Question: AutoSave Home DW Insert Review Formulas Page Layout Data View Tell me 16 Am ab Wrap Text General Paste Merge & Center $ % B2

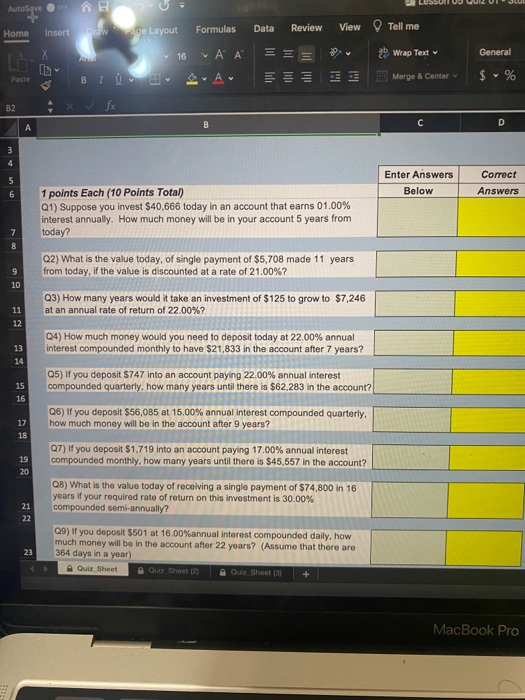

AutoSave Home DW Insert Review Formulas Page Layout Data View Tell me 16 Am ab Wrap Text General Paste Merge & Center $ % B2 C D A 3 4 Enter Answers Below Correct Answers 6 1 points Each (10 Points Total) Q1) Suppose you invest $40,666 today in an account that earns 01.00% interest annually. How much money will be your account 5 years from today? 7 8 9 10 11 12 13 14 Q2) What is the value today, of single payment of $5,708 made 11 years from today, if the value is discounted at a rate of 21.00%? Q3) How many years would it take an investment of $125 to grow to $7,246 at an annual rate of return of 22.00%? Q4) How much money would you need to deposit today at 22.00% annual interest compounded monthly to have $21,833 in the account after 7 years? Q5) If you deposit $747 into an account paying 22.00% annual interest compounded quarterly, how many years until there is $62.283 in the account? 06) If you deposit $56,085 at 15.00% annual interest compounded quarterly, how much money will be in the account after 9 years? 07) If you deposit $1,719 into an account paying 17.00% annual interest compounded monthly, how many years until there is $45,557 in the account? 15 16 17 18 19 20 Q8) What is the value today of receiving a single payment of $74,800 in 16 years if your required rate of return on this investment is 30.00% compounded semi-annually? 21 22 23 Q9) If you deposit $601 at 16.00%annual interest compounded daily, how much money will be in the account after 22 years? (Assume that there are 364 days in a year) Quiz Sheet Quiz Sheet (2) Quiz Sheet (3) + MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts