Question: BACKGROUND: It is important to be able to solve accounting problems, but it is equally important to have a good understanding of how various transactions

BACKGROUND: It is important to be able to solve accounting problems, but it is equally important to have a good understanding of how various transactions and decisions affect the financial statements.

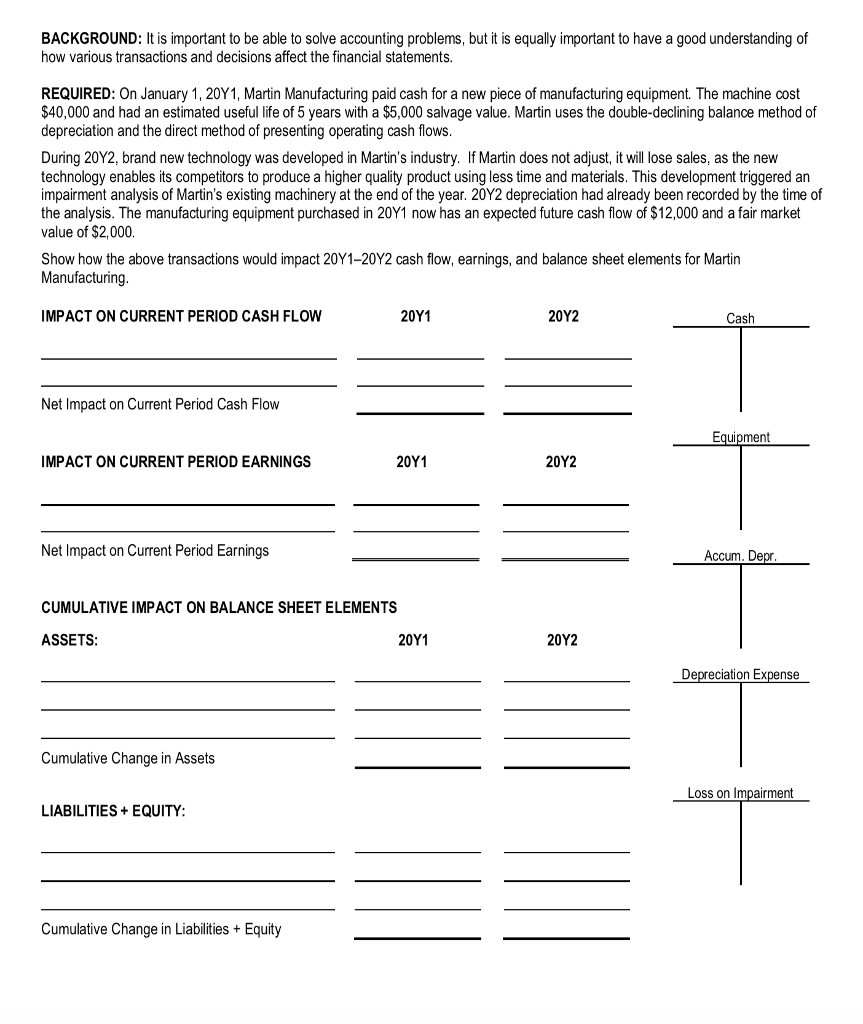

REQUIRED: On January 1, 20Y1, Martin Manufacturing paid cash for a new piece of manufacturing equipment. The machine cost $40,000 and had an estimated useful life of 5 years with a $5,000 salvage value. Martin uses the double-declining balance method of depreciation and the direct method of presenting operating cash flows.

During 20Y2, brand new technology was developed in Martins industry. If Martin does not adjust, it will lose sales, as the new technology enables its competitors to produce a higher quality product using less time and materials. This development triggered an impairment analysis of Martins existing machinery at the end of the year. 20Y2 depreciation had already been recorded by the time of the analysis. The manufacturing equipment purchased in 20Y1 now has an expected future cash flow of $12,000 and a fair market value of $2,000.

Show how the above transactions would impact 20Y120Y2 cash flow, earnings, and balance sheet elements for Martin Manufacturing.

(Please use the formatting as the image shows)

BACKGROUND: It is important to be able to solve accounting problems, but it is equally important to have a good understanding of how various transactions and decisions affect the financial statements. REQUIRED: On January 1, 20Y1, Martin Manufacturing paid cash for a new piece of manufacturing equipment. The machine cost $40,000 and had an estimated useful life of 5 years with a $5,000 salvage value. Martin uses the double-declining balance method of depreciation and the direct method of presenting operating cash flows During 20Y2, brand new technology was developed in Martin's industry. If Martin does not adjust, it will lose sales, as the new technology enables its competitors to produce a higher quality product using less time and materials. This development triggered an impairment analysis of Martin's existing machinery at the end of the year. 20Y2 depreciation had already been recorded by the time of the analysis. The manufacturing equipment purchased in 20Y1 now has an expected future cash flow of $12,000 and a fair market value of $2,000 Show how the above transactions would impact 20Y1-20Y2 cash flow, earnings, and balance sheet elements for Martin Manufacturing IMPACT ON CURRENT PERIOD CASH FLOW 20Y1 20Y2 Cash Net Impact on Current Period Cash FloW Equipment IMPACT ON CURRENT PERIOD EARNINGS 20Y1 20Y2 Net Impact on Current Period Earnings Accum. De CUMULATIVE IMPACT ON BALANCE SHEET ELEMENTS ASSETS 20Y1 20Y2 Depreciation Expense Cumulative Change in Assets Loss on Impairment LIABILITIES+EQUITY Cumulative Change in Liabilities+ Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts