Question: B Font LZ Paragraph Assignment #2 1) Watkins Inc. has never paid a dividend, and it's not known when the firm might begin paying

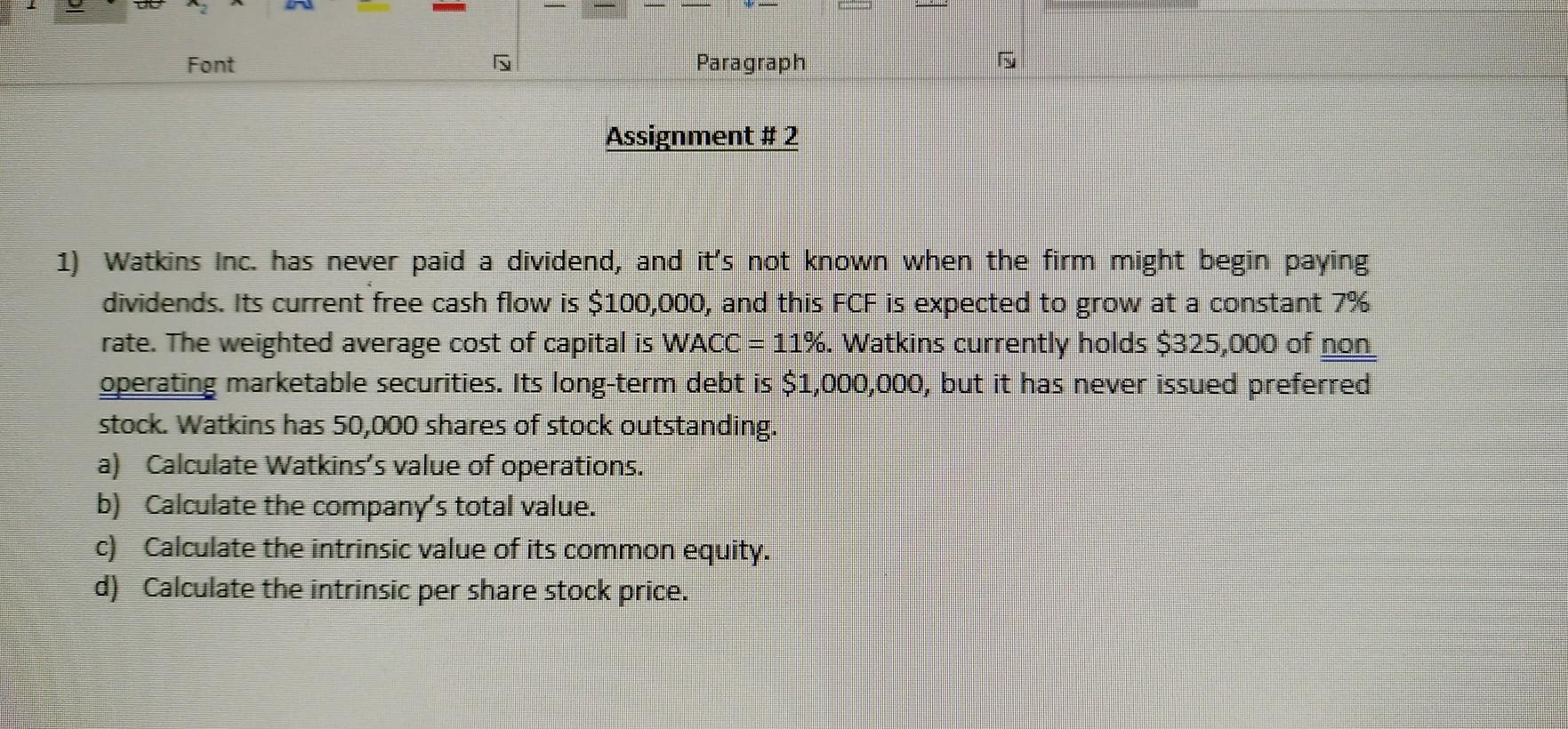

B Font LZ Paragraph Assignment #2 1) Watkins Inc. has never paid a dividend, and it's not known when the firm might begin paying dividends. Its current free cash flow is $100,000, and this FCF is expected to grow at a constant 7% rate. The weighted average cost of capital is WACC = 11%. Watkins currently holds $325,000 of non operating marketable securities. Its long-term debt is $1,000,000, but it has never issued preferred stock. Watkins has 50,000 shares of stock outstanding. a) Calculate Watkins's value of operations. b) Calculate the company's total value. c) Calculate the intrinsic value of its common equity. d) Calculate the intrinsic per share stock price.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts