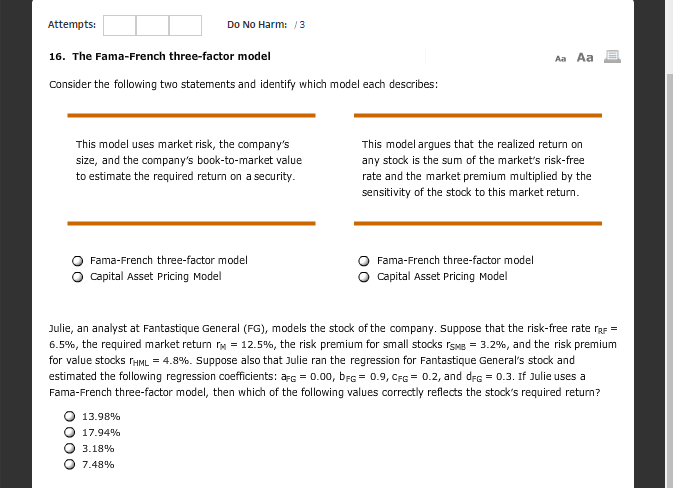

Question: Attempts: DO No Harm: 3 16. The Fama-French three-factor model Aa Aa Consider the following two statements and identify which model each describes: This model

Attempts: DO No Harm: 3 16. The Fama-French three-factor model Aa Aa Consider the following two statements and identify which model each describes: This model uses market risk, the company's size, and the company's book-to-market value to estimate the required return on a security This model argues that the realized return on any stock is the sum of the market's risk-free rate and the market premium multiplied by the sensitivity of the stock to this market return O Fama-French three-factor model O Capital Asset Pricing Model O Fama-French three-factor model Capital Asset Pricing Model Julie, an analyst at Fantastique General (FG), models the stock of the company. Suppose that the risk-free rate rF 6.5%, the required market return rn = 12.5%, the risk premium for small stocks rSMB = 3.2%, and the risk premium for value stocks rHML-4.8%. Suppose also that Julie ran the regression for Fantastique General's stock and estimated the following regression coefficients: aFG = 0.00, bFG = 0.9, CFG= 0.2, and dFG 0.3. If Julie uses a Fama-French three-factor model, then which of the following values correctly reflects the stock's required return? 13.98% 17.94% 3.18% 7.48%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts