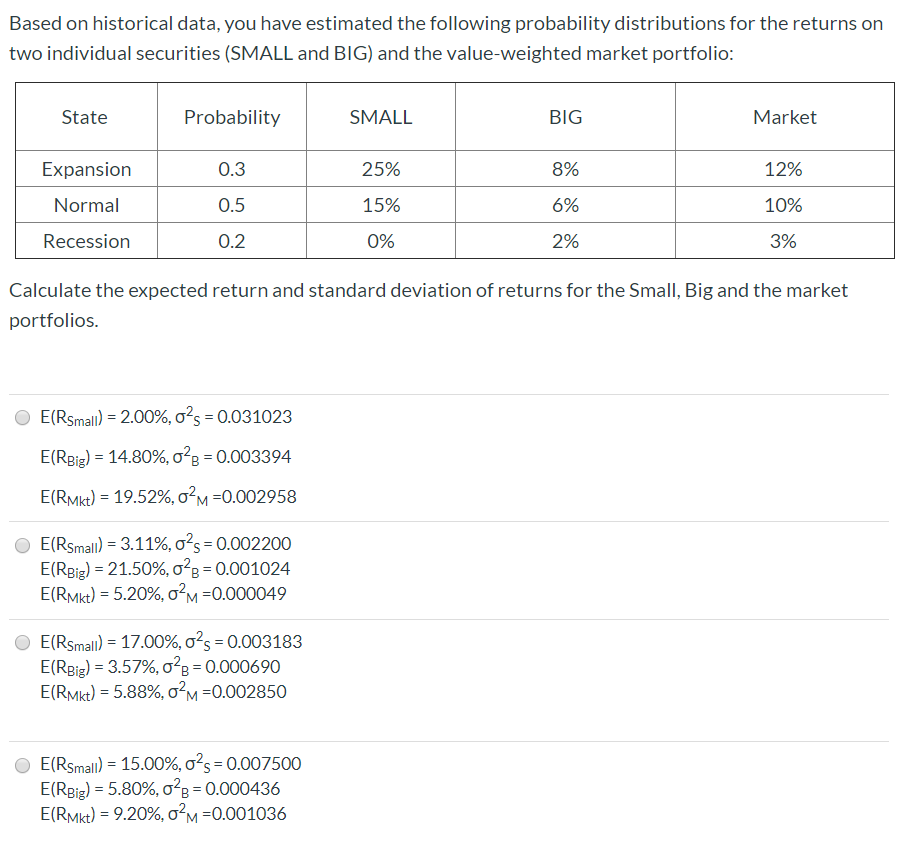

Question: Based on historical data, you have estimated the following probability distributions for the returns on two individual securities (SMALL and BIG) and the value-weighted market

Based on historical data, you have estimated the following probability distributions for the returns on two individual securities (SMALL and BIG) and the value-weighted market portfolio: State Probability SMALL BIG Market Expansion 25% 8% 12% 0.3 0.5 Normal 15% 10% 6% 2% Recession 0.2 0% 3% Calculate the expected return and standard deviation of returns for the Small, Big and the market portfolios. E(Rsmall) = 2.00%, os = 0.031023 E(RBig) = 14.80%, 0%g=0.003394 E(RMkt) = 19.52%, 0% =0.002958 E(Rsmall) = 3.11%, 0?s=0.002200 E(RBig) = 21.50%, 0%8= 0.001024 E(RMkt) = 5.20%, 0% =0.000049 OE(Rsmall) = 17.00%,0?s=0.003183 E(RBig) = 3.57%, 02B = 0.000690 E(RMkt) = 5.88%, 0% =0.002850 E(Rsmall) = 15.00%,0?s=0.007500 (RBig) = 5.80%, 02B = 0.000436 E(RMkt) = 9.20%, 0% =0.001036

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts