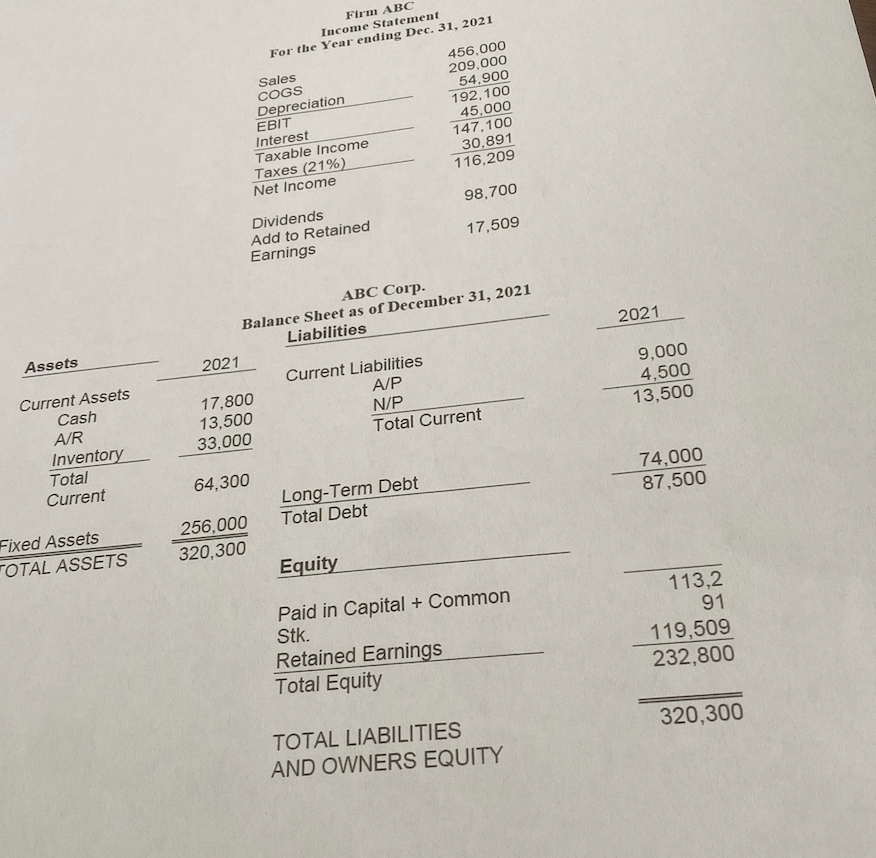

Question: Assets Current Assets Cash A/R Inventory Total Current Fixed Assets TOTAL ASSETS Firm ABC Income Statement For the Year ending Dec. 31, 2021 Sales 456,000

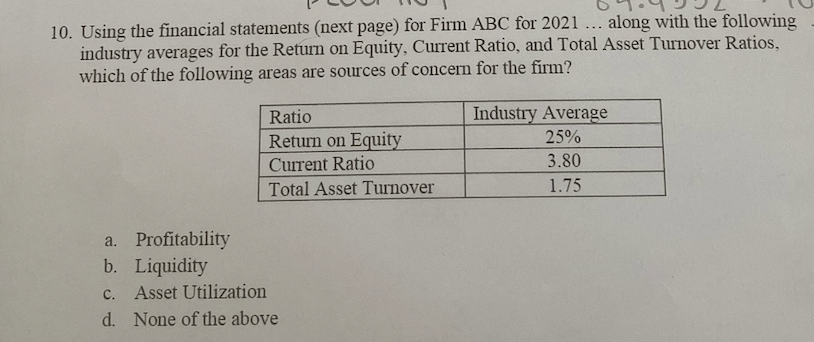

Assets Current Assets Cash A/R Inventory Total Current Fixed Assets TOTAL ASSETS Firm ABC Income Statement For the Year ending Dec. 31, 2021 Sales 456,000 COGS 209,000 Depreciation 54,900 EBIT 192,100 Interest 45,000 Taxable Income 147,100 Taxes (21%) 30,891 Net Income 116,209 Dividends 98,700 Add to Retained Earnings 17,509 ABC Corp. Balance Sheet as of December 31, 2021 Liabilities Current Liabilities A/P N/P Total Current 2021 17,800 13,500 33,000 64,300 256,000 320,300 Long-Term Debt Total Debt Equity Paid in Capital + Common Stk. Retained Earnings Total Equity TOTAL LIABILITIES AND OWNERS EQUITY 2021 9,000 4,500 13,500 74,000 87,500 113,2 91 119,509 232,800 320,300 10. Using the financial statements (next page) for Firm ABC for 2021 ... along with the following industry averages for the Return on Equity, Current Ratio, and Total Asset Turnover Ratios, which of the following areas are sources of concern for the firm? Ratio Industry Average 25% Return on Equity Current Ratio 3.80 Total Asset Turnover 1.75 a. Profitability b. Liquidity C. Asset Utilization d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts