Question: AutoSave Insert Draw @ Design 6 - References >> Tes... - saved to my Share a ev Comments Layout Times New... 12 Styles 5. What

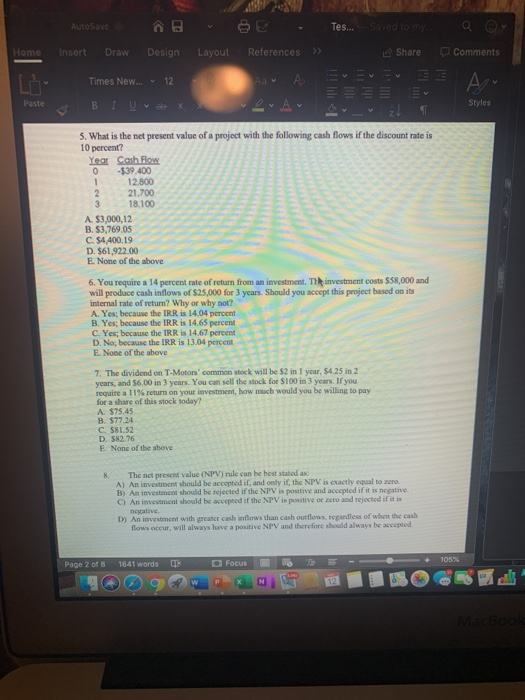

AutoSave Insert Draw @ Design 6 - References >> Tes... - saved to my Share a ev Comments Layout Times New... 12 Styles 5. What is the net present value of a project with the following cash flows if the discount rate is 10 percent? Year Cash Flow 0 - $39.400 1 12.800 2 21.700 18.100 A. $3,000,12 B. $3,769.05 C. $4400 19 D. $61,922.00 E None of the above 6. You require a 14 percent rate of return from an investment. The investment costs $58,000 and will produce cash inflows of $25,000 for 3 years. Should you accept this project based on its internal rate of return? Why or why not? A Yes, because the IRR I 14.04 percent B. Yes, because the IRR is 14.65 percent C. Yes, because the IRR is 14.67 percent D. No, because the IRR is 13.04 percent E None of the above 7. The dividend on T-Motors' common stock will be $2 in 1 year, 54.25 in 2 years, and $6.00 in 3 year. You can sell the stock for $100 in 3 years. If you require a 1196 return on your investment, how much would you be willing to pay for a share of this stock today? A $75.45 B $77.24 CS1.52 E None of the shove The net present Value(NPV) rule can be best stated as A) An investment should be accepted it, and only if the NPV is actualto B) An investment should be rejected if the NPV is positive and compled if it is negative C) An investment should be copied if the NPV is positive or rejected if it is negative D) An investment with great cash flows than cash outils endless of when the cash flows occur will always uw a positive NPV and therefore should always be accepted Page 2 of 1641 words Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts