Question: AUS-based lender wishes to hedge against decrease in future interest rates. The lender proposes to hedge against this risk by entering into a FRA with

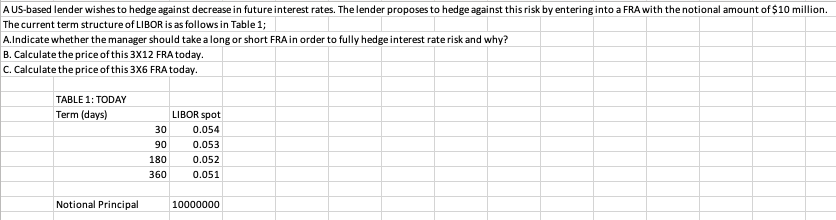

AUS-based lender wishes to hedge against decrease in future interest rates. The lender proposes to hedge against this risk by entering into a FRA with the notional amount of $10 million. The current term structure of LIBOR is as follows in Table 1; A.Indicate whether the manager should take a long or short FRA in order to fully hedge interest rate risk and why? B. Calculate the price of this 3X12 FRA today. C. Calculate the price of this 3X6 FRA today. TABLE 1: TODAY Term (days) LIBOR spot 30 0.054 90 0.053 180 0.052 360 0.051 Notional Principal 10000000 AUS-based lender wishes to hedge against decrease in future interest rates. The lender proposes to hedge against this risk by entering into a FRA with the notional amount of $10 million. The current term structure of LIBOR is as follows in Table 1; A.Indicate whether the manager should take a long or short FRA in order to fully hedge interest rate risk and why? B. Calculate the price of this 3X12 FRA today. C. Calculate the price of this 3X6 FRA today. TABLE 1: TODAY Term (days) LIBOR spot 30 0.054 90 0.053 180 0.052 360 0.051 Notional Principal 10000000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts