Question: Assignment Module 3 This assignment is mandatory and will therefore be evaluated as part of your final grade. This assignment must be completed individually. Before

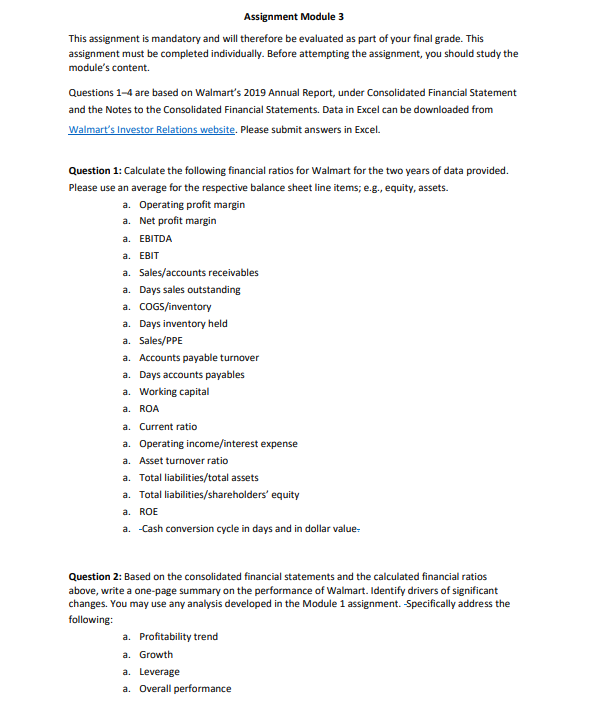

Assignment Module 3 This assignment is mandatory and will therefore be evaluated as part of your final grade. This assignment must be completed individually. Before attempting the assignment, you should study the module's content. Questions 1-4 are based on Walmart's 2019 Annual Report, under Consolidated Financial Statement and the Notes to the Consolidated Financial Statements. Data in Excel can be downloaded from Walmart's Investor Relations website. Please submit answers in Excel. Question 1: Calculate the following financial ratios for Walmart for the two years of data provided. Please use an average for the respective balance sheet line items; e.g., equity, assets. a. Operating profit margin a. Net profit margin a. EBITDA a. EBIT a. Sales/accounts receivables a. Days sales outstanding a. COGS/inventory a. Days inventory held a. Sales/PPE a. Accounts payable turnover a. Days accounts payables a. Working capital a. ROA a. Current ratio a. Operating income/interest expense a. Asset turnover ratio a. Total liabilities/total assets a. Total liabilities/shareholders' equity a. ROE a. -Cash conversion cycle in days and in dollar value- Question 2: Based on the consolidated financial statements and the calculated financial ratios above, write a one-page summary on the performance of Walmart. Identify drivers of significant changes. You may use any analysis developed in the Module 1 assignment. -Specifically address the following: a. Profitability trend a. Growth a. Leverage a. Overall performance Question 3: Calculate ROE and identify drivers. Calculate growth rate (g). Question 4: Project income statement and balance sheet for the next 5 years, assuming that revenue growth continues at the same rate and cost structure and common-size position remain the same. Assignment Module 3 This assignment is mandatory and will therefore be evaluated as part of your final grade. This assignment must be completed individually. Before attempting the assignment, you should study the module's content. Questions 1-4 are based on Walmart's 2019 Annual Report, under Consolidated Financial Statement and the Notes to the Consolidated Financial Statements. Data in Excel can be downloaded from Walmart's Investor Relations website. Please submit answers in Excel. Question 1: Calculate the following financial ratios for Walmart for the two years of data provided. Please use an average for the respective balance sheet line items; e.g., equity, assets. a. Operating profit margin a. Net profit margin a. EBITDA a. EBIT a. Sales/accounts receivables a. Days sales outstanding a. COGS/inventory a. Days inventory held a. Sales/PPE a. Accounts payable turnover a. Days accounts payables a. Working capital a. ROA a. Current ratio a. Operating income/interest expense a. Asset turnover ratio a. Total liabilities/total assets a. Total liabilities/shareholders' equity a. ROE a. -Cash conversion cycle in days and in dollar value- Question 2: Based on the consolidated financial statements and the calculated financial ratios above, write a one-page summary on the performance of Walmart. Identify drivers of significant changes. You may use any analysis developed in the Module 1 assignment. -Specifically address the following: a. Profitability trend a. Growth a. Leverage a. Overall performance Question 3: Calculate ROE and identify drivers. Calculate growth rate (g). Question 4: Project income statement and balance sheet for the next 5 years, assuming that revenue growth continues at the same rate and cost structure and common-size position remain the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts