Question: Baker & Co. has applied for a loan from the Trust Us Bank to invest in several potential opportunities. To evaluate the firm as a

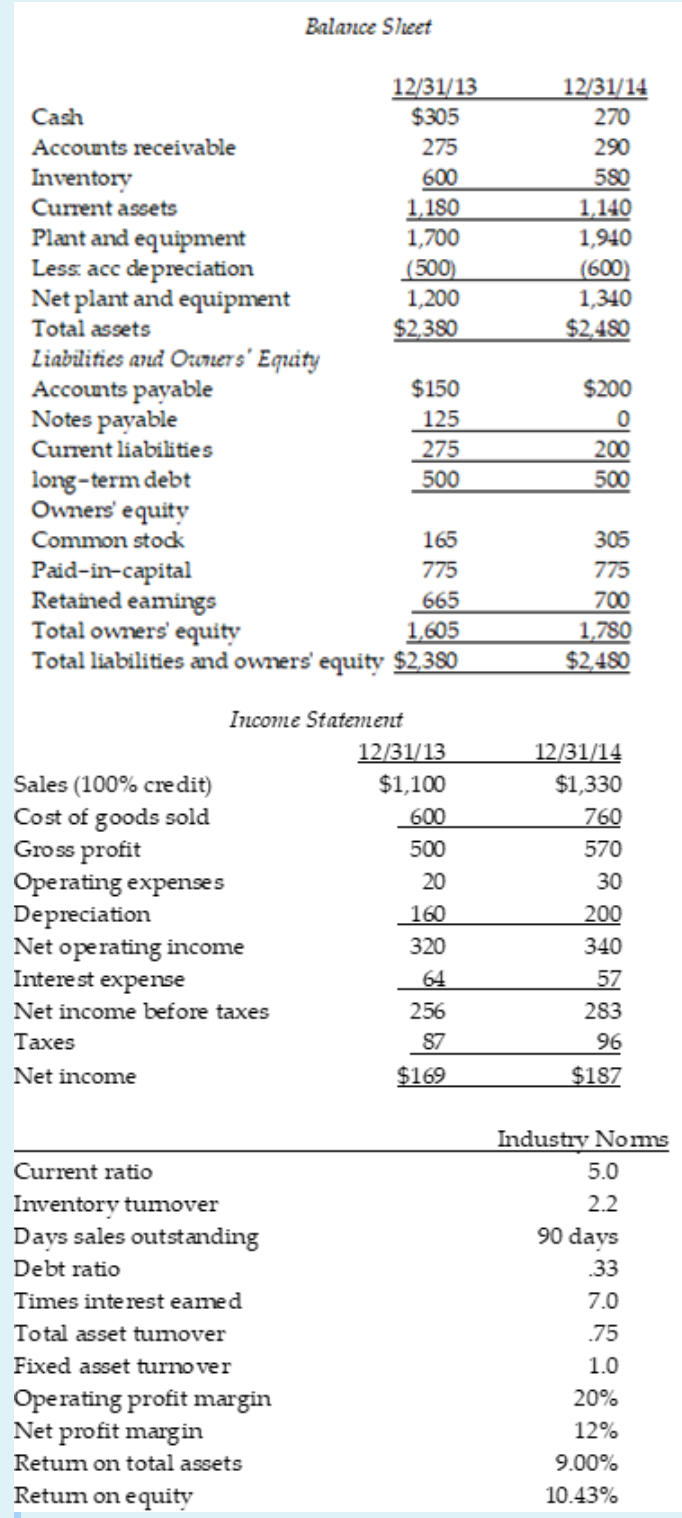

Baker & Co. has applied for a loan from the Trust Us Bank to invest in several potential opportunities. To evaluate the firm as a potential debtor, the bank would like to compare Baker & Co. to the industry. The following are the financial statements given to Trust Us Bank:

In 2014, Baker & Co's days sales outstanding is Select one:

A. 78 days

B. 35 days

C.50 days

D. 60 days

Balance Sheet 12/31/14 270 290 550 1,140 1,940 (600 1,340 $2,450 12/31/13 Cash $305 Accounts receivable 275 Inventory 600 Current assets 1,180 Plant and equipment 1,700 Less: acc depreciation (500) Net plant and equipment 1,200 Total assets $2,380 Liabilities and Orriers' Equity Accounts payable $150 Notes payable 125 Current liabilities 275 long-term debt 500 Owners' equity Common stock 165 Paid-in-capital 775 Retained eamings 665 Total owners' equity 1,605 Total liabilities and owners' equity $2,380 $200 0 200 500 306 775 700 1,750 $2,450 Income Statement 12/31/13 Sales (100% credit) $1,100 Cost of goods sold 600 Gross profit 500 Operating expenses 20 Depreciation 160 Net operating income 320 Interest expense Net income before taxes 256 Taxes 87 Net income $169 12/31/14 $1,330 760 570 30 200 340 57 283 96 $187 Current ratio Inventory tumover Days sales outstanding Debt ratio Times interest eamed Total asset tumover Fixed asset turnover Operating profit margin Net profit margin Retum on total assets Retum on equity Industry Norms 5.0 2.2 90 days 33 7.0 .75 1.0 20% 12% 9.00% 10.43%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts