Question: ASSIGNMENT #3 The purpose of this assignment is to solidify your understanding on the applications of the cost of capital topics. The scores of this

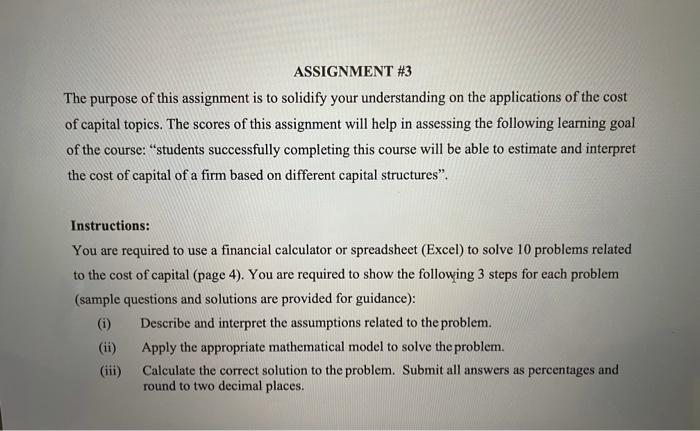

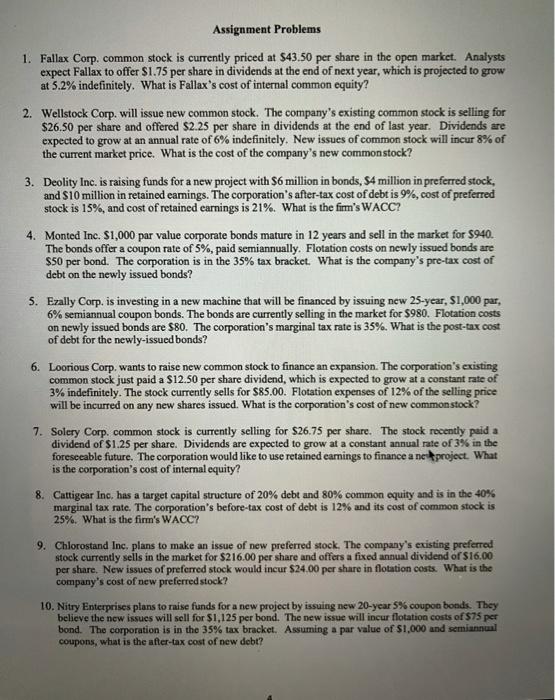

ASSIGNMENT #3 The purpose of this assignment is to solidify your understanding on the applications of the cost of capital topics. The scores of this assignment will help in assessing the following learning goal of the course: students successfully completing this course will be able to estimate and interpret the cost of capital of a firm based on different capital structures. Instructions: You are required to use a financial calculator or spreadsheet (Excel) to solve 10 problems related to the cost of capital (page 4). You are required to show the following 3 steps for each problem (sample questions and solutions are provided for guidance): (1) Describe and interpret the assumptions related to the problem. (ii) Apply the appropriate mathematical model to solve the problem. (iii) Calculate the correct solution to the problem. Submit all answers as percentages and round to two decimal places. Assignment Problems 1. Fallax Corp. common stock is currently priced at $43.50 per share in the open market. Analysts expect Fallax to offer S1.75 per share in dividends at the end of next year, which is projected to grow at 5.2% indefinitely. What is Fallax's cost of internal common equity? 2. Wellstock Corp. will issue new common stock. The company's existing common stock is selling for $26.50 per share and offered $2.25 per share in dividends at the end of last year. Dividends are expected to grow at an annual rate of 6% indefinitely. New issues of common stock will incur 8% of the current market price. What is the cost of the company's new common stock? 3. Deolity Inc. is raising funds for a new project with $6 million in bonds, S4 million in preferred stock, and $10 million in retained earings. The corporation's after-tax cost of debt is 9%, cost of preferred stock is 15%, and cost of retained earnings is 21%. What is the firm's WACC? 4. Monted Inc. $1,000 par value corporate bonds mature in 12 years and sell in the market for $940. The bonds offer a coupon rate of 5%, paid semiannually. Flotation costs on newly issued bonds are $50 per bond. The corporation is in the 35% tax bracket. What is the company's pre-tax cost of debt on the newly issued bonds? 5. Ezally Corp. is investing in a new machine that will be financed by issuing new 25-year, $1,000 par, 6% semiannual coupon bonds. The bonds are currently selling in the market for $980. Flotation costs on newly issued bonds are $80. The corporation's marginal tax rate is 35%. What is the post-tax cost of debt for the newly-issued bonds? 6. Loorious Corp. wants to raise new common stock to finance an expansion. The corporation's existing common stock just paid a $12.50 per share dividend, which is expected to grow at a constant rate of 3% indefinitely. The stock currently sells for $85.00. Flotation expenses of 12% of the selling price will be incurred on any new shares issued. What is the corporation's cost of new common stock? 7. Solery Corp. common stock is currently selling for $26.75 per share. The stock recently paid a dividend of $1.25 per share. Dividends are expected to grow at a constant annual rate of 3% in the foreseeable future. The corporation would like to use retained earnings to finance a ne project. What is the corporation's cost of internal equity? 8. Cattigear Inc. has a target capital structure of 20% debt and 80% common equity and is in the 40% marginal tax rate. The corporation's before-tax cost of debt is 12% and its cost of common stock is 25%. What is the firm's WACC? 9. Chlorostand Inc. plans to make an issue of new preferred stock. The company's existing preferred stock currently sells in the market for $216.00 per share and offers a fixed annual dividend of $16.00 per share. New issues of preferred stock would incur S24.00 per share in flotation costs. What is the company's cost of new preferred stock? 10. Nitry Enterprises plans to raise funds for a new project by issuing new 20-year 5% coupon bonds. They believe the new issues will sell for $1,125 per bond. The new issue will incur flotation costs of $75 per bond. The corporation is in the 35% tax bracket. Assuming a par value of $1,000 and semiannual coupons, what is the after-tax cost of new debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts