expected return on the portfolio of 8%. (b) Can the variance of the portfolio be smaller than the variance of any individual stock? Explain. (c) Use the Lagrange multiplier information to estimate what would happen to the variance of the optimal portfolio if the minimum expected return were raised to 9%. Compare your estimate with the actual by resolving the model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts