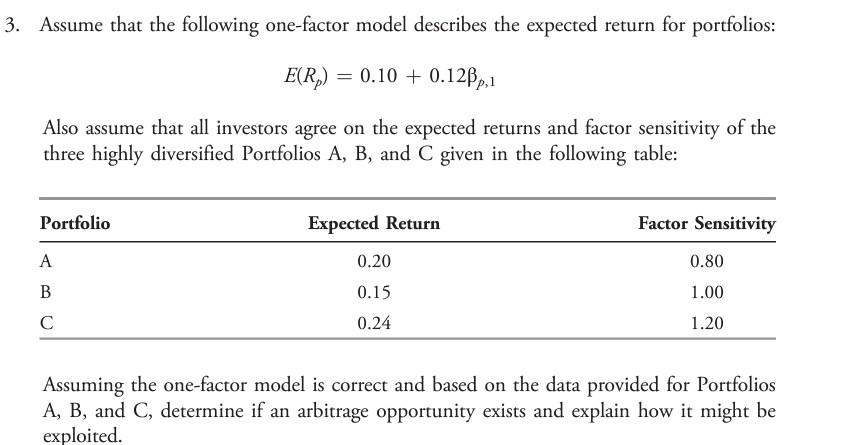

Question: Assume that the following one-factor model describes the expected return for portfolios: E(Rp)=0.10+0.12p,1 Also assume that all investors agree on the expected returns and factor

Assume that the following one-factor model describes the expected return for portfolios: E(Rp)=0.10+0.12p,1 Also assume that all investors agree on the expected returns and factor sensitivity of the three highly diversified Portfolios A, B, and C given in the following table: Assuming the one-factor model is correct and based on the data provided for Portfolios A, B, and C, determine if an arbitrage opportunity exists and explain how it might be exploited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts