Question: B C D E F G Balance Sheet 2019 H 2018 2017 2016 K L M Cash and Cash N P Q R S Equivalents

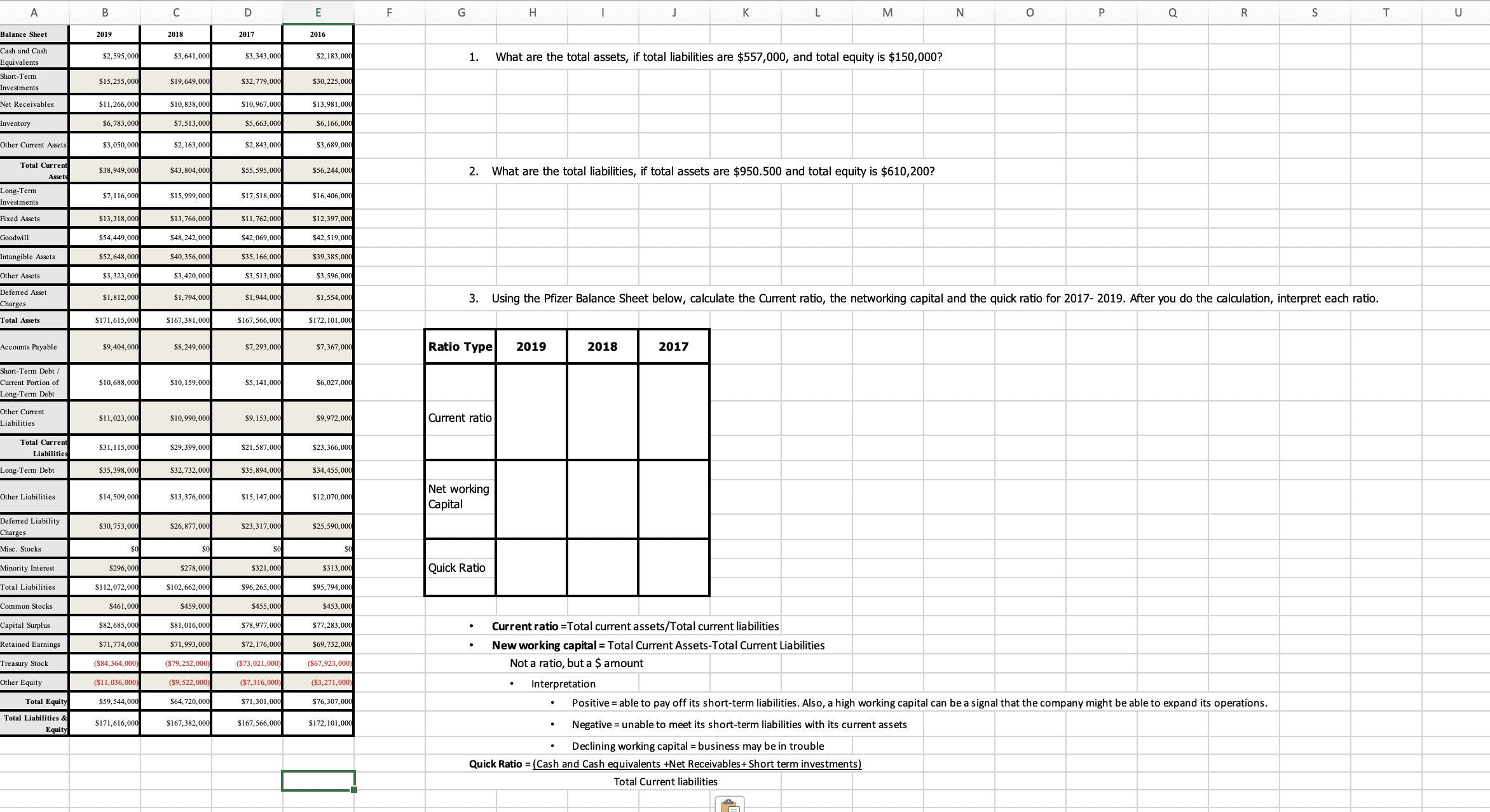

B C D E F G Balance Sheet 2019 H 2018 2017 2016 K L M Cash and Cash N P Q R S Equivalents $2,595,00 $3,641,00 $3,343,00 T $2, 183,00 U Short-Term $15,255,000 $19,649,000 1. What are the total assets, if total liabilities are $557,000, and total equity is $150,000? nvestments $32, 779,000 $30,225,000 Net Receivables $11,266,000 $10,838,000 $10,967,000 $13,981,000 nventory 6,783,00 $7,513,00 5,663,00 $6, 166,00 Other Current Assets $3,050,0 $2, 163,000 $2, 843,00 $3,689,00 Total Curren Assets $38,949,000 $43,804,000 $55,595,00 $56,244,000 Long-Term 2. What are the total liabilities, if total assets are $950.500 and total equity is $610,200? Investments $7,116,000 $15,999,000 $17,518,00 $16,406,000 Fixed Assets $13,318,000 $13,766,000 $11, 762,00 12,397,00 Goodwill $54,449,00 $48,242,000 $42,069,00 42,519,000 ntangible Assets $52,648,00 $40,356,000 $35,166,000 $39,385,000 Other Assets $3,323,00 $3,420,00 $3,513,00 3,596.000 Deferred Asset Charges $1,812,000 $1,794,000 $1, 944,000 $1,554,000 Total Assets $171,615,000 $167,381,00 $167,566,00 172, 101,00 3. Using the Pfizer Balance Sheet below, calculate the Current ratio, the networking capital and the quick ratio for 2017- 2019. After you do the calculation, interpret each ratio. Accounts Payable $9,404,000 $8,249,000 $7,293,000 $7,367,000 Ratio Type 2019 Short-Term Debt / 2018 2017 Current Portion of $10,688,000 Long-Term Debt $10, 159,000 $5, 141,000 $6,027,000 Other Current Liabilities $11,023,00 $10,990,00 $9, 153,00 $9,972,000 Current ratio Total Current Liabilitie $31, 115,00 $29,399,00 $21,587,00 $23,366,00 Long-Term Debt $35,398,000 32,732,000 $35,894,000 34,455,000 Other Liabilities $14,509,00 $13,376,000 $15, 147,00 $12,070,00 Net working Deferred Liability Capital $30, 753,00 $26,877,000 23,317,00 25,590,000 sc. Stocks SO Minority Interest $296,000 $278,000 $321,000 313,00 Total Liabilities $112,072,00 Quick Ratio $102,662,000 $96,265,000 $95,794,000 Common Stocks $461,00 $459,00 $455,00 $453 00 Capital Surplus $82,685,000 $81,016,00 78,977,00 77,283.00 Retained Earnings $71, 774,000 $71,993,000 $72, 176,000 Current ratio =Total current assets/Total current liabilities $69,732,000 reasury Stock ($84,364,000 ($79,252,000 ($73,021,000 $67,923,000 New working capital = Total Current Assets-Total Current Liabilities Other Equity ($11, 036,000 $9,522,000 Not a ratio, but a $ amount ($7,316,000 ($3,271,000 Total Equity $59,544,00 64,720,00 $71,301,00 Interpretation $76,307,00 Total Liabilities & Equity $171,616,00 $167,382,00 $167,566,00 $172, 101,00 Positive = able to pay off its short-term liabilities. Also, a high working capital can be a signal that the company might be able to expand its operations. Negative = unable to meet its short-term liabilities with its current assets Declining working capital = business may be in trouble Quick Ratio = (Cash and Cash equivalents +Net Receivables + Short term investments) Total Current liabilities