Question: B.6 is pointing to B.5. its confusing, but its how its requested. Both are in the bottom picture. More information is not posted in case

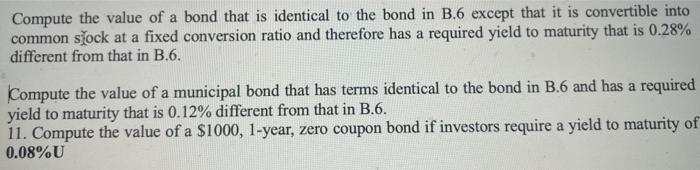

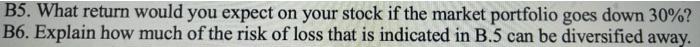

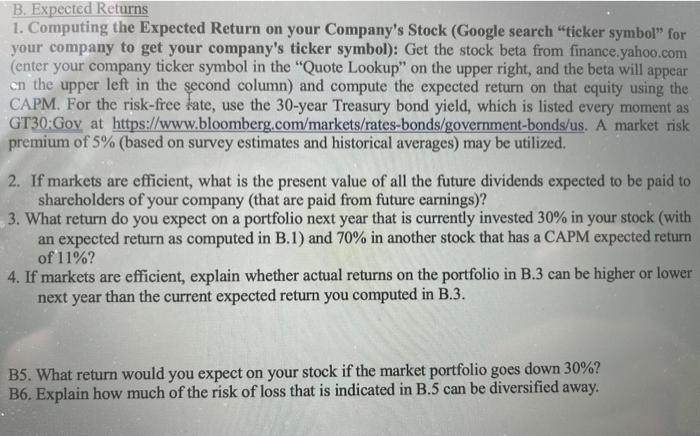

Compute the value of a bond that is identical to the bond in B.6 except that it is convertible into common slock at a fixed conversion ratio and therefore has a required yield to maturity that is 0.28% different from that in B.6. Compute the value of a municipal bond that has terms identical to the bond in B.6 and has a required yield to maturity that is 0.12% different from that in B.6. 11. Compute the value of a $1000, 1-year, zero coupon bond if investors require a yield to maturity of 0.08%U B5. What return would you expect on your stock if the market portfolio goes down 30%? B6. Explain how much of the risk of loss that is indicated in B.5 can be diversified away. B. Expected Returns 1. Computing the Expected Return on your Company's Stock (Google search "ticker symbol" for your company to get your company's ticker symbol): Get the stock beta from finance.yahoo.com (enter your company ticker symbol in the "Quote Lookup" on the upper right, and the beta will appear cn the upper left in the second column) and compute the expected return on that equity using the CAPM. For the risk-free kate, use the 30-year Treasury bond yield, which is listed every moment as GT30:Gov at https://www.bloomberg.com/markets/rates-bonds/government-bonds/us. A market risk premium of 5% (based on survey estimates and historical averages) may be utilized. 2. If markets are efficient, what is the present value of all the future dividends expected to be paid to shareholders of your company (that are paid from future earnings)? 3. What return do you expect on a portfolio next year that is currently invested 30% in your stock (with an expected return as computed in B.1) and 70% in another stock that has a CAPM expected return of 11%? 4. If markets are efficient, explain whether actual returns on the portfolio in B.3 can be higher or lower next year than the current expected return you computed in B.3. B5. What return would you expect on your stock if the market portfolio goes down 30%? B6. Explain how much of the risk of loss that is indicated in B.5 can be diversified away. Compute the value of a bond that is identical to the bond in B.6 except that it is convertible into common slock at a fixed conversion ratio and therefore has a required yield to maturity that is 0.28% different from that in B.6. Compute the value of a municipal bond that has terms identical to the bond in B.6 and has a required yield to maturity that is 0.12% different from that in B.6. 11. Compute the value of a $1000, 1-year, zero coupon bond if investors require a yield to maturity of 0.08%U B5. What return would you expect on your stock if the market portfolio goes down 30%? B6. Explain how much of the risk of loss that is indicated in B.5 can be diversified away. B. Expected Returns 1. Computing the Expected Return on your Company's Stock (Google search "ticker symbol" for your company to get your company's ticker symbol): Get the stock beta from finance.yahoo.com (enter your company ticker symbol in the "Quote Lookup" on the upper right, and the beta will appear cn the upper left in the second column) and compute the expected return on that equity using the CAPM. For the risk-free kate, use the 30-year Treasury bond yield, which is listed every moment as GT30:Gov at https://www.bloomberg.com/markets/rates-bonds/government-bonds/us. A market risk premium of 5% (based on survey estimates and historical averages) may be utilized. 2. If markets are efficient, what is the present value of all the future dividends expected to be paid to shareholders of your company (that are paid from future earnings)? 3. What return do you expect on a portfolio next year that is currently invested 30% in your stock (with an expected return as computed in B.1) and 70% in another stock that has a CAPM expected return of 11%? 4. If markets are efficient, explain whether actual returns on the portfolio in B.3 can be higher or lower next year than the current expected return you computed in B.3. B5. What return would you expect on your stock if the market portfolio goes down 30%? B6. Explain how much of the risk of loss that is indicated in B.5 can be diversified away

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts