Question: Assessment 5 - Group Presentation Please see below for the specific case study to be used for the completion of your group assessment. It is

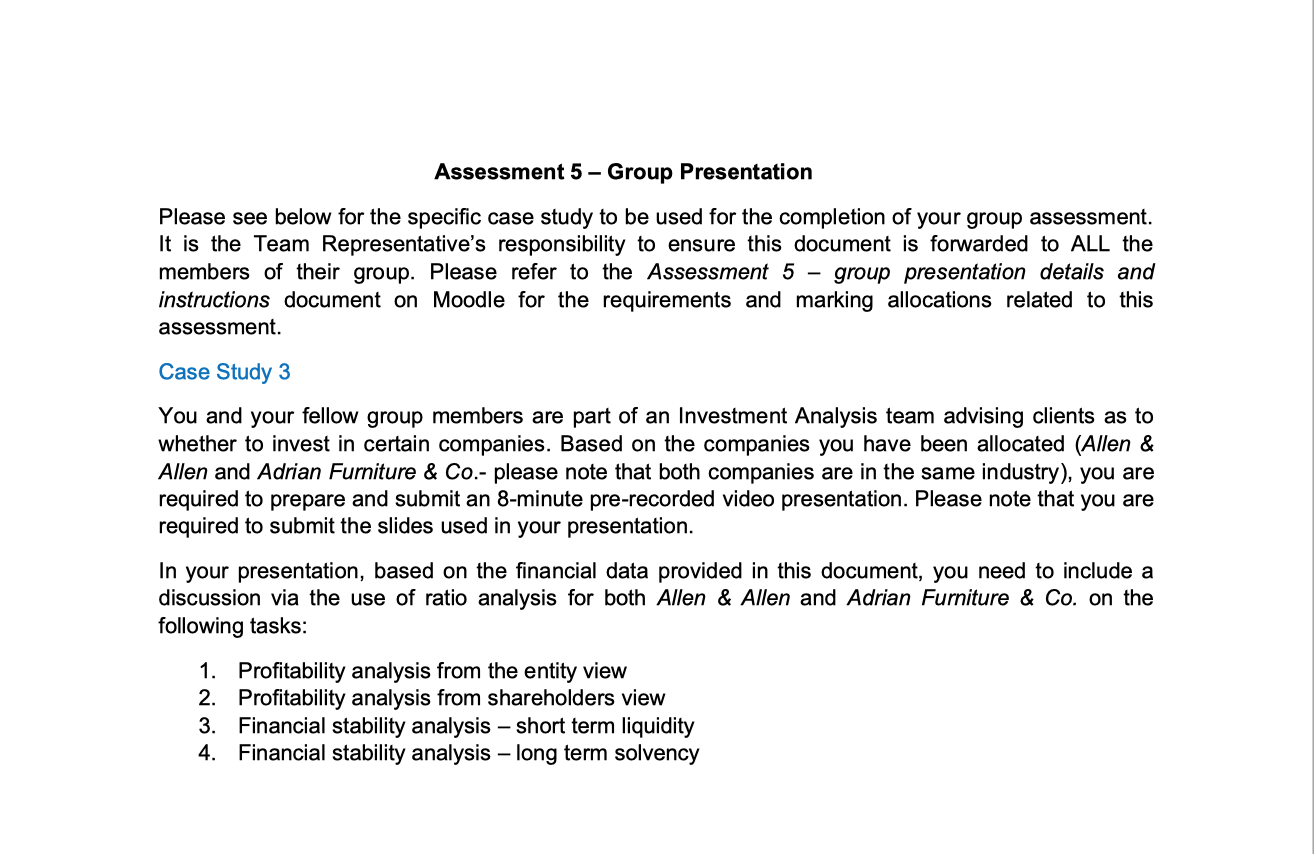

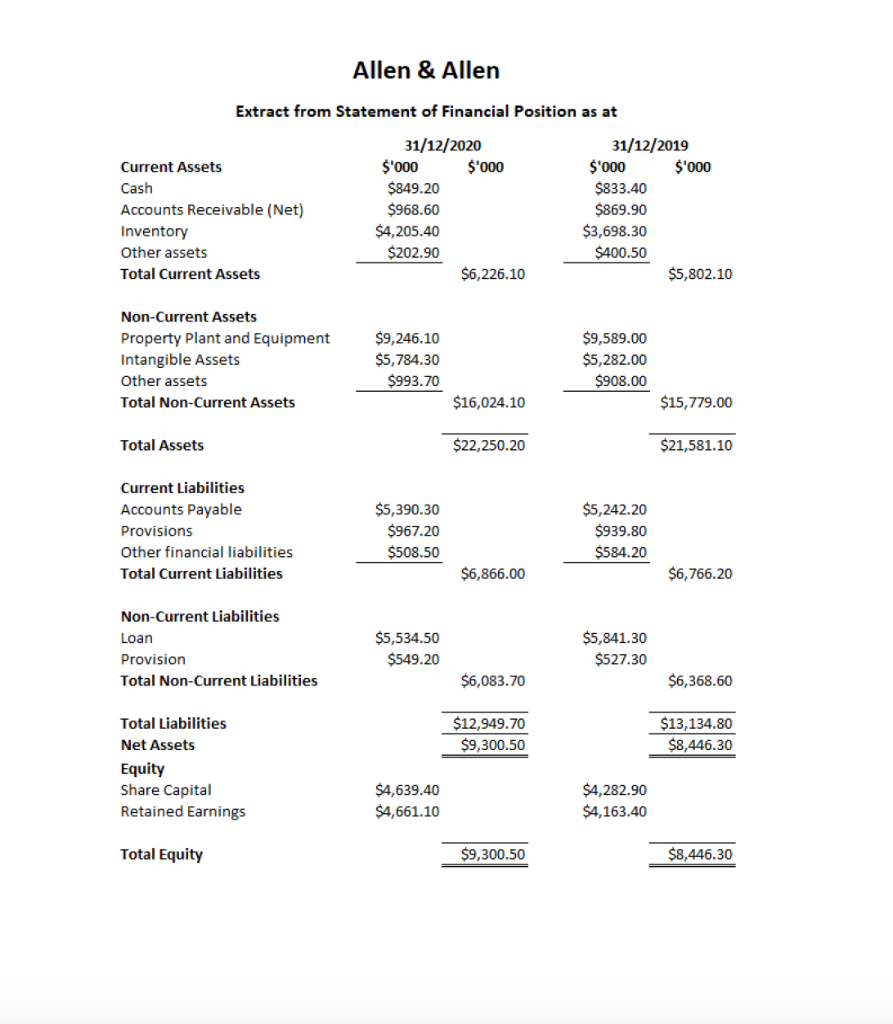

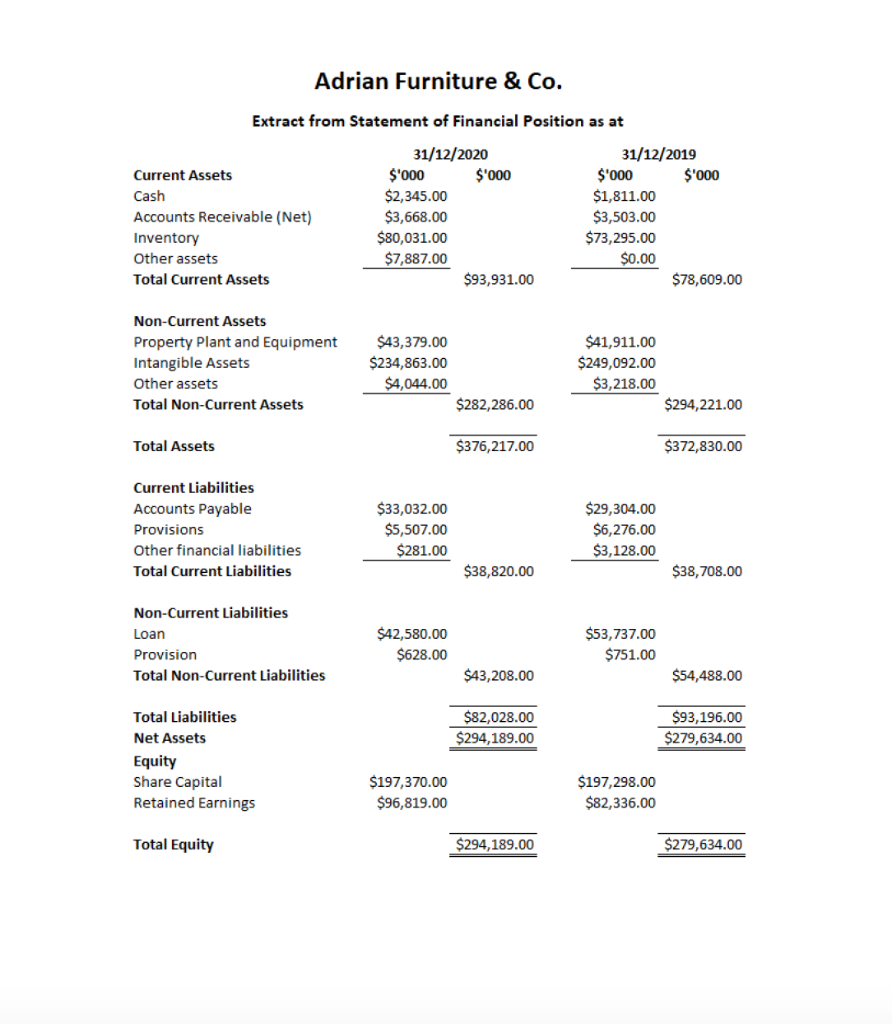

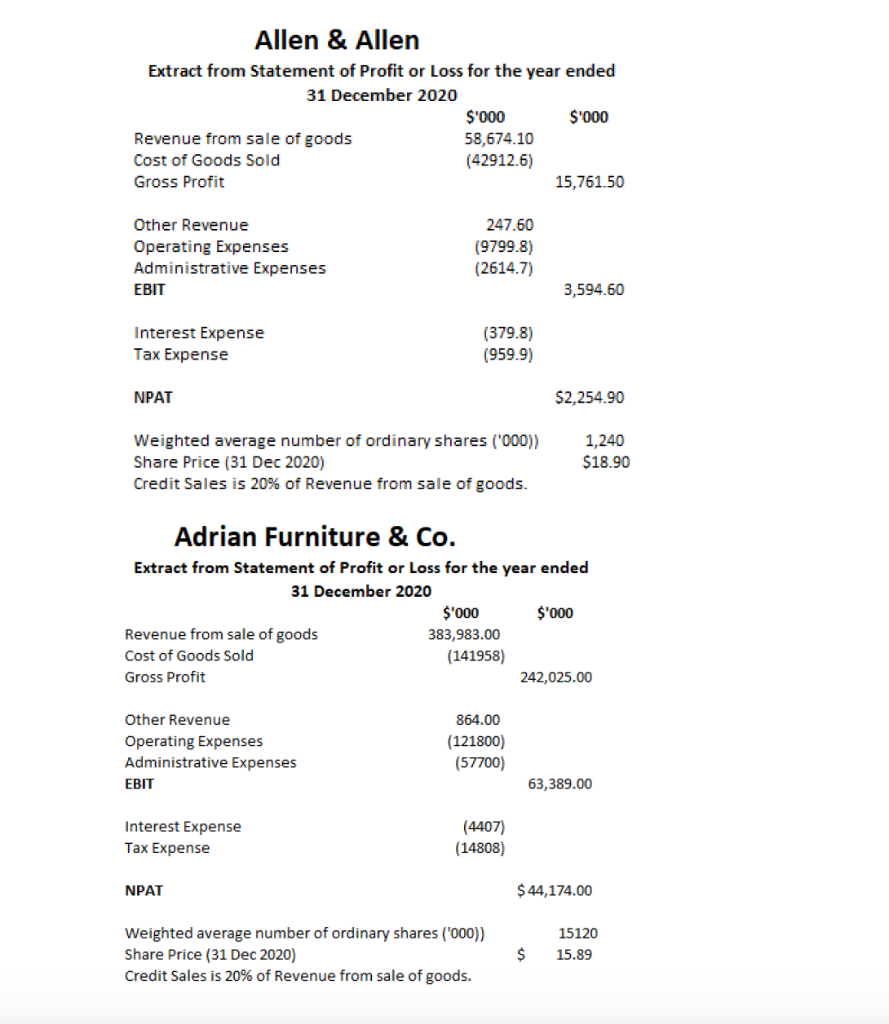

Assessment 5 - Group Presentation Please see below for the specific case study to be used for the completion of your group assessment. It is the Team Representative's responsibility to ensure this document is forwarded to ALL the members of their group. Please refer to the Assessment 5 group presentation details and instructions document on Moodle for the requirements and marking allocations related to this assessment. Case Study 3 You and your fellow group members are part of an Investment Analysis team advising clients as to whether to invest in certain companies. Based on the companies you have been allocated (Allen & Allen and Adrian Furniture & Co.- please note that both companies are in the same industry), you are required to prepare and submit an 8-minute pre-recorded video presentation. Please note that you are required to submit the slides used in your presentation. In your presentation, based on the financial data provided in this document, you need to include a discussion via the use of ratio analysis for both Allen & Allen and Adrian Furniture & Co. on the following tasks: 1. Profitability analysis from the entity view 2. Profitability analysis from shareholders view 3. Financial stability analysis short term liquidity 4. Financial stability analysis - long term solvency Allen & Allen Extract from Statement of Financial Position as at Current Assets Cash Accounts Receivable (Net) Inventory Other assets Total Current Assets 31/12/2020 $'000 $'000 $849.20 $968.60 $4,205.40 $202.90 $6,226.10 31/12/2019 $'000 $'000 $833.40 $869.90 $3,698.30 $400.50 $5,802.10 Non-Current Assets Property Plant and Equipment Intangible Assets Other assets Total Non-Current Assets $9,246.10 $5,784.30 $993.70 $9,589.00 $5,282.00 $908.00 $16,024.10 $15,779.00 Total Assets $22,250.20 $21,581.10 Current Liabilities Accounts Payable Provisions Other financial liabilities Total Current Liabilities $5,390.30 $967.20 $508.50 $5,242.20 $939.80 $584.20 $6,866.00 $6,766.20 Non-Current Liabilities Loan Provision Total Non-Current Liabilities $5,534.50 $549.20 $5,841.30 $527.30 $6,083.70 $6,368.60 $12,949.70 $9,300.50 $13,134.80 $8,446.30 Total Liabilities Net Assets Equity Share Capital Retained Earnings $4,639.40 $4,661.10 $4,282.90 $4,163.40 Total Equity $9,300.50 $8,446.30 Adrian Furniture & Co. Extract from Statement of Financial Position as at Current Assets Cash Accounts Receivable (Net) Inventory Other assets Total Current Assets 31/12/2020 $'000 $'000 $2,345.00 $3,668.00 $80,031.00 $7,887.00 $93,931.00 31/12/2019 $'000 $'000 $1,811.00 $3,503.00 $73,295.00 $0.00 $78,609.00 Non-Current Assets Property Plant and Equipment Intangible Assets Other assets Total Non-Current Assets $43,379.00 $234,863.00 $4,044.00 $282,286.00 $41,911.00 $249,092.00 $3,218.00 $294,221.00 Total Assets $376,217.00 $372,830.00 Current Liabilities Accounts Payable Provisions Other financial liabilities Total Current Liabilities $33,032.00 $5,507.00 $281.00 $29,304.00 $6,276.00 $3,128.00 $38,820.00 $38,708.00 Non-Current Liabilities Loan Provision Total Non-Current Liabilities $42,580.00 $628.00 $53,737.00 $751.00 $43,208.00 $54,488.00 $82,028.00 $294,189.00 $93,196.00 $279,634.00 Total Liabilities Net Assets Equity Share Capital Retained Earnings $197,370.00 $96,819.00 $197,298.00 $82,336.00 Total Equity $294,189.00 $279,634.00 Allen & Allen Extract from Statement of Profit or Loss for the year ended 31 December 2020 $'000 $'000 Revenue from sale of goods 58,674.10 Cost of Goods Sold (42912.6) Gross Profit 15,761.50 Other Revenue Operating Expenses Administrative Expenses EBIT 247.60 (9799.8) (2614.7) 3,594.60 Interest Expense Tax Expense (379.8) (959.9) NPAT $2,254.90 Weighted average number of ordinary shares ('000)) Share Price (31 Dec 2020) Credit Sales is 20% of Revenue from sale of goods. 1,240 $18.90 Adrian Furniture & Co. Extract from Statement of Profit or Loss for the year ended 31 December 2020 $'000 $'000 Revenue from sale of goods 383,983.00 Cost of Goods Sold (141958) Gross Profit 242,025.00 Other Revenue Operating Expenses Administrative Expenses EBIT 864.00 (121800) (57700) 63,389.00 Interest Expense Tax Expense (4407) (14808) NPAT $ 44,174.00 Weighted average number of ordinary shares ('000)) Share Price (31 Dec 2020) Credit Sales is 20% of Revenue from sale of goods. 15120 15.89 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts