Question: Assume that the annual inverse demand function for a product be P-150-Q. The product is offered by a pair of Bertrand competitors, each with

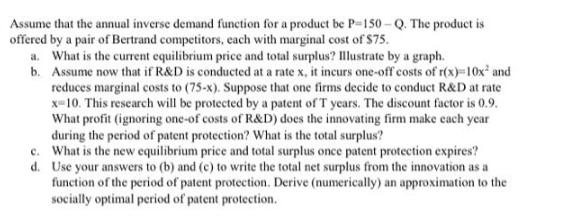

Assume that the annual inverse demand function for a product be P-150-Q. The product is offered by a pair of Bertrand competitors, each with marginal cost of $75. a. What is the current equilibrium price and total surplus? Illustrate by a graph. b. Assume now that if R&D is conducted at a rate x, it incurs one-off costs of r(x)=10x and reduces marginal costs to (75-x). Suppose that one firms decide to conduct R&D at rate x-10. This research will be protected by a patent of 'T years. The discount factor is 0.9. What profit (ignoring one-of costs of R&D) does the innovating firm make each year during the period of patent protection? What is the total surplus? c. What is the new equilibrium price and total surplus once patent protection expires? d. Use your answers to (b) and (c) to write the total net surplus from the innovation as a function of the period of patent protection. Derive (numerically) an approximation to the socially optimal period of patent protection.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts