Question: Assume a borrower purchased a $ 1 0 0 , 0 0 0 house with a $ 5 , 0 0 0 down payment and

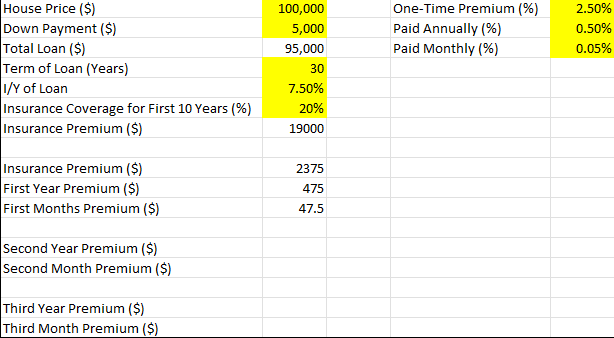

Assume a borrower purchased a $ house with a $ down payment and a year loan with a fixed annual rate of The lender takes a private mortgage insurance that covers percent of the loan for the first years of the loan term. Compute the dollar amount of insurance premium if: a the premium is of the loan amount and it is paid at closing as a one time premium; b the premium is of outstanding mortgage balance and it is paid annually as a percentage of remaining loan balance; c the premium is of outstanding mortgage balance and it is paid monthly as a percentage of remaining loan balance.

These are the answers, please make an excel file able to get these numbers and solve the problem. Please use cell referances.

a $; b first years premium is $ second years premium is $ third years premium is $ etc.; c first months premium is $ second months premium is $ third months premium is $ etc.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock