Question: B) 1. YES/NO 2. IS/IS NOT 3. DOES/DOES NOT ANSWER ALL FOR THUMBS UP Talbot Industries is considering launching a new product. The new manufacturing

B)

1. YES/NO

2. IS/IS NOT

3. DOES/DOES NOT

ANSWER ALL FOR THUMBS UP

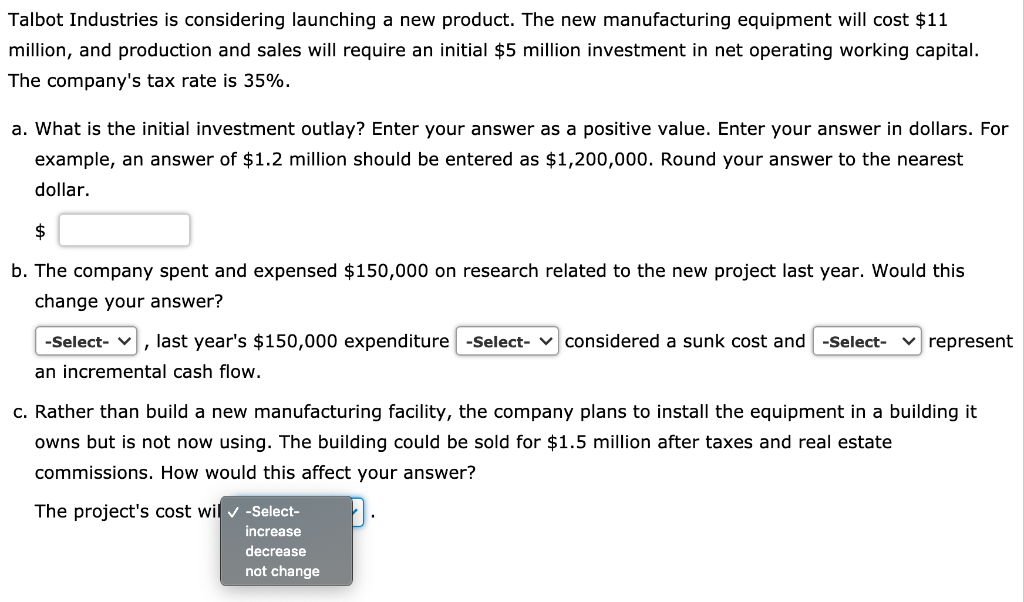

Talbot Industries is considering launching a new product. The new manufacturing equipment will cost $11 million, and production and sales will require an initial $5 million investment in net operating working capital. The company's tax rate is 35%. a. What is the initial investment outlay? Enter your answer as a positive value. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Round your answer to the nearest dollar. $ b. The company spent and expensed $150,000 on research related to the new project last year. Would this change your answer? represent -Select- last year's $150,000 expenditure -Select- v considered a sunk cost and -Select- an incremental cash flow. c. Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. How would this affect your answer? The project's cost wil v-Select- increase decrease not change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts