Question: Determine an asset allocation using bootstrapping and solver methodologies. Refer to the yearly returns on Stocks, Bills and Bonds for 1928-2021. Assume that each asset

Determine an asset allocation using bootstrapping and solver methodologies. Refer to the yearly returns on Stocks, Bills and Bonds for 1928-2021. Assume that each asset class has a current price of $1. You are planning to invest for a ten-year period and based on the historical data provided to you.

PART 3:

Use SOLVER to solve for the minimum risk (as measured by standard deviation) asset allocation with >15% return associated with it.

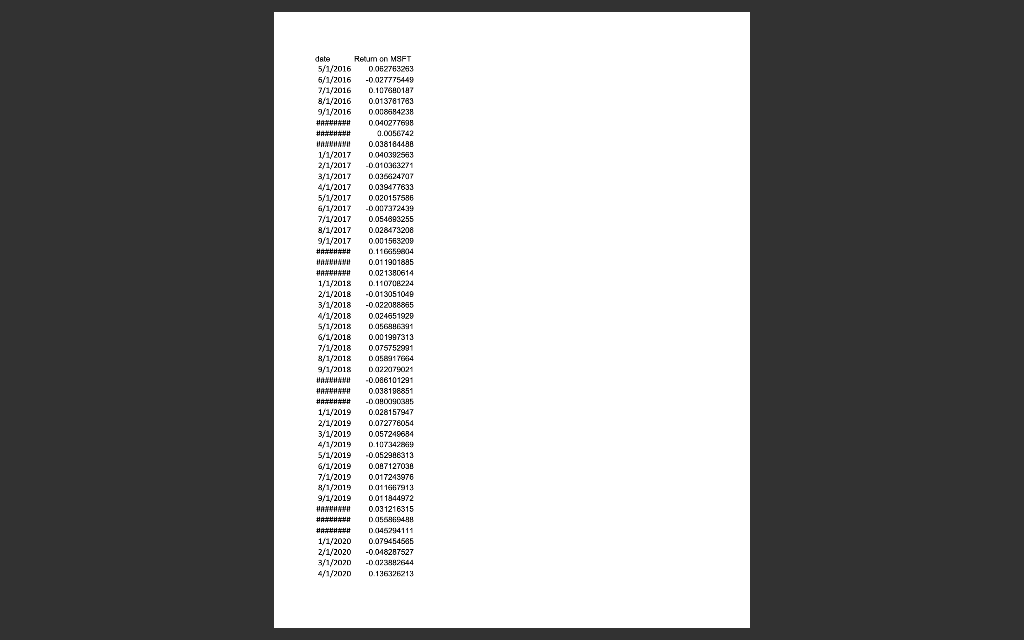

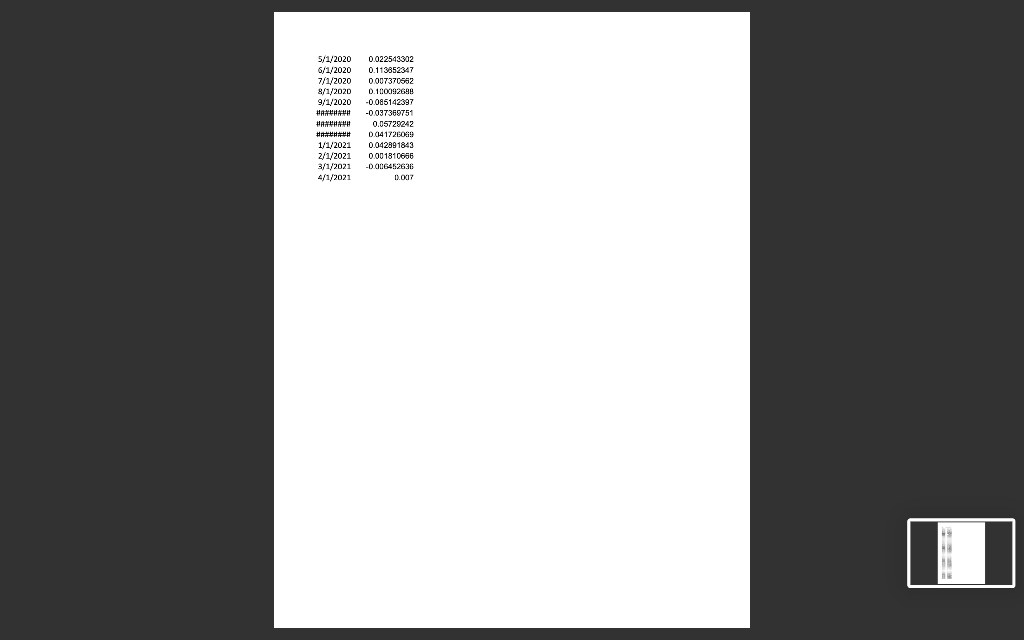

### ## date Retum on MSFT 5/1/2016 0062763253 5/1/2016 -0027544 11,201 . 11 YeTHE 147 8/1/2016 0.013781783 9/1/2016 0.00858423 H 0.040277698 0.0056742 WANN MBI 0.0381844BB 1/1/2017 0.040392553 2/1/2017 -0.010363271 3/1/2017 | 0312407 4/1/2017 0.039477633 5/1/2017 0.020157586 6/1/2017 -0.007372439 7/1/2017 0.054893255 8/1/2017 0.028473208 9/1/2017 0.001563209 2.11 E-SIM HANUMAH 0.01 1901885 0.021380614 1/1/2018 0.110706224 2/1/2018 -0.013051049 3/1/2018 -0.022088865 4/1/2018 0.024651929 5/1/2018 DC15BHES3 1' 2018 0.001997313 7/1/2018 0.075752991 8/1/2018 15F 9/1/2018 0.022179021 -0.086101291 0.038198851 -DH009035 1/1/2019 0.028157947 2/1/2019 3/1/2019 0.057249634 4/1/2015 D.1073428619 5/1/2019 -0.052986313 6/1/2019 0.087127036 7/1/2019 0.017243976 8/1/2019 1 114 9/1/2019 0.01 1844972 0.031216315 11/1548 CH528411f 1/1/2020 0.079454585 2/1/2020 -0.048287527 1/2020 - 1/2020 1362EP13 titHitF 0.072776054 ### 5/1/2020 5/1/2020 9/2020 8/1/2020 9/1/2020 1/1/2021 2/1/2021 3/1/2021 1,7021 0.022543302 0.113852347 0.007370552 0.100092694 -0.005142397 -0.037369751 0.05729243 0.041726089 0.042891843 0.001310656 -0.006452636 0.007 ### ## date Retum on MSFT 5/1/2016 0062763253 5/1/2016 -0027544 11,201 . 11 YeTHE 147 8/1/2016 0.013781783 9/1/2016 0.00858423 H 0.040277698 0.0056742 WANN MBI 0.0381844BB 1/1/2017 0.040392553 2/1/2017 -0.010363271 3/1/2017 | 0312407 4/1/2017 0.039477633 5/1/2017 0.020157586 6/1/2017 -0.007372439 7/1/2017 0.054893255 8/1/2017 0.028473208 9/1/2017 0.001563209 2.11 E-SIM HANUMAH 0.01 1901885 0.021380614 1/1/2018 0.110706224 2/1/2018 -0.013051049 3/1/2018 -0.022088865 4/1/2018 0.024651929 5/1/2018 DC15BHES3 1' 2018 0.001997313 7/1/2018 0.075752991 8/1/2018 15F 9/1/2018 0.022179021 -0.086101291 0.038198851 -DH009035 1/1/2019 0.028157947 2/1/2019 3/1/2019 0.057249634 4/1/2015 D.1073428619 5/1/2019 -0.052986313 6/1/2019 0.087127036 7/1/2019 0.017243976 8/1/2019 1 114 9/1/2019 0.01 1844972 0.031216315 11/1548 CH528411f 1/1/2020 0.079454585 2/1/2020 -0.048287527 1/2020 - 1/2020 1362EP13 titHitF 0.072776054 ### 5/1/2020 5/1/2020 9/2020 8/1/2020 9/1/2020 1/1/2021 2/1/2021 3/1/2021 1,7021 0.022543302 0.113852347 0.007370552 0.100092694 -0.005142397 -0.037369751 0.05729243 0.041726089 0.042891843 0.001310656 -0.006452636 0.007

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts