Question: AutoSave OFF Q AF ? C ... 3. BRI Practice Set Part 1 Fall 2023 rev (1) ~ Home Insert Draw Page Layout Formulas Data

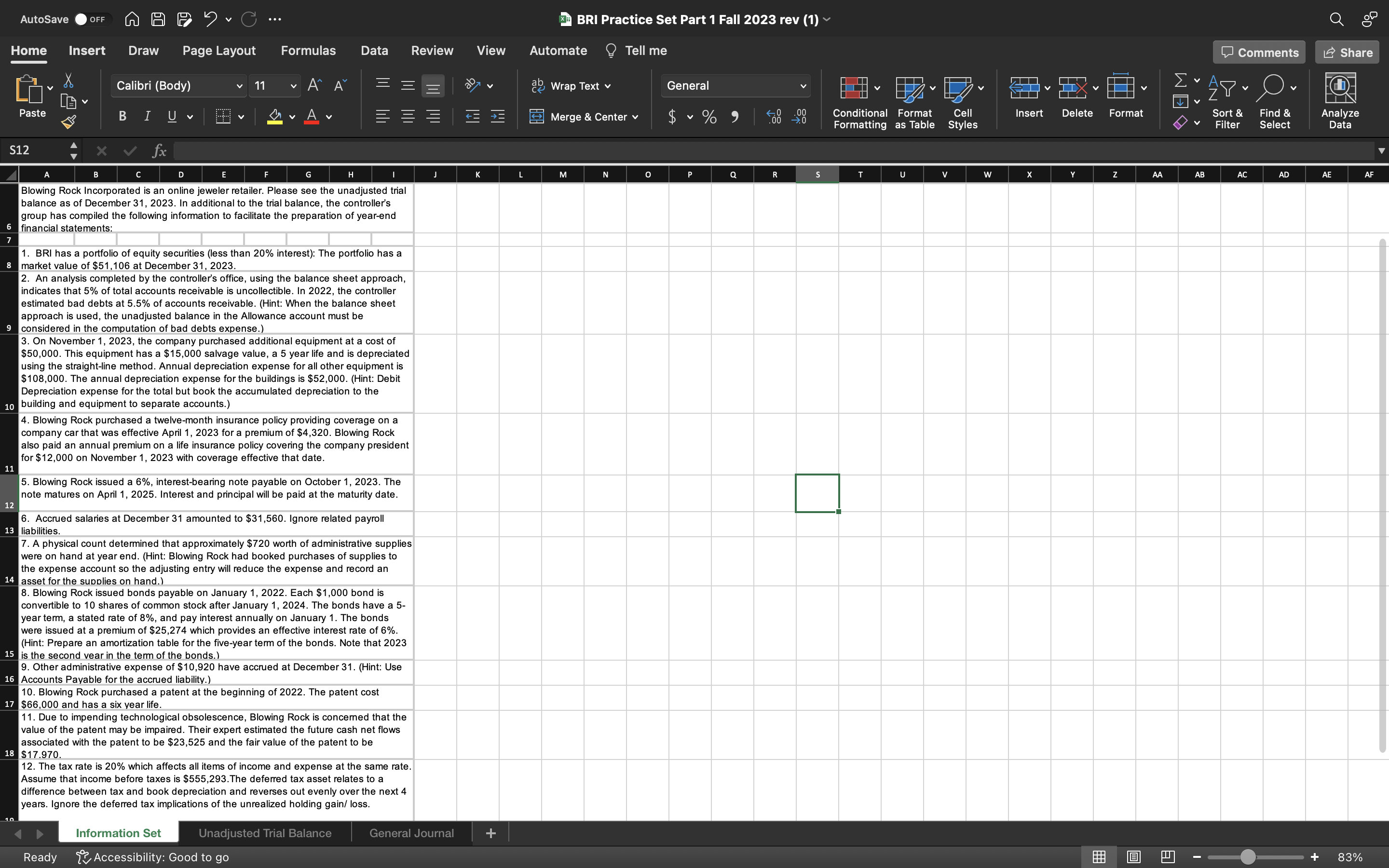

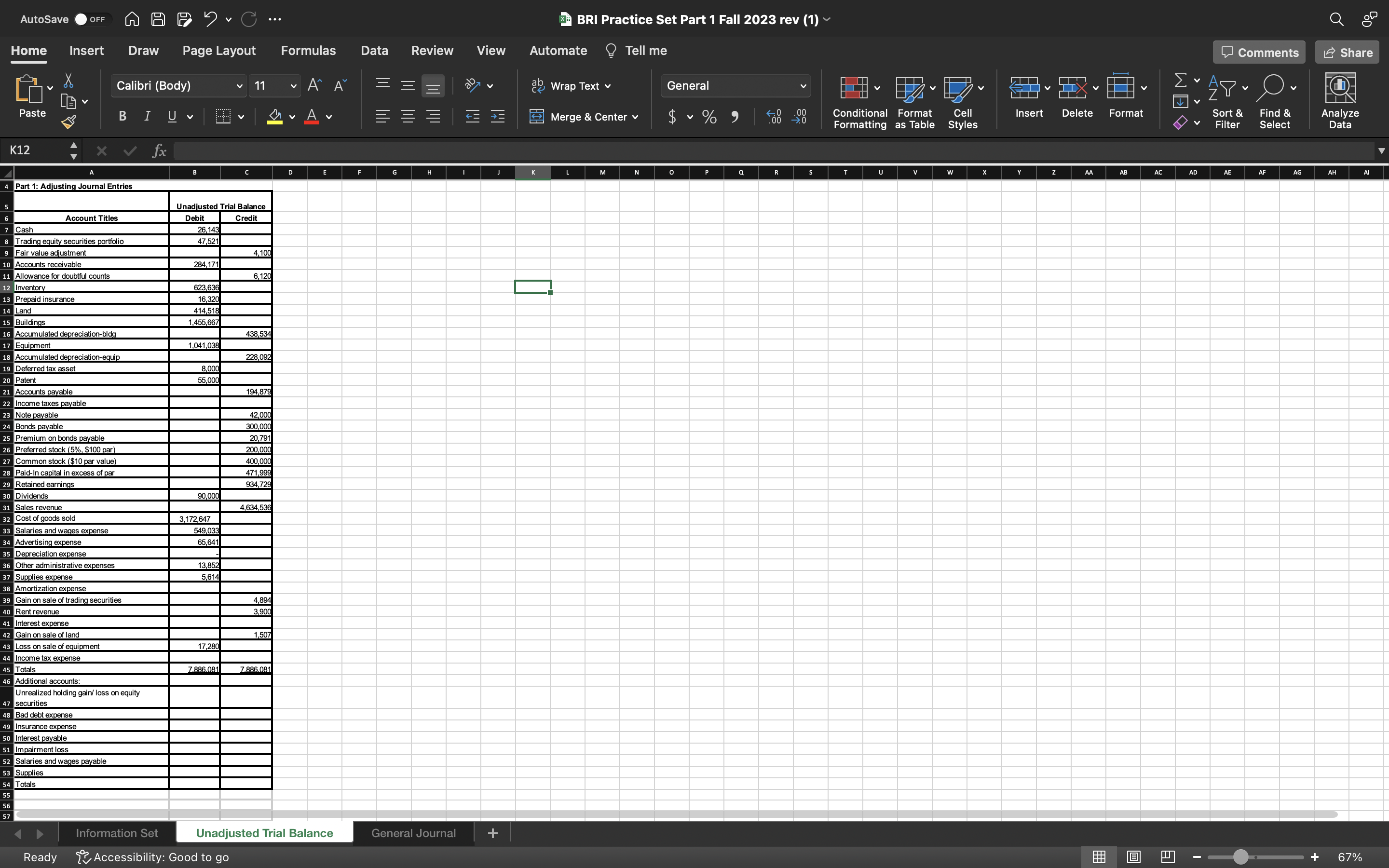

AutoSave OFF Q AF ? C ... 3. BRI Practice Set Part 1 Fall 2023 rev (1) ~ Home Insert Draw Page Layout Formulas Data Review View Automate ? Tell me Comments Share Calibri (Body) AA D Wrap Text v General Paste B A Merge & Center v $ Conditional Format Cell Insert Delete Format Sort & Find & Analyze Formatting as Table Styles Filter Select Data S12 V fx G M N 0 Q R U AA AB AC AD AE AF Blowing Rock Incorporated is an online jeweler retailer. Please see the unadjusted trial balance as of December 31, 2023. In additional to the trial balance, the controller's group has compiled the following information to facilitate the preparation of year-end financial statements: 1. BRI has a portfolio of equity securities (less than 20% interest): The portfolio has a market value of $51,106 at December 31, 2023. 2. An analysis completed by the controller's office, using the balance sheet approach, indicates that 5% of total accounts receivable is uncollectible. In 2022, the controller estimated bad debts at 5.5% of accounts receivable. (Hint: When the balance sheet approach is used, the unadjusted balance in the Allowance account must be considered in the computation of bad debts expense.) 3. On November 1, 2023, the company purchased additional equipment at a cost of $50,000. This equipment has a $15,000 salvage value, a 5 year life and is depreciated using the straight-line method. Annual depreciation expense for all other equipment is $108,000. The annual depreciation expense for the buildings is $52,000. (Hint: Debit Depreciation expense for the total but book the accumulated depreciation to the building and equipment to separate accounts.) 4. Blowing Rock purchased a twelve-month insurance policy providing coverage on a company car that was effective April 1, 2023 for a premium of $4,320. Blowing Rock also paid an annual premium on a life insurance policy covering the company president for $12,000 on November 1, 2023 with coverage effective that date. 5. Blowing Rock issued a 6%, interest-bearing note payable on October 1, 2023. The note matures on April 1, 2025. Interest and principal will be paid at the maturity date. 12 6. Accrued salaries at December 31 amounted to $31,560. Ignore related payroll 13 liabilities. 7. A physical count determined that approximately $720 worth of administrative supplies were on hand at year end. (Hint: Blowing Rock had booked purchases of supplies to the expense account so the adjusting entry will reduce the expense and record an 14 asset for the supplies on hand.) 8. Blowing Rock issued bonds payable on January 1, 2022. Each $1,000 bond is convertible to 10 shares of common stock after January 1, 2024. The bonds have a 5- year term, a stated rate of 8%, and pay interest annually on January 1. The bonds were issued at a premium of $25,274 which provides an effective interest rate of 6%. (Hint: Prepare an amortization table for the five-year term of the bonds. Note that 2023 15 is the second vear in the term of the bonds.) 9. Other administrative expense of $10,920 have accrued at December 31. (Hint: Use 16 Accounts Payable for the accrued liability.) 10. Blowing Rock purchased a patent at the beginning of 2022. The patent cost 17 $66,000 and has a six year life. 11. Due to impending technological obsolescence, Blowing Rock is concerned that the value of the patent may be impaired. Their expert estimated the future cash net flows associated with the patent to be $23,525 and the fair value of the patent to be 18 $17.970. 12. The tax rate is 20% which affects all items of income and expense at the same rate. Assume that income before taxes is $555,293. The deferred tax asset relates to a lifference between tax and book depreciation and reverses out evenly over the next 4 years. Ignore the deferred tax implications of the unrealized holding gain/ loss. Information Set Unadjusted Trial Balance General Journal + Ready Accessibility: Good to go 83%AutoSave OFF A H FC ... 3. BRI Practice Set Part 1 Fall 2023 rev (1) ~ Home Insert Draw Page Layout Formulas Data Review View Automate ? Tell me Comments Share Calibri (Body) AA D Wrap Text v General Paste BI UV A Merge & Center v $ Conditional Format Cell Insert Delete Format Sort & Find & Analyze Formatting as Table Styles Filter Select Data K12 X V fx 4 Part 1: Adjusting Journal Entries AA AC AD AE AF AG AH Al Unadjusted Trial Balance Account Titles Debit Credit Cash 26.143 Trading equity securities portfolio 47.521 Fair value adjustment 0 Accounts receivable 284,171 Allowance for doubtful counts 6,120 12 Inventory 623.636 3 Prepaid insurance 16.320 4 Land 414.518 5 Buildings 1.455,667 16 Accumulated depreciation-bidg 438.534 7 Equipment 1,041,038 18 Accumulated depreciation-equip 228,092 9 Deferred tax asset 8,00 20 Patent 55,000 Accounts payable 194.879 22 Income taxes payable Note payable 42,000 24 Bonds payable 300,000 Premium on bonds payable 20,791 26 Preferred stock (5%, $100 par) 200,000 Common stock ($10 par value) 400,000 28 Paid-In capital in excess of par 471,999 29 Retained earnings 934,72 Dividends 90,000 1 Sales revenue 4,634.536 Cost of goods sold 3,172,647 33 Salaries and wages expense 549,033 Advertising expense 65.641 35 Depreciation expense 6 Other administrative expenses 13.852 Supplies expense 5.614 38 Amortization expense Gain on sale of trading securities 40 Rent revenue Interest expense 42 Gain on sale of land Loss on sale of equipment 17,280 14 Income tax expense 45 Totals 7.886.081 7.886.081 16 Additional accounts: Unrealized holding gain/ loss on equity securities 48 Bad debt expense Insurance expense 50 Interest payable Impairment loss 52 Salaries and wages payable Supplies 54 Totals Information Set Unadjusted Trial Balance General Journal + Ready Accessibility: Good to go 67%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts