Question: Assignment Task Three 5 marks Ms Adder is a 28 year old individual resident of Australia (Melbourne) for taxation purposes. She was employed as an

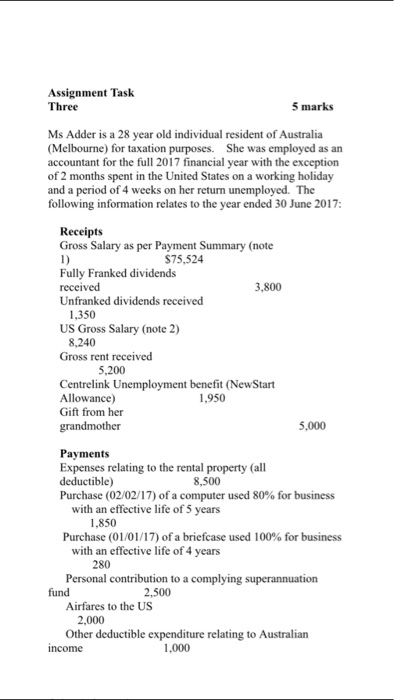

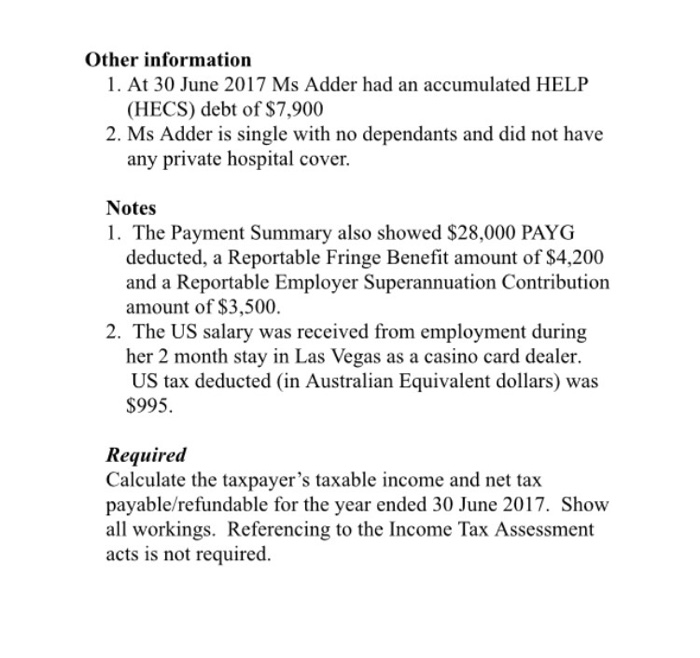

Assignment Task Three 5 marks Ms Adder is a 28 year old individual resident of Australia (Melbourne) for taxation purposes. She was employed as an accountant for the full 2017 financial year with the exception of 2 months spent in the United States on a working holiday and a period of 4 weeks on her return unemployed. The following information relates to the year ended 30 June 2017: Receipts Gross Salary as per Payment Summary (note $75,524 Fully Franked dividends received 3.800 Unfranked dividends received 1,350 US Gross Salary (note 2) 8,240 Gross rent received 5,200 Centrelink Unemployment benefit (NewStart 1,950 Allowance) Gift from her grandmother 5.000 Payments Expenses relating to the rental property (all deductible) 8,500 Purchase (02/02/17) of a computer used 80% for business with an effective life of 5 years 1.850 Purchase (01/01/17) of a briefcase used 100% for business with an effective life of 4 years 280 Personal contribution to a complying superannuation fund 2,500 Airfares to the US 2,000 other deductible expenditure relating to Australian 1.000 Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts