Question: Attempts Attempts Average / 2 Evaluating free cash flows and return on invested capital You are an industry analyst for the telecom sector. You are

Attempts Attempts

Average

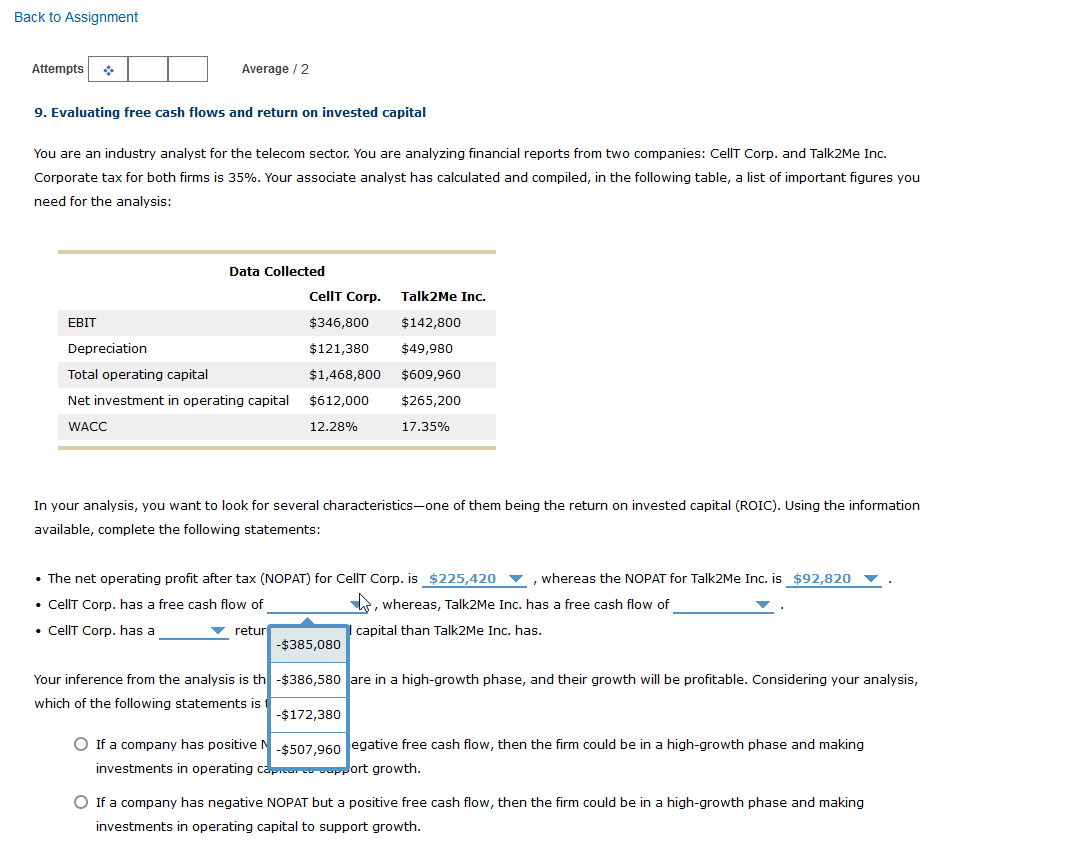

Evaluating free cash flows and return on invested capital

You are an industry analyst for the telecom sector. You are analyzing financial reports from two companies: CellT Corp. and TalkMe Inc.

Corporate tax for both firms is Your associate analyst has calculated and compiled, in the following table, a list of important figures you

need for the analysis:

In your analysis, you want to look for several characteristicsone of them being the return on invested capital ROIC Using the information

available, complete the following statements:

The net operating profit after tax NOPAT for CellT Corp. is

$

whereas the NOPAT for TalkMe Inc. is

$ V

Cellt Corp. has a free cash flow of

as

Cellt Corp. has a

return on invested capital than TalkMe Inc. has.

Your inference from the analysis is that both firms are in a highgrowth phase, and their growth will b

which of the following statements is true?

If a company has positive NOPAT but a negative free cash flow, then the firm could be in a

$

hase and making

investments in operating capital to support growth.

Considering your analysis,

$

If a company has negative NOPAT but a positive free cash flow, then the firm could be in a highgrowth phase and making

investments in operating capital to support growth.

Average

Evaluating free cash flows and return on invested capital

You are an industry analyst for the telecom sector. You are analyzing financial reports from two companies: CellT Corp. and TalkMe Inc.

Corporate tax for both firms is Your associate analyst has calculated and compiled, in the following table, a list of important figures you

need for the analysis:

In your analysis, you want to look for several characteristicsone of them being the return on invested capital ROIC Using the information

available, complete the following statements:

The net operating profit after tax NOPAT for CellT Corp. is

$

whereas the NOPAT for TalkMe Inc. is

$

Cellt Corp. has a free cash flow of

: whereas, TalkMe Inc. has a free cash flow of

Cellt Corp. has a

retur

$

capital than TalkMe Inc. has.

Your inference from the analysis is th

$

are in a highgrowth phase, and their growth will be profitable. Considering your analysis,

which of the following statements is

$

If a company has positive

$

egative free cash flow, then the firm could be in a highgrowth phase and making

investments in operating caprarcorpport growth.

If a company has negative NOPAT but a positive free cash flow, then the firm could be in a highgrowth phase and making

investments in operating capital to support growth.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock