Question: at will be sales grow is financing. 2. tional consequence to 10 10 per in 2016 at cash the by efficiency? of the do with

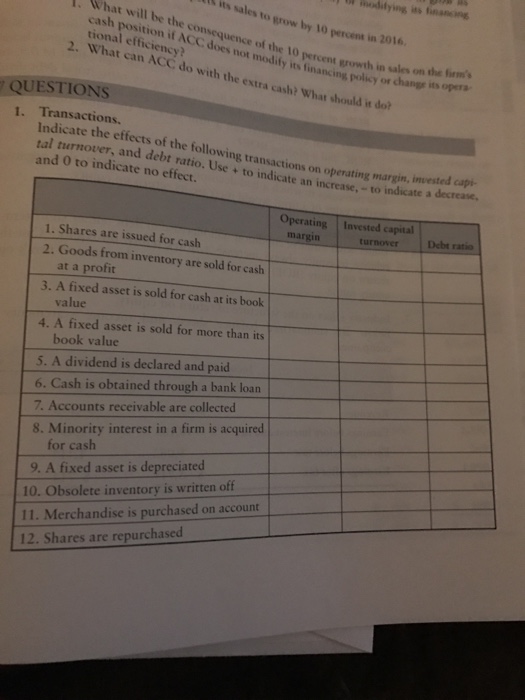

at will be sales grow is financing. 2. tional consequence to 10 10 per in 2016 at cash the by efficiency? of the do with y financi on the firm's its QUESTIONS the extra y or change its opera cash? What should it doh 1. Transactions. tal the effects of the following transactions on operating margin, in and 0 to and debt no effect an increase a decrease to i operating Invested capital margin 1. Shares are issued for cash 2. Goods from inventory are sold for cash at a profit 3. A fixed asset is sold for cash at its book value 4. A fixed asset is sold for more than its book value 5. A dividend is declared and paid 6. Cash is obtained through a bank loan 7. Accounts receivable are collected 8. Minority interest in a firm is acquired for cash 9. A fixed asset is depreciated 10. obsolete inventory is written off 11. Merchandise is purchased on account 12. Shares are repurchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts