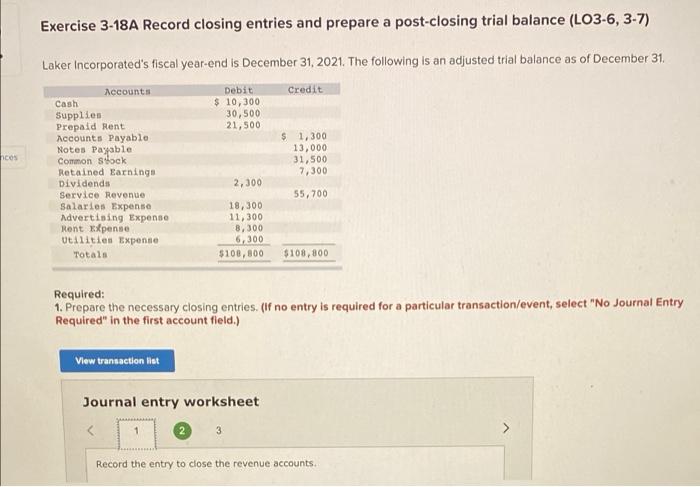

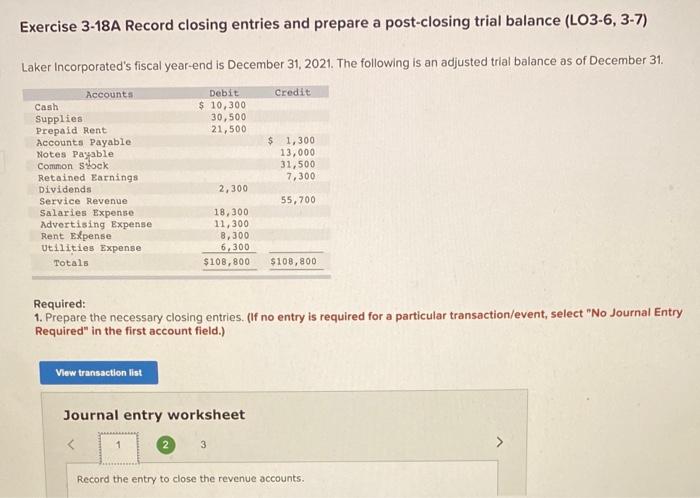

Question: b Exercise 3-18A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is

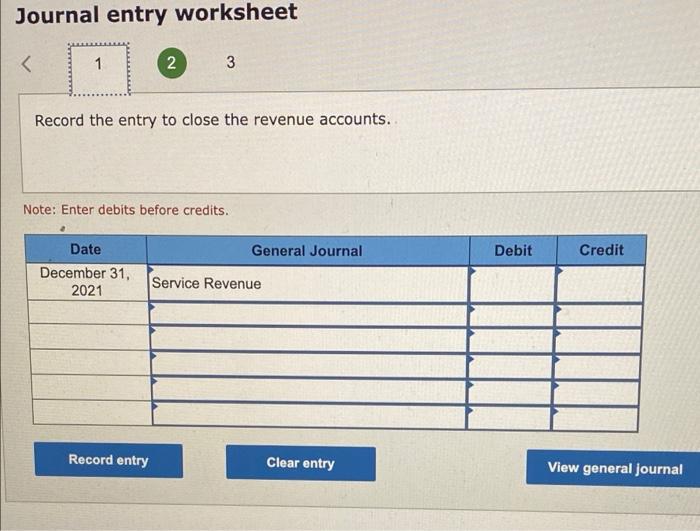

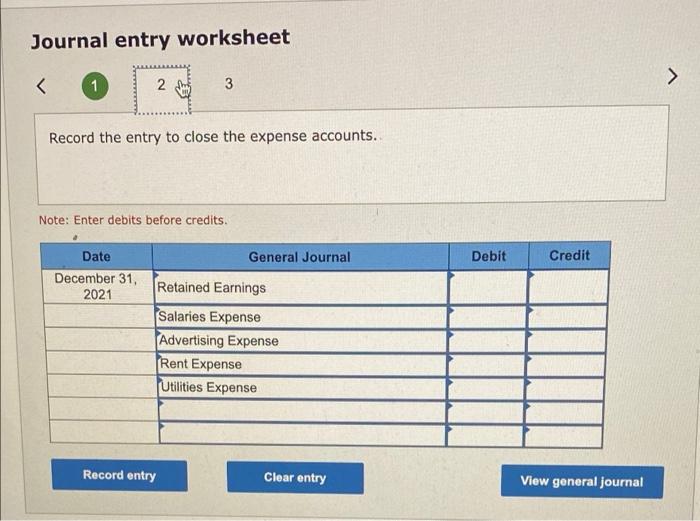

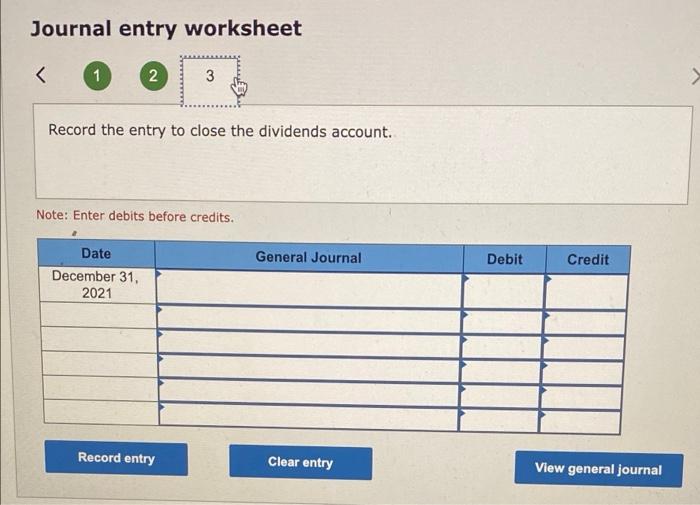

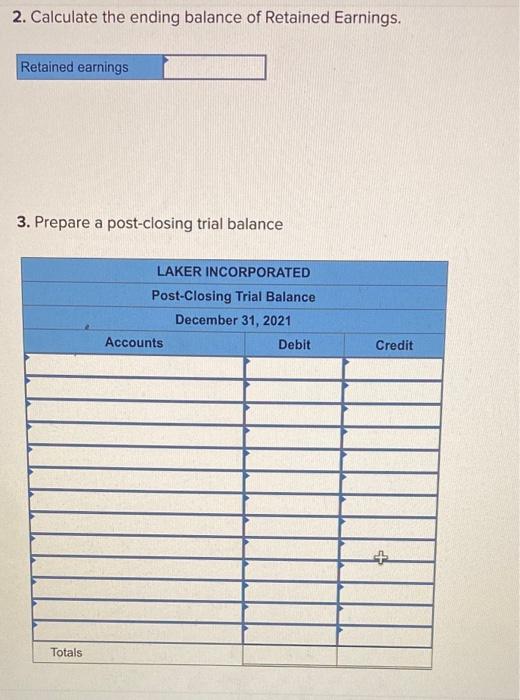

Exercise 3-18A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is an adjusted trial balance as of December 31, Credit Debit $ 10,300 30,500 21,500 hoos Accounts Cash Supplies Prepaid Rent Accounts Payable Notes Payable Common stock Retained Earnings Dividends Service Revenue salaries Expenso Advertising Expense Rent Expense Utilities Expense Totals $ 1,300 13,000 31,500 7,300 2,300 55,700 18,300 11,300 8,300 6,300 $100,800 $108,800 Required: 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3 Record the entry to close the revenue accounts Exercise 3-18A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is an adjusted trial balance as of December 31 Credit Debit $ 10,300 30,500 21,500 Accounts Cash Supplies Prepaid Rent Accounts Payable Notes Payable Common slock Retained Earnings Dividends Service Revenue Salaries Expense Advertising Expense Rent Expense Utilities Expense Totals $ 1,300 13,000 31,500 7,300 2,300 55,700 18,300 11,300 8,300 6,300 $108,800 $108,800 Required: 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3 Record the entry to close the revenue accounts. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts