Question: Back to Assignment Attempts: Average: 2 10. The Capital Asset Pricing Model and the security market line Simone holds a portfolio that invests equally in

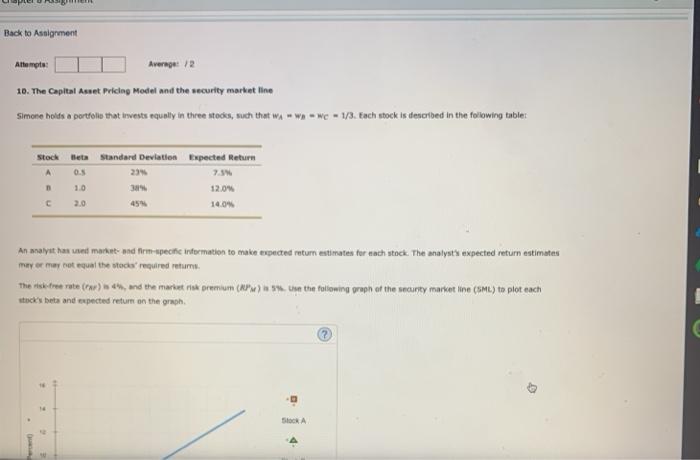

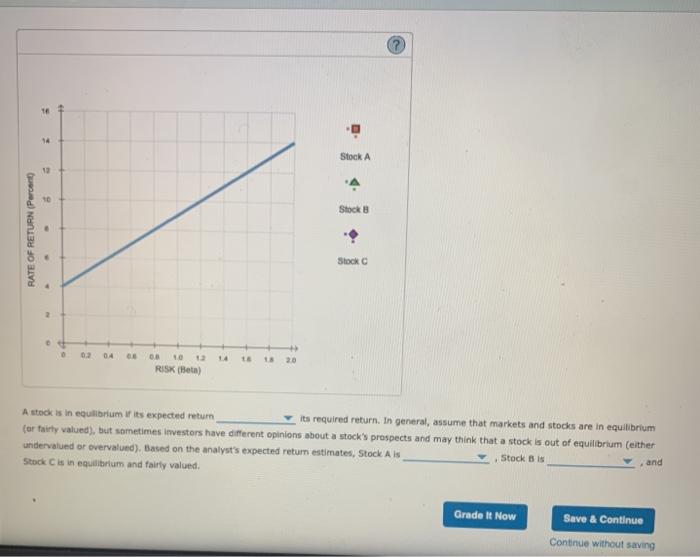

Back to Assignment Attempts: Average: 2 10. The Capital Asset Pricing Model and the security market line Simone holds a portfolio that invests equally in three stoes, such that wawa-W - 1/3. Each stock is described in the following tables Stock Heta Standard deviation Expected Return OS 10 12.04 2.0 14.0% An analyst has set market and formere information to make expected return estimates for each stock. The analysts expected return estimates may or may not equal the stocarequired retums. The tree vote (rar), and the market in premium (NP) Un the following prop of the security market ine (SML) to plot each stockbets and expected return on the graph - 18 14 Stock 10 Stock RATE OF RETURN(Percent) Stock 2 0 0.2 04 LE 15 20 08 10 12 RISK (Beta) Astock is in equilibrium ir its expected return its required return. In general, assume that markets and stocks are in equilibrium (or fairty valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, Stock Ais Stock Bis and Stock is in equilibrium and fairly valued Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts