Question: b) Corn Corp. and Grain Ltd. are the two main players in the plantation industry. Both of the firms are considering a financing of

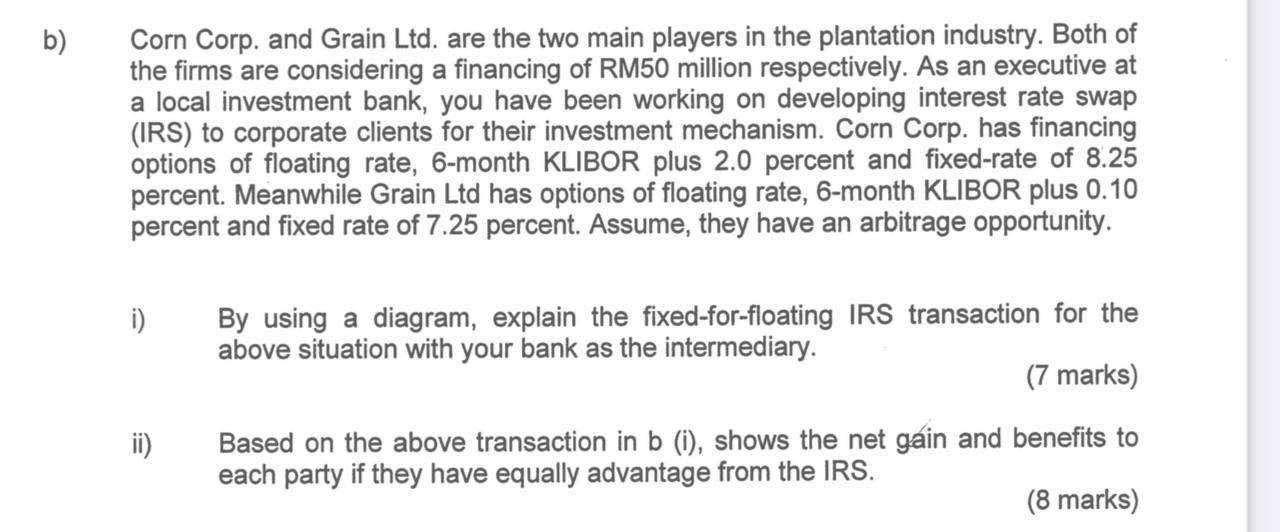

b) Corn Corp. and Grain Ltd. are the two main players in the plantation industry. Both of the firms are considering a financing of RM50 million respectively. As an executive at a local investment bank, you have been working on developing interest rate swap (IRS) to corporate clients for their investment mechanism. Corn Corp. has financing options of floating rate, 6-month KLIBOR plus 2.0 percent and fixed-rate of 8.25 percent. Meanwhile Grain Ltd has options of floating rate, 6-month KLIBOR plus 0.10 percent and fixed rate of 7.25 percent. Assume, they have an arbitrage opportunity. i) ii) By using a diagram, explain the fixed-for-floating IRS transaction for the above situation with your bank as the intermediary. (7 marks) Based on the above transaction in b (i), shows the net gain and benefits to each party if they have equally advantage from the IRS. (8 marks)

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

ANSWER a To find the data of the market lets denote M Mandarin stock TS TriStar stock Given Current ... View full answer

Get step-by-step solutions from verified subject matter experts