Question: Assignment 5 - Modelling the Volatility Smile. The Black Scholes Option Pricing Model can be modified to value options on securities paying a continuous dividend.

Assignment 5 - Modelling the Volatility Smile.

The Black Scholes Option Pricing Model can be modified to value options on securities paying a continuous dividend. This modification is known as the Garman Kohlhagen model and is frequently applied to options on currencies and stock market indices.

Whereand.

Required:

1.Build a function to value options using the Garman Kohlhagen model above.

2.Build a function to calculate implied volatility.

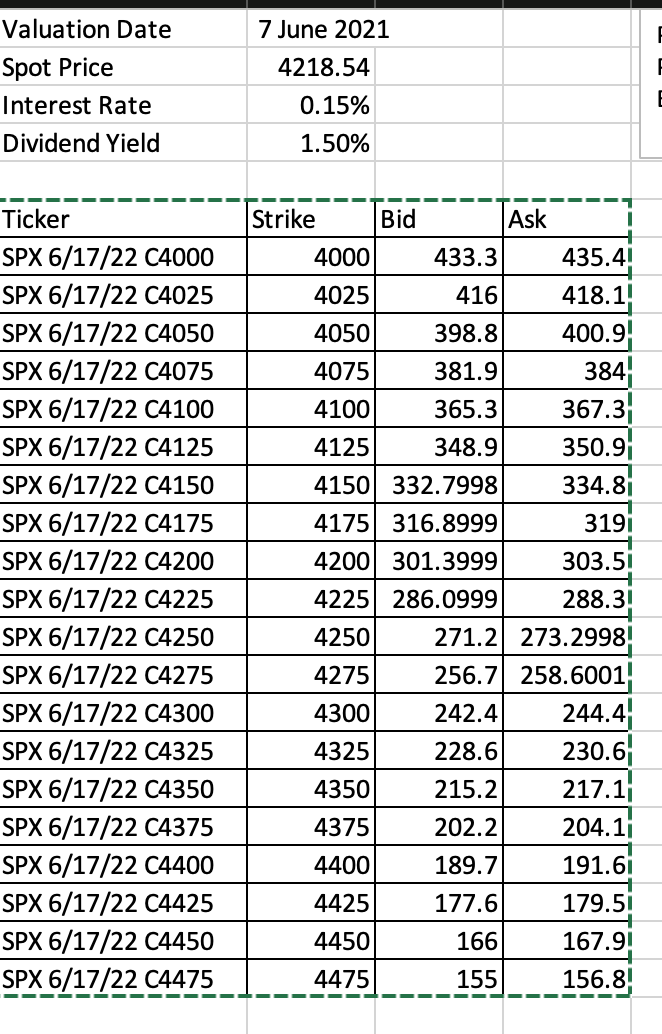

3.Use the implied volatility function to compute the market volatility values associated with the strike prices and option prices supplied in the spreadsheets Option Data A, Option Data B and Option Data C depending on the letter assigned to you.

4.Sketch the volatility smile, write a short explanation of the volatility smile.

Price data forcalloptions onthe S&P 500

Pricing Date 7th June 2021

Expiration Date 17th June 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts