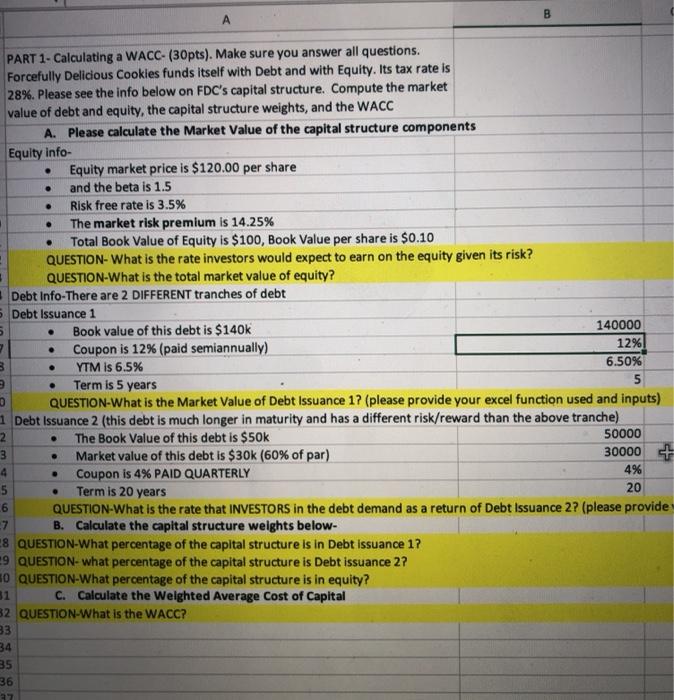

Question: B . . . 5 . PART 1- Calculating a WACC- (30pts). Make sure you answer all questions. Forcefully Delicious Cookies funds itself with Debt

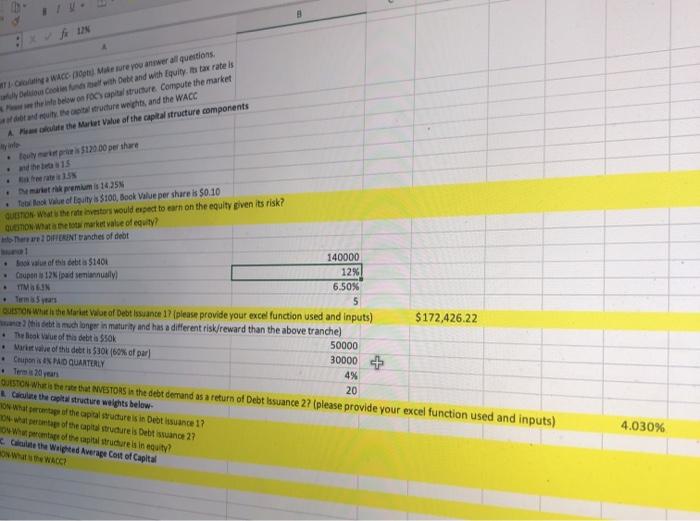

B . . . 5 . PART 1- Calculating a WACC- (30pts). Make sure you answer all questions. Forcefully Delicious Cookies funds itself with Debt and with Equity. Its tax rate is 28%. Please see the info below on FDC's capital structure. Compute the market value of debt and equity, the capital structure weights, and the WACC A. Please calculate the Market Value of the capital structure components Equity Info- Equity market price is $120.00 per share and the beta is 1.5 Risk free rate is 3.5% The market risk premium is 14.25% Total Book Value of Equity is $100, Book Value per share is $0.10 QUESTION- What is the rate investors would expect to earn on the equity given its risk? QUESTION-What is the total market value of equity? Debt Info-There are 2 DIFFERENT tranches of debt 5 Debt Issuance 1 Book value of this debt is $140k 140000 Coupon is 12% (paid semiannually) 12% 3 YTM is 6.5% 6.50% Term is 5 years 5 0 QUESTION-What is the Market Value of Debt Issuance 1? (please provide your excel function used and inputs) Debt Issuance 2 (this debt is much longer in maturity and has a different risk/reward than the above tranche) 2 The Book Value of this debt is $50k 50000 Market value of this debt is $30k (60% of par) 30000 4 Coupon is 4% PAID QUARTERLY 4% Term is 20 years 20 6 QUESTION-What is the rate that INVESTORS in the debt demand as a return of Debt Issuance 2? (please provide 7 B. Calculate the capital structure weights below- 8 QUESTION-What percentage of the capital structure is in Debt Issuance 1? 9 QUESTION- what percentage of the capital structure is Debt issuance 2? 10 QUESTION-What percentage of the capital structure is in equity? C. Calculate the weighted Average Cost of Capital 2 QUESTION-What is the WACCP 33 . . 3 . 5 31 34 35 36 27 AIN 4 WTI WA on Moere you answer all questions Debih band with Equity. It tax rates the bowo Foopital structure Compute the market w the trutture weights, and the WACC A the Market value of the capital structure components wypre 512000 per share the le premium is 1425 tebe We Luty $100, Book Value per share is $0.10 QUESTION Wat the restors would expect to earn on the equity pven its risk? QUOTO What to market value of equity? Horare DIFERINT tranches of debt 140000 . wfhl debta $1401 12% Cupen 12Nipad seniannually 6.50% TTM IN Terms 5 years 5 QUESTON Which the Market wor of Debt Issuance 17(please provide your excel function used and inputs) a thin detta much longer in maturity and has a different risk/reward than the above tranche) The Book of the debts Sok 50000 Marital of the deitti 530k (60% of par 30000 + Chupons N PO QUARTERLY 4% 20 $172,426.22 Term OTO What is the rate that INVESTORS in the debt derrand as a return of Debt Issuance 2? (please provide your excel function used and inputs) the pit structure weights below. Torta of the pastructure is in Debt lisance 17 what percent of the capital structure is Debt since 27 Os permitage of the upital structure in equity? Caine the Wripted Average cost of Capital 4,030%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts