Question: Assuming ThermaClear was successful using DRTV as Scocimara predicted, the product line would self-fund its growth. Scocimara explained DRTV is an extremely capital-efficient model. With

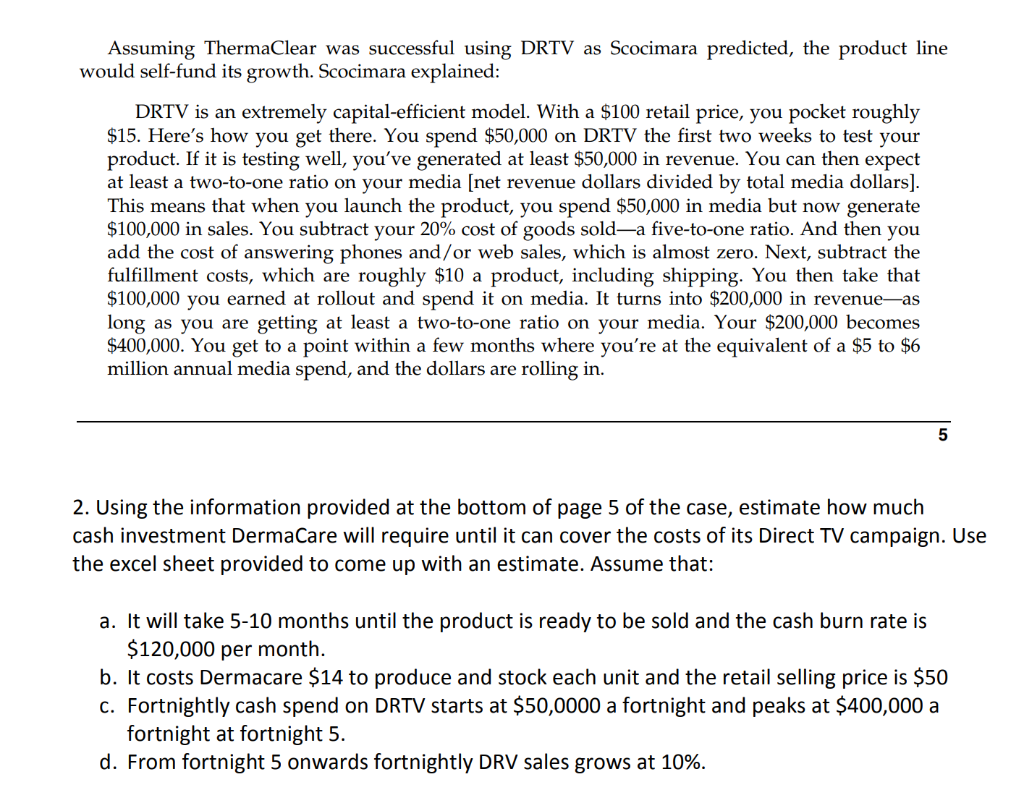

Assuming ThermaClear was successful using DRTV as Scocimara predicted, the product line would self-fund its growth. Scocimara explained DRTV is an extremely capital-efficient model. With a $100 retail price, you pocket roughly $15. Here's how you get there. You spend $50,000 on DRTV the first two weeks to test your product. If it is testing well, you've generated at least $50,000 in revenue. You can then expect at least a two-to-one ratio on your media [net revenue dollars divided by total media dollars]. This means that when you launch the product, you spend $50,000 in media but now generate $100,000 in sales. You subtract your 20% cost of goods sold-a five-to-one ratio. And then you add the cost of answering phones and/or web sales, which is almost zero. Next, subtract the fulfillment costs, which are roughly $10 a product, including shipping. You then take that $100,000 you earned at rollout and spend it on media. It turns into $200,000 in revenue-as long as you are getting at least a two-to-one ratio on your media. Your $200,000 becomes $400,000. You get to a point within a few months where you're at the equivalent of a $5 to $6 million annual media spend, and the dollars are rolling in. 5 2. Using the information provided at the bottom of page 5 of the case, estimate how much cash investment DermaCare will require until it can cover the costs of its Direct TV campaign. Use the excel sheet provided to come up with an estimate. Assume that: a. It will take 5-10 months until the product is ready to be sold and the cash burn rate is $120,000 per month b. It costs Dermacare $14 to produce and stock each unit and the retail selling price is $50 c. Fortnightly cash spend on DRTV starts at $50,0000 a fortnight and peaks at $400,000 a fortnight at fortnight 5 d. From fortnight 5 onwards fortnightly DRV sales grows at 10%. Assuming ThermaClear was successful using DRTV as Scocimara predicted, the product line would self-fund its growth. Scocimara explained DRTV is an extremely capital-efficient model. With a $100 retail price, you pocket roughly $15. Here's how you get there. You spend $50,000 on DRTV the first two weeks to test your product. If it is testing well, you've generated at least $50,000 in revenue. You can then expect at least a two-to-one ratio on your media [net revenue dollars divided by total media dollars]. This means that when you launch the product, you spend $50,000 in media but now generate $100,000 in sales. You subtract your 20% cost of goods sold-a five-to-one ratio. And then you add the cost of answering phones and/or web sales, which is almost zero. Next, subtract the fulfillment costs, which are roughly $10 a product, including shipping. You then take that $100,000 you earned at rollout and spend it on media. It turns into $200,000 in revenue-as long as you are getting at least a two-to-one ratio on your media. Your $200,000 becomes $400,000. You get to a point within a few months where you're at the equivalent of a $5 to $6 million annual media spend, and the dollars are rolling in. 5 2. Using the information provided at the bottom of page 5 of the case, estimate how much cash investment DermaCare will require until it can cover the costs of its Direct TV campaign. Use the excel sheet provided to come up with an estimate. Assume that: a. It will take 5-10 months until the product is ready to be sold and the cash burn rate is $120,000 per month b. It costs Dermacare $14 to produce and stock each unit and the retail selling price is $50 c. Fortnightly cash spend on DRTV starts at $50,0000 a fortnight and peaks at $400,000 a fortnight at fortnight 5 d. From fortnight 5 onwards fortnightly DRV sales grows at 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts