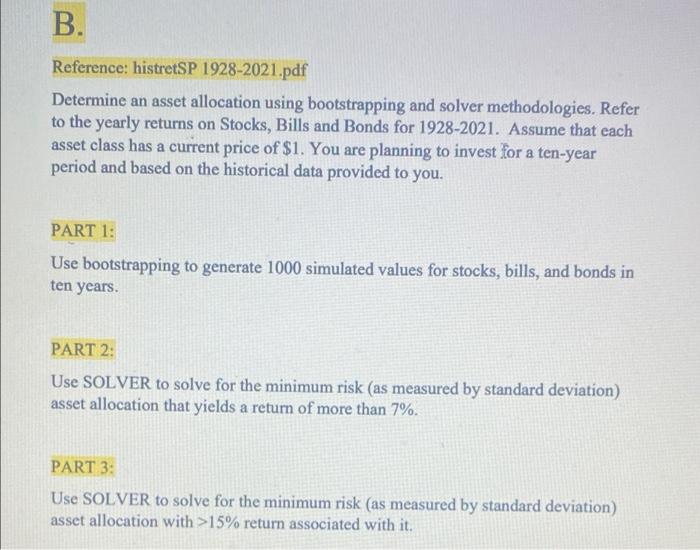

Question: B. Reference: histretSP 1928-2021.pdf Determine an asset allocation using bootstrapping and solver methodologies. Refer to the yearly returns on Stocks, Bills and Bonds for 1928-2021.

B. Reference: histretSP 1928-2021.pdf Determine an asset allocation using bootstrapping and solver methodologies. Refer to the yearly returns on Stocks, Bills and Bonds for 1928-2021. Assume that each asset class has a current price of $1. You are planning to invest for a ten-year period and based on the historical data provided to you. a PART 1: Use bootstrapping to generate 1000 simulated values for stocks, bills, and bonds in ten years. PART 2: Use SOLVER to solve for the minimum risk (as measured by standard deviation) asset allocation that yields a return of more than 7%. PART 3: Use SOLVER to solve for the minimum risk as measured by standard deviation) asset allocation with >15% return associated with it B. Reference: histretSP 1928-2021.pdf Determine an asset allocation using bootstrapping and solver methodologies. Refer to the yearly returns on Stocks, Bills and Bonds for 1928-2021. Assume that each asset class has a current price of $1. You are planning to invest for a ten-year period and based on the historical data provided to you. a PART 1: Use bootstrapping to generate 1000 simulated values for stocks, bills, and bonds in ten years. PART 2: Use SOLVER to solve for the minimum risk (as measured by standard deviation) asset allocation that yields a return of more than 7%. PART 3: Use SOLVER to solve for the minimum risk as measured by standard deviation) asset allocation with >15% return associated with it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts