Question: QUESTION 1 a. Critically evaluate the Capital Asset Pricing Model (CAPM), in your opinion, can we use the beta concept and its determination as our

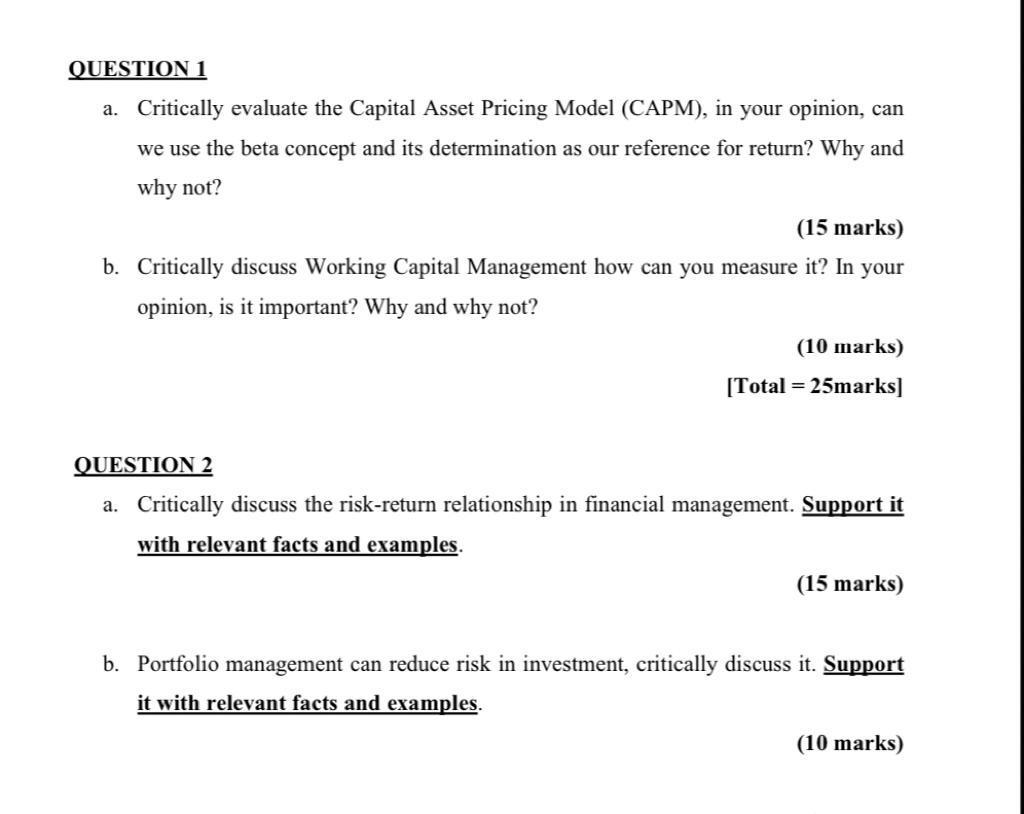

QUESTION 1 a. Critically evaluate the Capital Asset Pricing Model (CAPM), in your opinion, can we use the beta concept and its determination as our reference for return? Why and why not? (15 marks) b. Critically discuss Working Capital Management how can you measure it? In your opinion, is it important? Why and why not? (10 marks) [Total = 25marks] QUESTION 2 a. Critically discuss the risk-return relationship in financial management. Support it with relevant facts and examples. (15 marks) b. Portfolio management can reduce risk in investment, critically discuss it. Support it with relevant facts and examples. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts