Question: Background The spreadsheet Group Report Data.xlsx contains monthly returns on ten Australian industry indices from January 2016 to July 2021. The industry abbreviations are in

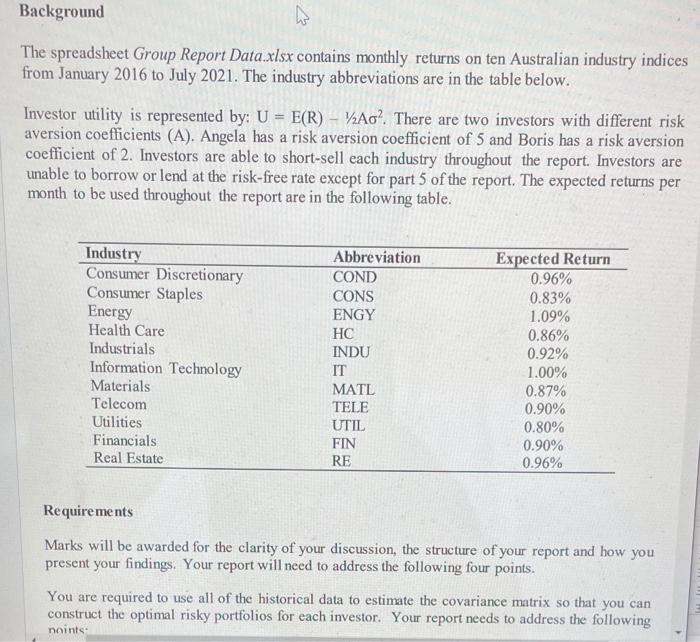

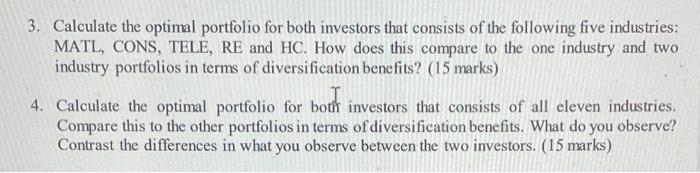

Background The spreadsheet Group Report Data.xlsx contains monthly returns on ten Australian industry indices from January 2016 to July 2021. The industry abbreviations are in the table below. Investor utility is represented by: U = E(R) VA0?. There are two investors with different risk aversion coefficients (A). Angela has a risk aversion coefficient of 5 and Boris has a risk aversion coefficient of 2. Investors are able to short-sell each industry throughout the report. Investors are unable to borrow or lend at the risk-free rate except for part 5 of the report. The expected returns per month to be used throughout the report are in the following table. Industry Consumer Discretionary Consumer Staples Energy Health Care Industrials Information Technology Materials Telecom Utilities Financials Real Estate Abbreviation COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE Expected Return 0.96% 0.83% 1.09% 0.86% 0.92% 1.00% 0.87% 0.90% 0.80% 0.90% 0.96% Requirements Marks will be awarded for the clarity of your discussion, the structure of your report and how you present your findings. Your report will need to address the following four points. You are required to use all of the historical data to estimate the covariance matrix so that you can construct the optimal risky portfolios for each investor. Your report needs to address the following noints 3. Calculate the optimal portfolio for both investors that consists of the following five industries: MATL, CONS, TELE, RE and HC. How does this compare to the one industry and two industry portfolios in terms of diversification benefits? (15 marks) 4. Calculate the optimal portfolio for both investors that consists of all eleven industries. Compare this to the other portfolios in terms of diversification benefits. What do you observe? Contrast the differences in what you observe between the two investors. (15 marks) Background The spreadsheet Group Report Data.xlsx contains monthly returns on ten Australian industry indices from January 2016 to July 2021. The industry abbreviations are in the table below. Investor utility is represented by: U = E(R) VA0?. There are two investors with different risk aversion coefficients (A). Angela has a risk aversion coefficient of 5 and Boris has a risk aversion coefficient of 2. Investors are able to short-sell each industry throughout the report. Investors are unable to borrow or lend at the risk-free rate except for part 5 of the report. The expected returns per month to be used throughout the report are in the following table. Industry Consumer Discretionary Consumer Staples Energy Health Care Industrials Information Technology Materials Telecom Utilities Financials Real Estate Abbreviation COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE Expected Return 0.96% 0.83% 1.09% 0.86% 0.92% 1.00% 0.87% 0.90% 0.80% 0.90% 0.96% Requirements Marks will be awarded for the clarity of your discussion, the structure of your report and how you present your findings. Your report will need to address the following four points. You are required to use all of the historical data to estimate the covariance matrix so that you can construct the optimal risky portfolios for each investor. Your report needs to address the following noints 3. Calculate the optimal portfolio for both investors that consists of the following five industries: MATL, CONS, TELE, RE and HC. How does this compare to the one industry and two industry portfolios in terms of diversification benefits? (15 marks) 4. Calculate the optimal portfolio for both investors that consists of all eleven industries. Compare this to the other portfolios in terms of diversification benefits. What do you observe? Contrast the differences in what you observe between the two investors. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts