Question: Based on the chart provided below: 1. What investment advice would you give potential investors? 2. How much would you advise a strategic buyer to

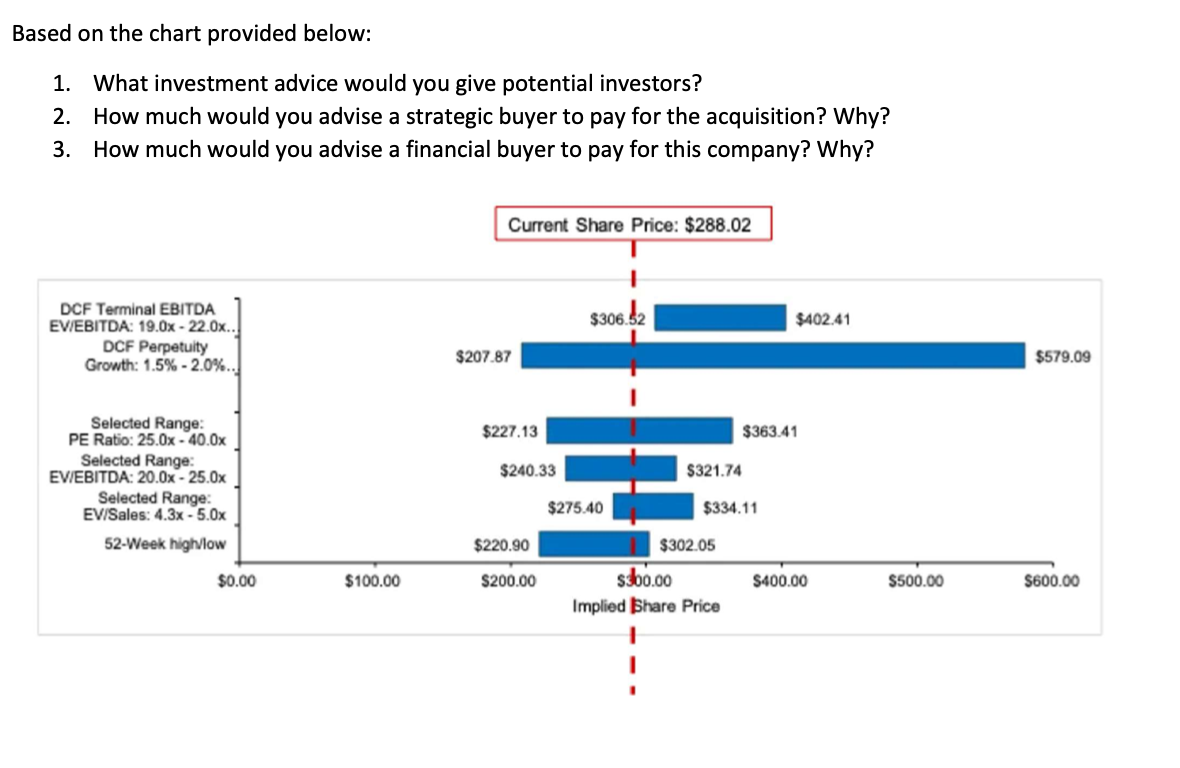

Based on the chart provided below: 1. What investment advice would you give potential investors? 2. How much would you advise a strategic buyer to pay for the acquisition? Why? 3. How much would you advise a financial buyer to pay for this company? Why? Current Share Price: $288.02 $306.52 $402.41 DCF Terminal EBITDA EVEBITDA: 19.0x - 22.0x. DCF Perpetuity Growth: 1.5% - 2.0%.. $207.87 $579.09 $227,13 $363.41 $240.33 $321.74 Selected Range: PE Ratio: 25.0x - 40.0x Selected Range: EVIEBITDA: 20.0x - 25.0x Selected Range: EV/Sales: 4.3x - 5.0x 52-Week highlow $275.40 $334.11 $220.90 $0.00 $100.00 $200.00 $302.05 $400.00 Implied Share Price $400.00 $500.00 $600.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts