Question: Based on the analysis in case Exhibit 14, what is the anticipated Chipotle share price under each scenario? Exhibit 14 Chipotle: Capital Structure Decision Pro

Based on the analysis in case Exhibit 14, what is the anticipated Chipotle share price under each scenario?

Based on the analysis in case Exhibit 14, what is the anticipated Chipotle share price under each scenario?

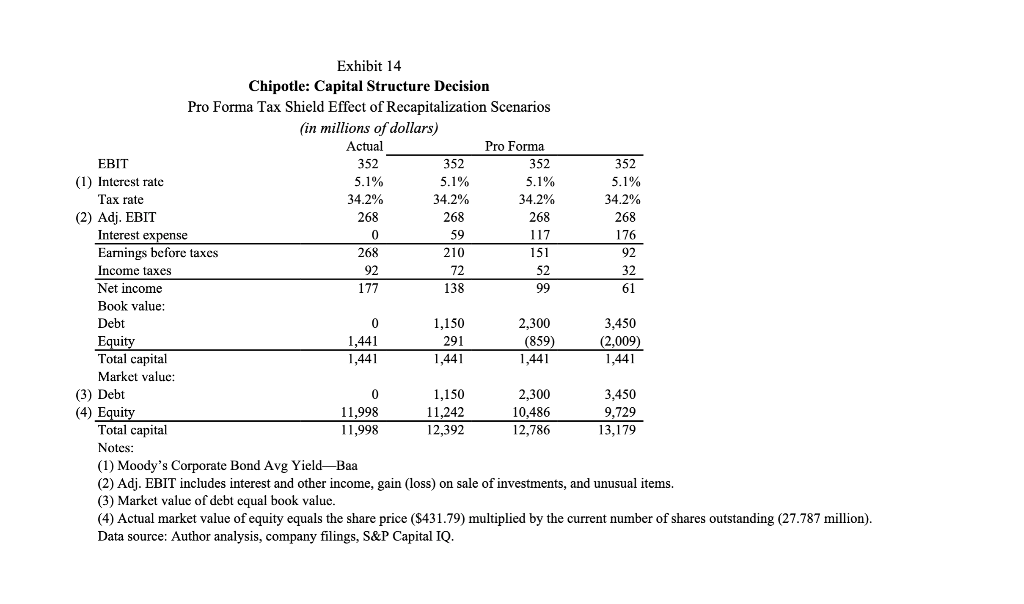

Exhibit 14 Chipotle: Capital Structure Decision Pro Forma Tax Shield Effect of Recapitalization Scenarios (in millions of dollars) Actual Pro Forma EBIT 352 352 352 352 (1) Interest rate 5.1% 5.1% 5.1% 5.1% Tax rate 34.2% 34.2% 34.2% 34.2% (2) Adj. EBIT 268 268 268 268 Interest expense 0 0 59 117 176 Earnings before taxes 268 210 151 92 Income taxes 92 72 52 32 Net income 177 138 99 61 Book value: Debt 0 1,150 2,300 3,450 Equity 1,441 291 (859) (2,009) Total capital 1,441 1,441 1,441 1,441 Market value: (3) Debt 0 1,150 2,300 3,450 (4) Equity 11,998 11,242 10,486 9,729 Total capital 11,998 12,392 12,786 13,179 Notes: (1) Moody's Corporate Bond Avg Yield-Baa (2) Adj. EBIT includes interest and other income, gain (loss) on sale of investments, and unusual items. (3) Market value of debt equal book value. (4) Actual market value of equity equals the share price ($431.79) multiplied by the current number of shares outstanding (27.787 million). Data source: Author analysis, company filings, S&P Capital IQ. Exhibit 14 Chipotle: Capital Structure Decision Pro Forma Tax Shield Effect of Recapitalization Scenarios (in millions of dollars) Actual Pro Forma EBIT 352 352 352 352 (1) Interest rate 5.1% 5.1% 5.1% 5.1% Tax rate 34.2% 34.2% 34.2% 34.2% (2) Adj. EBIT 268 268 268 268 Interest expense 0 0 59 117 176 Earnings before taxes 268 210 151 92 Income taxes 92 72 52 32 Net income 177 138 99 61 Book value: Debt 0 1,150 2,300 3,450 Equity 1,441 291 (859) (2,009) Total capital 1,441 1,441 1,441 1,441 Market value: (3) Debt 0 1,150 2,300 3,450 (4) Equity 11,998 11,242 10,486 9,729 Total capital 11,998 12,392 12,786 13,179 Notes: (1) Moody's Corporate Bond Avg Yield-Baa (2) Adj. EBIT includes interest and other income, gain (loss) on sale of investments, and unusual items. (3) Market value of debt equal book value. (4) Actual market value of equity equals the share price ($431.79) multiplied by the current number of shares outstanding (27.787 million). Data source: Author analysis, company filings, S&P Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts