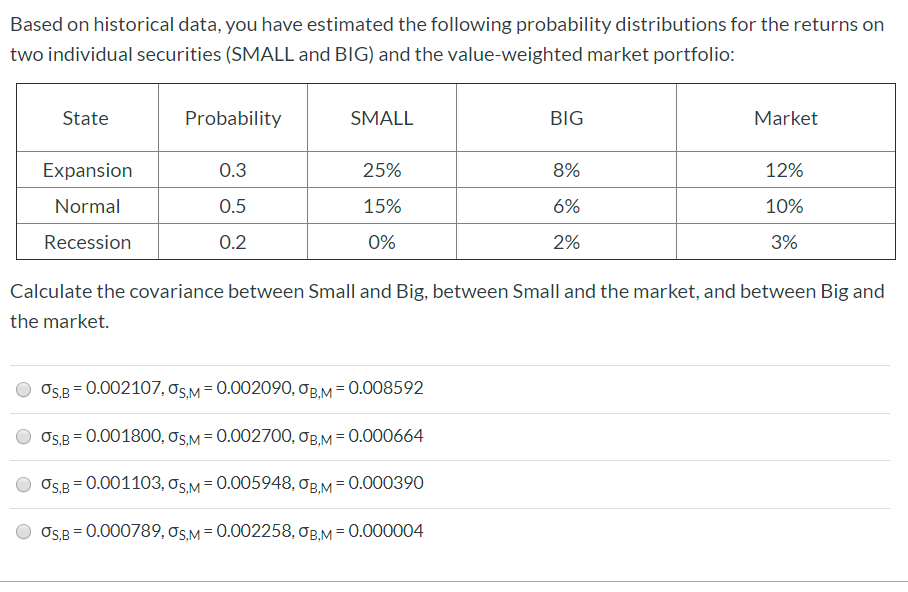

Question: Based on historical data, you have estimated the following probability distributions for the returns on two individual securities (SMALL and BIG) and the value-weighted market

Based on historical data, you have estimated the following probability distributions for the returns on two individual securities (SMALL and BIG) and the value-weighted market portfolio: State Probability SMALL BIG Market Expansion 0.3 25% 8% 12% Normal 0.5 15% 6% 10% Recession 0.2 0% 2% 3% Calculate the covariance between Small and Big, between Small and the market, and between Big and the market. O 05,8 = 0.002107,05,m= 0.002090, 0B,m=0.008592 O 05,8 = 0.001800, Os,M=0.002700, 0B,M = 0.000664 OS.B = 0.001103, OS.M = 0.005948, OB.M = 0.000390 Os,B = 0.000789, 0s,M=0.002258, 0B,M=0.000004

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock