Question: B. You could have purchased a new computer system for $260,000 in cash. The computer had an estimated life of 10 years with a $20,000

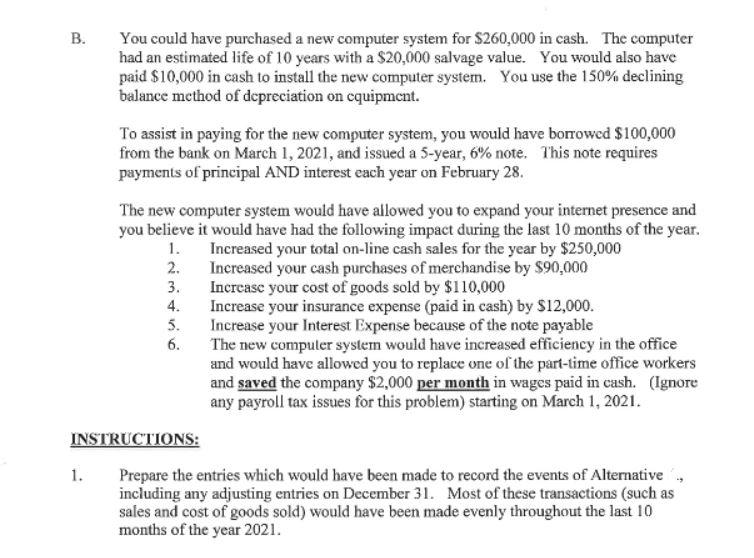

B. You could have purchased a new computer system for $260,000 in cash. The computer had an estimated life of 10 years with a $20,000 salvage value. You would also have paid $10,000 in cash to install the new computer system. You use the 150% declining balance method of depreciation on cquipment. To assist in paying for the new computer system, you would have borrowed $100,000 from the bank on March 1, 2021, and issued a 5-year, 6% note. This note requires payments of principal AND interest each year on February 28. The new computer system would have allowed you to expand your internet presence and you believe it would have had the following impact during the last 10 months of the year. 1. Increased your total on-line cash sales for the year by $250,000 2. Increased your cash purchases of merchandise by $90,000 3. Increase your cost of goods sold by $110,000 4. Increase your insurance expense (paid in cash) by S12,000. 5. Increase your Interest Expense because of the note payable 6. The new computer system would have increased efficiency in the office and would have allowed you to replace one of the part-time office workers and saved the company $2,000 per month in wages paid in cash. (Ignore any payroll tax issues for this problem) starting on March 1, 2021. INSTRUCTIONS: 1. Prepare the entries which would have been made to record the events of Alternative, including any adjusting entries on December 31. Most of these transactions (such as sales and cost of goods sold) would have been made evenly throughout the last 10 months of the year 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts