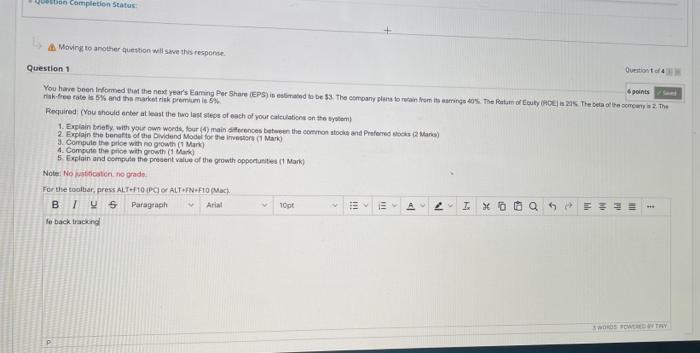

Question: ASAPP en Completion Status Moving to another question will save this response Question 1 You have been informed that the next year's Eaming Per Share

en Completion Status Moving to another question will save this response Question 1 You have been informed that the next year's Eaming Per Share (EPS) is stated to be 53. The company plans to main from the wings. The Return outy O 25 The beta of the company is 2 The mak.free rates 5% and the markers premium is 5% Required: (You should enter at least the two last steps of each of your calculations on the 1. Explain bratly with your own words four (4) main iferences between the common stock and Preferred to Mars 2. Explain the benefits of the Dividend Model for the investors (Mark) 3. Compute the price with no growth (1 Mark) 4. Compute the price with growth (1 mark) 5. Explain and compute the present value of the growth opportunites Mark) Note: No to no grado For the toolbar, press ALT 10 PCIO ALTOFN.F10 Mach BI US Paragraph Arial 10pt IXO QE Te back tracking 111 WORTHY

Step by Step Solution

There are 3 Steps involved in it

To solve the given problem well address each part of the question step by step 1 Differences Between Common Stock and Preferred Stock 1 Voting Rights ... View full answer

Get step-by-step solutions from verified subject matter experts