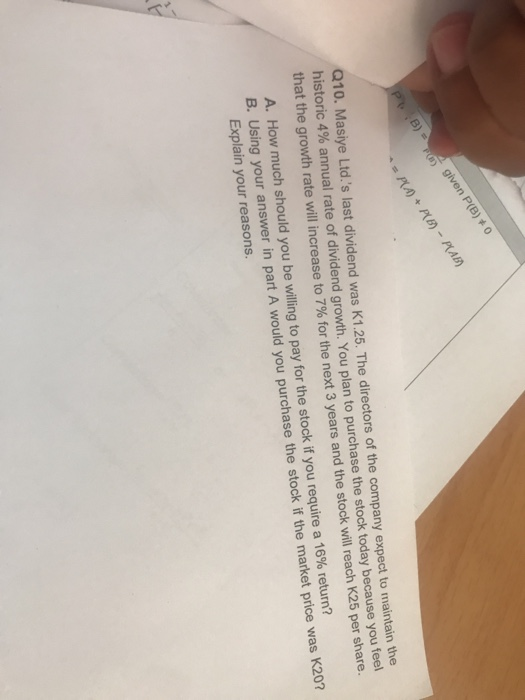

Question: B) - Ogiven P(B) * 0 P * = P(A) + P(6) - PAE) Q10. Masiye Ltd.'s last dividend was K1.25. The directors of the

B) - Ogiven P(B) * 0 P * = P(A) + P(6) - PAE) Q10. Masiye Ltd.'s last dividend was K1.25. The directors of the company expect to maintain the historic 4% annual rate of dividend growth. You plan to purchase the stock today because you feel that the growth rate will increase to 7% for the next 3 years and the stock will reach K25 per share. A. How much should you be willing to pay for the stock if you require a 16% return? B. Using your answer in part A would you purchase the stock if the market price was K20? Explain your reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts