Question: Assuming the capital asset pricing model (CAPM), we are looking at a market composed of only two risky assets A and B with returns rA

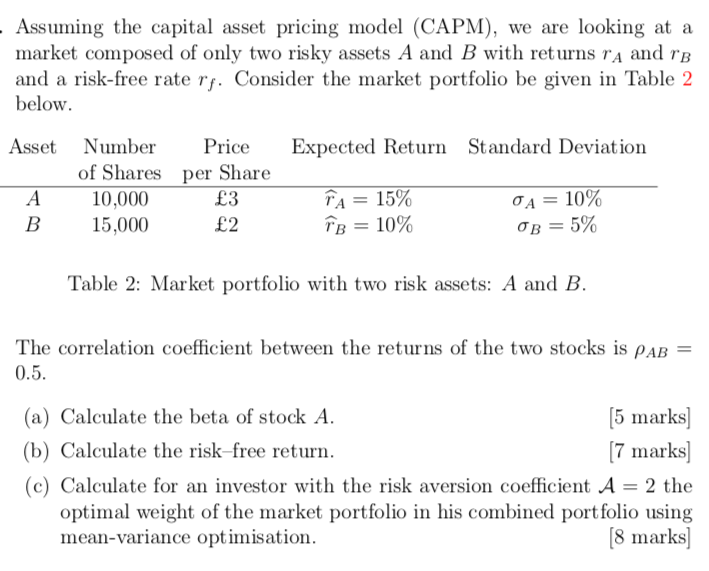

Assuming the capital asset pricing model (CAPM), we are looking at a market composed of only two risky assets A and B with returns rA and rb and a risk-free rate rf. Consider the market portfolio be given in Table 2 below. Asset Expected Return Standard Deviation Number of Shares 10,000 15,000 Price per Share 3 2 B TA = 15% 10% A = 10% ob = 5% Table 2: Market portfolio with two risk assets: A and B. The correlation coefficient between the returns of the two stocks is PAB 0.5. (a) Calculate the beta of stock A. [5 marks) (b) Calculate the risk-free return. [7 marks) (c) Calculate for an investor with the risk aversion coefficient A = 2 the optimal weight of the market portfolio in his combined portfolio using mean-variance optimisation. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts