Question: Balance Sheet: Income Statement: (a) Conduct a comparative analysis where you calculate and compare dollar changes or percentage changes in the balance sheet and income

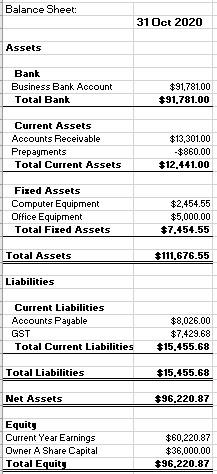

Balance Sheet:

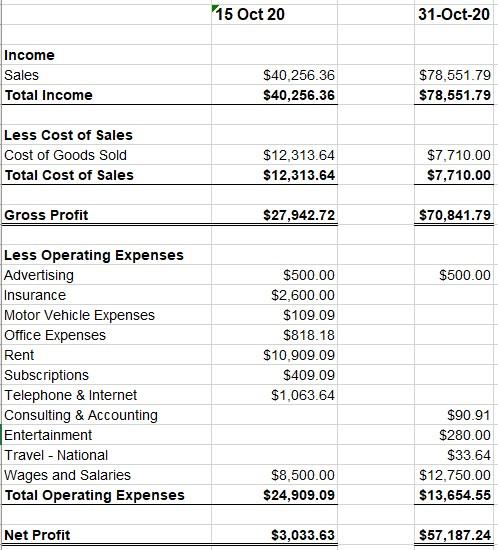

Income Statement:

(a) Conduct a comparative analysis where you calculate and compare dollar changes or percentage changes in the balance sheet and income statement items or totals for the two fortnights of the month of October 2020 (fortnight ending 15.10.20 and fortnight ending 31.10.20).

(a) Conduct a comparative analysis where you calculate and compare dollar changes or percentage changes in the balance sheet and income statement items or totals for the two fortnights of the month of October 2020 (fortnight ending 15.10.20 and fortnight ending 31.10.20).

(b) Calculate the following ratios for both fortnights:

ROA

Profit margin

Current ratio

Receivables turnover

(c) You then need to analyse the results and write a brief report (400 words) on the companys profitability and liquidity.

Balance Sheet: 31 Oct 2020 Assets Bank Business Bank Account Total Bank $91,781.00 $91,781.00 Current Assets Accounts Receivable Prepayments Total Current Assets $13,301.00 -$860.00 $12.441.00 Fized Assets Computer Equipment Office Equipment Total Fixed Assets $2,454.55 $5,000.00 $7.454.55 Total Assets $111.676.55 Liabilities Current Liabilities Accounts Payable GST Total Current Liabilities $8,026.00 $7.429.68 $15.455.68 Total Liabilities $15.455.68 Net Assets $96.220.87 Equity Current Year Earnings Owner A Share Capital Total Equity $60,220.87 $36,000.00 $96.220.87 15 Oct 20 31-Oct-20 Income Sales Total Income $40,256.36 $40,256.36 $78,551.79 $78,551.79 Less Cost of Sales Cost of Goods Sold Total Cost of Sales $12,313.64 $12,313.64 $7,710.00 $7,710.00 Gross Profit $27,942.72 $70,841.79 $500.00 Less Operating Expenses Advertising Insurance Motor Vehicle Expenses Office Expenses Rent Subscriptions Telephone & Internet Consulting & Accounting Entertainment Travel - National Wages and Salaries Total Operating Expenses $500.00 $2,600.00 $109.09 $818.18 $10.909.09 $409.09 $1,063.64 $90.91 $280.00 $33.64 $12.750.00 $13,654.55 $8,500.00 $24,909.09 Net Profit $3,033.63 $57,187.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts