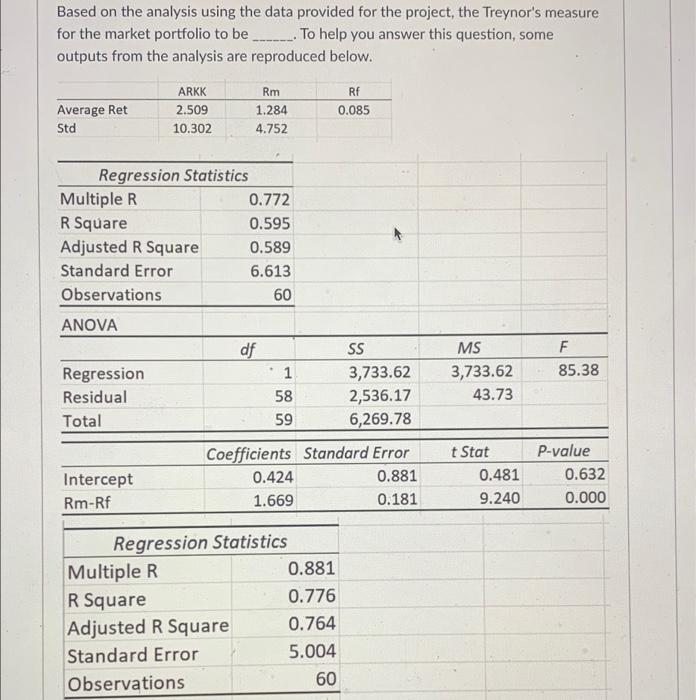

Question: Based on the analysis using the data provided for the project, the Treynor's measure for the market portfolio to beTo help you answer this question,

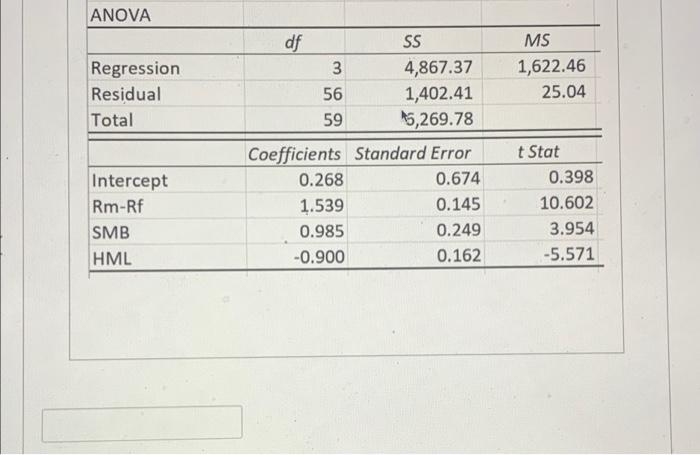

Based on the analysis using the data provided for the project, the Treynor's measure for the market portfolio to beTo help you answer this question, some outputs from the analysis are reproduced below. Rm ARKK 2.509 10.302 RE 0.085 Average Ret Std 1.284 4.752 Regression Statistics Multiple R 0.772 R Square 0.595 Adjusted R Square 0.589 Standard Error 6.613 Observations 60 ANOVA df Regression 1 Residual 58 Total 59 SS 3,733.62 2,536.17 6,269.78 MS 3,733.62 43.73 F 85.38 Intercept Rm-Rf Coefficients Standard Error 0.424 0.881 1.669 0.181 t Stat 0.481 9.240 P-value 0.632 0.000 Regression Statistics Multiple R 0.881 R Square 0.776 Adjusted R Square 0.764 Standard Error 5.004 Observations 60 ANOVA Regression Residual Total MS 1,622.46 25.04 59 df SS 3 4,867.37 56 1,402.41 15,269.78 Coefficients Standard Error 0.268 0.674 1.539 0.145 0.985 0.249 -0.900 0.162 Intercept Rm-Rf SMB HML t Stat 0.398 10.602 3.954 -5.571

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts