Question: Based on the case study Essess by Indian Coatings please write your personal well-considered answer to the questions given below. Ensure that you justify the

Based on the case study Essess by Indian Coatings please write your personal well-considered answer to the questions given below. Ensure that you justify the answer (quantitatively and qualitatively) with supporting analysis based only on information available specifically in the case document or established conceptual understanding.

- How important was the legacy EEBF salesman for the EIC distribution channel partners in FY 2020-21? How can EIC leverage this? Explain your answer.

- Which option do you recommend that Mr Kapoor accept and implement? Justify your answer.

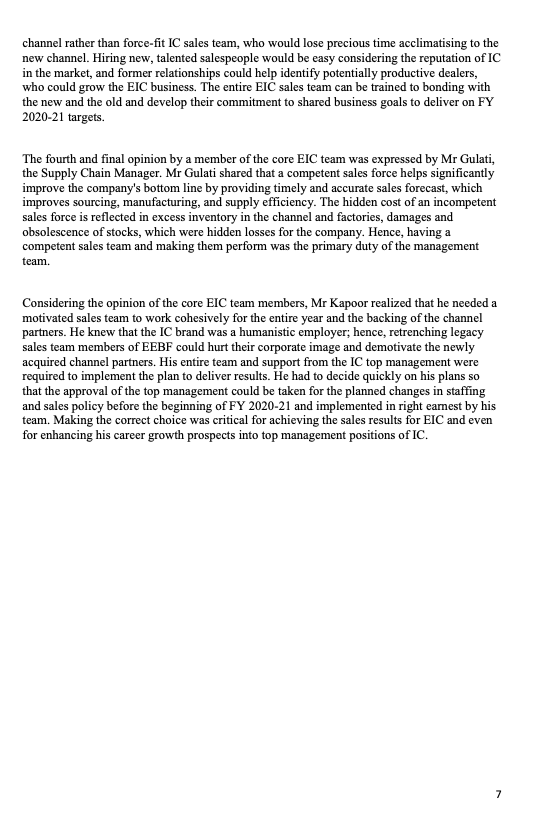

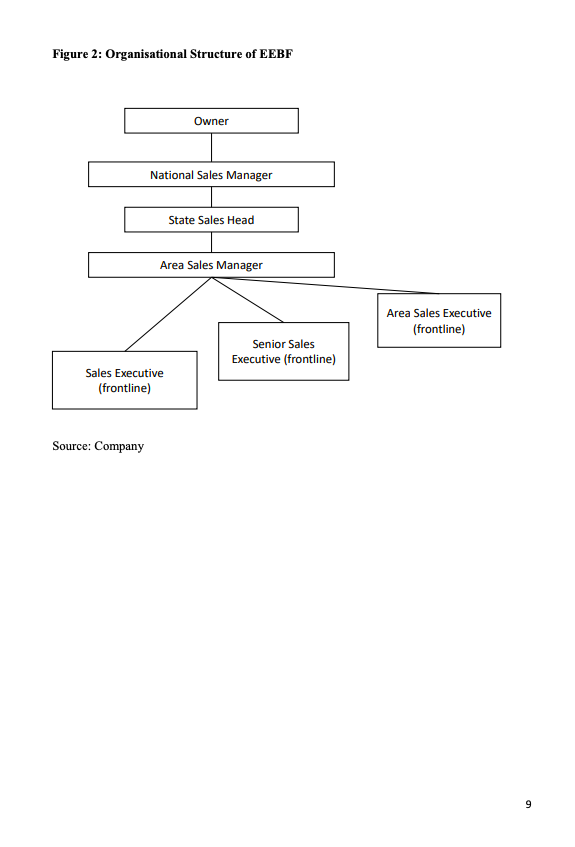

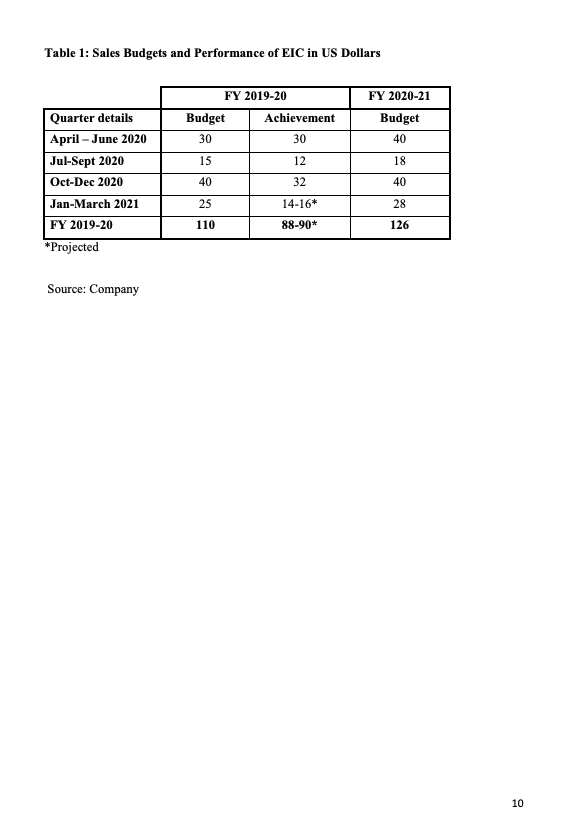

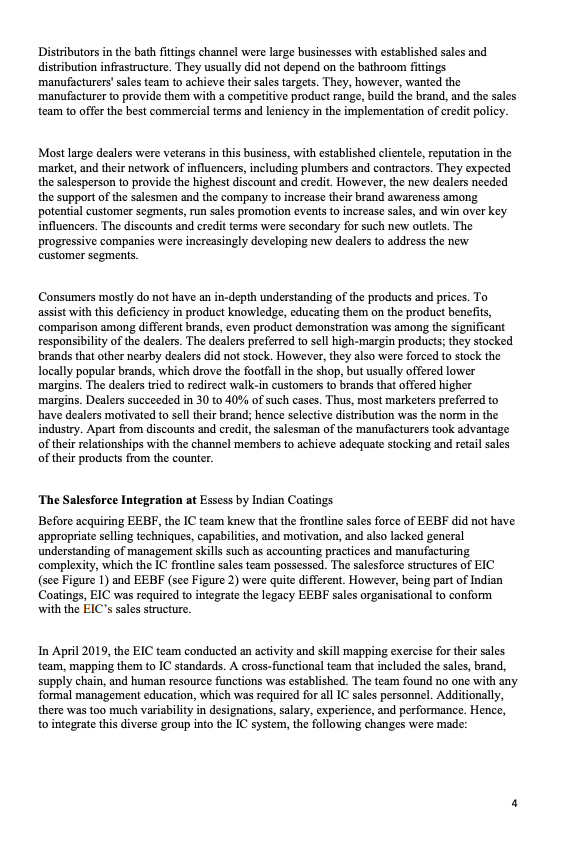

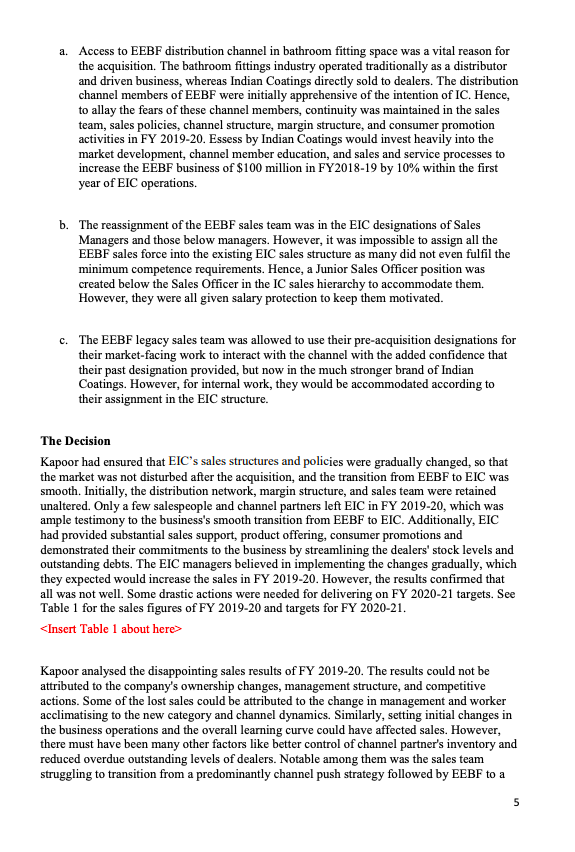

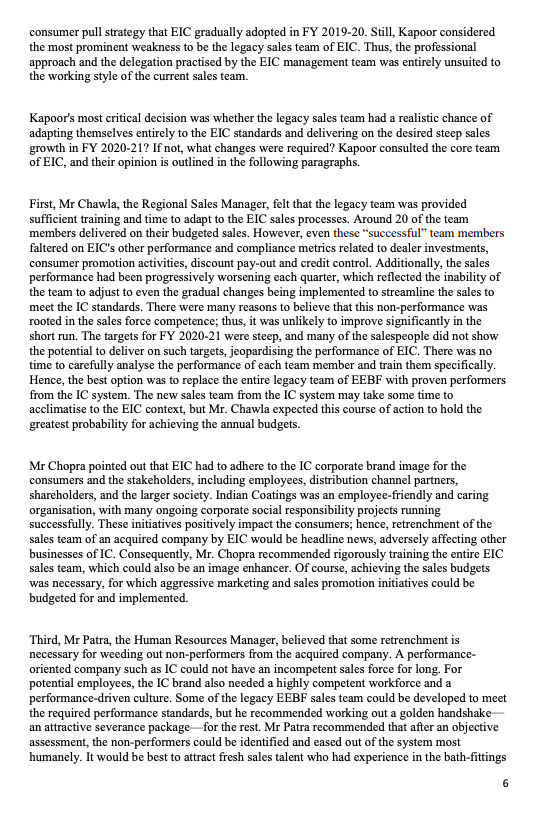

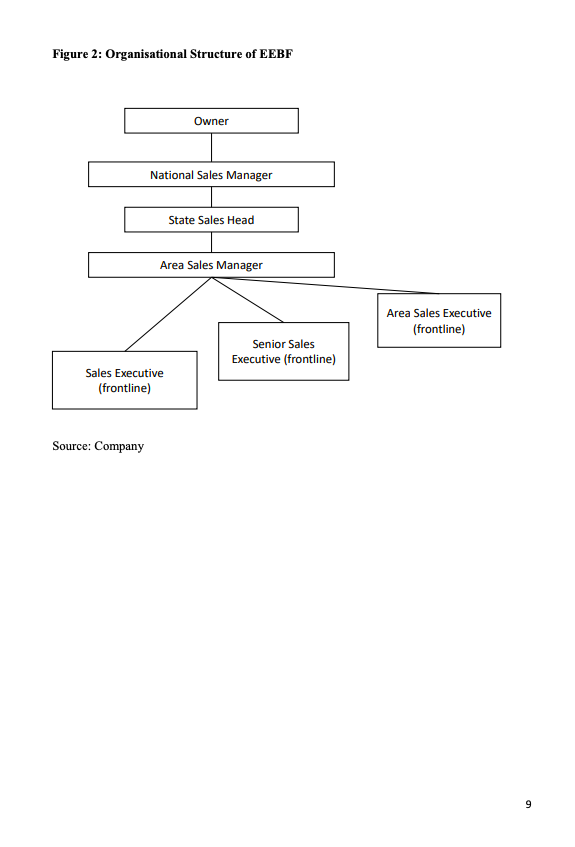

Essess by Indian Coatings On April 1, 2019, Sharat Kapoor was promoted to General Manager of Essess by Indian Coatings (EIC). Indian Coatings (IC), the market leader in decorative paints in India, acquired Ess Ess Bath Fittings (EEBF) in March 2019 to begin a business in the bathroom fittings and decoration sector. Top management of IC expected to use their company's superior marketing capabilities and sales processes to deliver business growth for EIC beginning with the first year of operations. However, by the end of January 2020, it was clear that financial year (FY) 2019-20 sales performance (the FY 2019-20 is from April 1 of 2019 to March 31 of 2020) of EIC would be 18% to 20% less than EEBF had achieved in FY 2018-19. Despite clear improvements in brand image perceptions, sales policy implementation, and sales force motivation, it was a disappointing result. On February 27, 2020, the IC top management communicated to Kapoor an above 40% annual sales growth targeted for EIC in FY 2020-21. Kapoor and his team concluded that the sales force was the root cause for lacklustre performance and shortlisted the possible options for rejuvenating the EIC sales for FY 2020-21. The first option was to continue with the legacy sales force of EEBF and intensively train them to use IC sales processes to grow sales. This choice could leverage the sales team's familiarity and experience in the bathroom fittings distribution channel. However, the FY 2019-20 experience showed that it would take two more years to deliver the desired results. The second option was to replace the entire legacy sales team of EEBF with members of the IC sales team, selecting those having a proven track record in the paints business. The advantage of this choice was that IC sales personnel could more efficiently and competently use the IC sales systems. However, as they would be new to bathroom fittings, it would take time to establish themselves into the unfamiliar bath fittings distribution channel, jeopardising their chances of delivering on the steep growth objectives in FY 2020-21. The third option was to retain only the best sales performers of EEBF who, hopefully, could successfully adapt IC's sales processes to deliver their sales volumes goals. The balance of the sales personnel would be newly hired employees who had experience in the bath fittings channel and who also matched the IC selection criteria. With this final scenario, the entire team would be trained to accomplish the sales targets for FY 2020-21. Background Indian Coatings was an Indian multinational paint company based in Mumbai, the financial capital of India. The company manufactured and sold paints and other wall coating products for home dcor, exterior wall finish, and had dominated the Indian paint industry for 30 years and enjoyed a market share of more than 54% in FY 2018-19. Ess Ess Bath Fittings was one of the oldest and most renowned bath fittings manufacturers in India. Over the years, the company had established its Essess brand, which was well-known for reliable high quality products that included faucets, shower faucets, and other bathroom fittings. Since 2016, Essess struggled to retain its position in the market, primarily due to financial constraints resulting from discord in the owner's family. In March 2019, IC acquired the entire front-end sales business, the Essess brand, and rights to use the distribution network and sales infrastructure of EEBF. However, manufacturing capability remained under the 1 control of EEBF. Thus, the acquisition involved a binding agreement between IC and EEPF that EIC was committed to delivering quality and design excellence to its consumers to strengthen the Essess brand in the bathroom space. Essess by Indian Coatings aimed to deliver a whole new world of contemporary bathroom fittings and accessories that assured quality and design excellence to its consumers. Since IC had no prior experience and expertise in the bathroom products market of India, this acquisition could induce uncertainty in the minds of stakeholders, which could affect the Essess brand. To mitigate that uncertainty, the EIC team decided to retain the entire 70- member sales team of EEBF, 1500 channel partners of EBIF, and the existing branch offices located across important state capital cities of India. These were expected to help EIC leverage the sales team's familiarity and relationship with the distribution channels, experience in the product category, and their established consumer base. Essess by Indian Coatings also began its investments in research to understand and adapt its products to the market's new aesthetical and functional demands. The Bathroom Fittings Market In general, bathroom fittings are a little considered category for most of the Indian population. However, since the turn of the twenty-first century, this aspect of home life had experienced a marked change. Now, a large majority of Indian houses have contemporary and stylish fittings and interiors. The growth in the housing sector drives the greater attention in this product category, which has expanded tremendously due to an increase in purchasing power, an escalation in nuclear families, rapid urbanisation, and more accessibility to housing loans at affordable prices. Apart from the housing units, a steep increase in demand for shopping malls, the products and services from the hospitality industry and logistics facilities fuelled the demand for bath fittings. This phenomenon was observed across the Indian market, including even small cities and towns. The Indian bathroom fitting market was almost US $ 1.5 billion in FY 2018-19 and intensely competitive. This market can be considered the premium end, the premium-mid market, the mid-market, and the economy. The premium end of this market accounted for 12%, and was principally occupied by major international firms including Kashigo, Graham, Texture, and Romanov. These brands were advertised in mass media and accumulated considerable brand equity over the years. Panther dominated the premium-mid market with a 28% market share, with a solid brand franchise and matching product and price combinations. The mid-market was 23%, in which Indian major firms with strong regional dominance, including Bharat Ceramics, Berry, Mica, Pulman & Sara, and Essess, compete. The unbranded products produced by the small scale industries were at the low price-low quality economy market, which accounted for the balance 37% of the market. The market was projected to grow at a compound annual growth rate of 10% for the next five years. 60% of the demand was for residential use and the rest for commercial. For residential uses, almost 30% of the demand was from institutional buyers such as large builders, who mostly purchased products from the manufacturers. Thus, around 42% of the total market was the retail consumer market, served by the distribution channel. 2 Retail Consumers Internet-facilitated information plays a significant and influential role in the choice of products and brands. Most consumers start their purchase journey with an online search of retailer and manufacturer websites and social media sites. However, the role of the physical retail channel was crucial, as only 8% of purchases were from online retailers. Initially, consumers were not aware of the technological features and the design elements of bathroom fittings. The retail channel had a considerable role in conveying information and helping consumers purchase decision making. Market research found that 35% of respondents used a professional design and planning service, whereas another 31% preferred to plan their bathroom remodelling themselves. A further 20% of respondents retained their layout, replicated a design they had seen in bathrooms in their friends and neighbours houses, or was recommended by someone they knew. Plumbers and cabinet and fixture installers had a considerable influence on the consumer decision-making process. Bathroom fitting channel members and marketers worked hard to win their confidence by sharing knowledge, providing training and even incentivised them. Consumers prefer a one-stop solution for all their bathroom fittings requirements. Ideally, customers could view an assortment of products and brands in one store.. Around 20% of consumers had bathroom remodelling work undertaken by a contractor, and depended entirely on the contractor to select brands. Another 30 % of consumers depended on plumbers to make product and brand choices and select the shops in which items were purchased. The remaining 50% of those who remodelled their bathrooms engaged in extensive internet research and visited several shops to view products and brands and compare prices. Apart from the premium end of the market, most category consumers compared and verified prices across various brands and dealers before purchasing. The price sensitivity was higher for the mid-lower end of the market, while the unorganised sector was primarily price-driven. Distribution channel The distribution channel in the bathroom fittings industry consists of distributors and dealers. In this industry, dealers are retailers who sell bathroom fittings to consumers. Bathroom fittings manufacturers appointed distributors for servicing the smaller shops in geographically widely dispersed areas or those stores with low sales potential, which could not be economically served by the direct sale team of the marketer. Distributors were exclusive to a company, though some could have non-competing business lines. High selling dealers located in big cities and towns were served directly by the manufacturers. After due diligence, the companies appointed authorised dealers either supplied and serviced directly by the company or distributors. Most of the dealers had a showroom for display, sales personnel, customer handling capabilities, and a conveniently located warehouse for stocking and delivery. 70% of the dealers in big cities and 20% of those located in small towns were multi-brand bathroom fitting outlets specialist, stocking three to five brands. The rest of the outlets stocked many associated products such as hardware, kitchenware, and sanitary ware. Thus, these outlets stocked only one or two brands of bathroom fittings. 3 Distributors in the bath fittings channel were large businesses with established sales and distribution infrastructure. They usually did not depend on the bathroom fittings manufacturers' sales team to achieve their sales targets. They, however, wanted the manufacturer to provide them with a competitive product range, build the brand, and the sales team to offer the best commercial terms and leniency in the implementation of credit policy. Most large dealers were veterans in this business, with established clientele, reputation in the market, and their network of influencers, including plumbers and contractors. They expected the salesperson to provide the highest discount and credit. However, the new dealers needed the support of the salesmen and the company to increase their brand awareness among potential customer segments, run sales promotion events to increase sales, and win over key influencers. The discounts and credit terms were secondary for such new outlets. The progressive companies were increasingly developing new dealers to address the new customer segments. Consumers mostly do not have an in-depth understanding of the products and prices. To assist with this deficiency in product knowledge, educating them on the product benefits, comparison among different brands, even product demonstration was among the significant responsibility of the dealers. The dealers preferred to sell high-margin products; they stocked brands that other nearby dealers did not stock. However, they also were forced to stock the locally popular brands, which drove the footfall in the shop, but usually offered lower margins. The dealers tried to redirect walk-in customers to brands that offered higher margins. Dealers succeeded in 30 to 40% of such cases. Thus, most marketers preferred to have dealers motivated to sell their brand; hence selective distribution was the norm in the industry. Apart from discounts and credit, the salesman of the manufacturers took advantage of their relationships with the channel members to achieve adequate stocking and retail sales of their products from the counter. The Salesforce Integration at Essess by Indian Coatings Before acquiring EEBF, the IC team knew that the frontline sales force of EEBF did not have appropriate selling techniques, capabilities, and motivation, and also lacked general understanding of management skills such as accounting practices and manufacturing complexity, which the IC frontline sales team possessed. The salesforce structures of EIC (see Figure 1) and EEBF (see Figure 2) were quite different. However, being part of Indian Coatings, EIC was required to integrate the legacy EEBF sales organisational to conform with the EIC's sales structure. In April 2019, the EIC team conducted an activity and skill mapping exercise for their sales team, mapping them to IC standards. A cross-functional team that included the sales, brand, supply chain, and human resource functions was established. The team found no one with any formal management education, which was required for all IC sales personnel. Additionally, there was too much variability in designations, salary, experience, and performance. Hence, to integrate this diverse group into the IC system, the following changes were made: 4 a. Access to EEBF distribution channel in bathroom fitting space was a vital reason for the acquisition. The bathroom fittings industry operated traditionally as a distributor and driven business, whereas Indian Coatings directly sold to dealers. The distribution channel members of EEBF were initially apprehensive of the intention of IC. Hence, to allay the fears of these channel members, continuity was maintained in the sales team, sales policies, channel structure, margin structure, and consumer promotion activities in FY 2019-20. Essess by Indian Coatings would invest heavily into the market development, channel member education, and sales and service processes to increase the EEBF business of $100 million in FY2018-19 by 10% within the first year of EIC operations. b. The reassignment of the EEBF sales team was in the EIC designations of Sales Managers and those below managers. However, it was impossible to assign all the EEBF sales force into the existing EIC sales structure as many did not even fulfil the minimum competence requirements. Hence, a Junior Sales Officer position was created below the Sales Officer in the IC sales hierarchy to accommodate them. However, they were all given salary protection to keep them motivated. c. The EEBF legacy sales team was allowed to use their pre-acquisition designations for their market-facing work to interact with the channel with the added confidence that their past designation provided, but now in the much stronger brand of Indian Coatings. However, for internal work, they would be accommodated according to their assignment in the EIC structure. The Decision Kapoor had ensured that EIC's sales structures and policies were gradually changed, so that the market was not disturbed after the acquisition, and the transition from EEBF to EIC was smooth. Initially, the distribution network, margin structure, and sales team were retained unaltered. Only a few salespeople and channel partners left EIC in FY 2019-20, which was ample testimony to the business's smooth transition from EEBF to EIC. Additionally, EIC had provided substantial sales support, product offering, consumer promotions and demonstrated their commitments to the business by streamlining the dealers' stock levels and outstanding debts. The EIC managers believed in implementing the changes gradually, which they expected would increase the sales in FY 2019-20. However, the results confirmed that all was not well. Some drastic actions were needed for delivering on FY 2020-21 targets. See Table 1 for the sales figures of FY 2019-20 and targets for FY 2020-21.

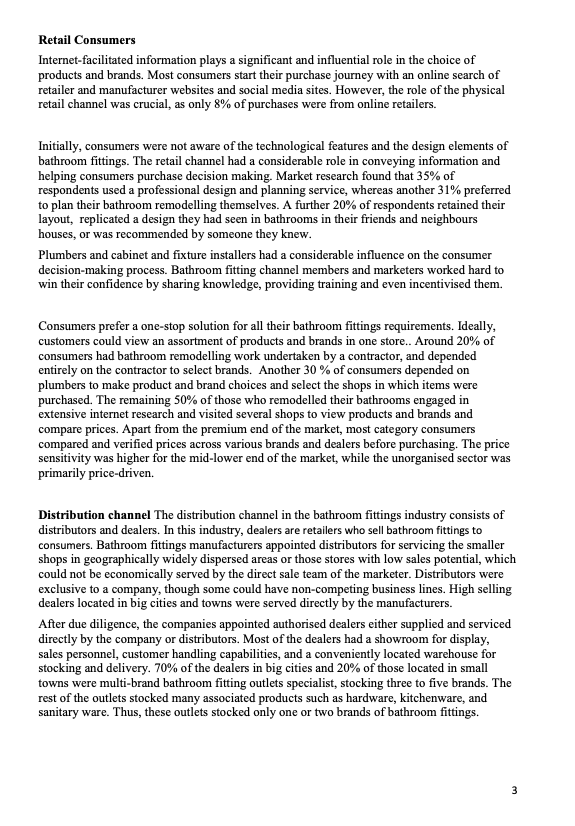

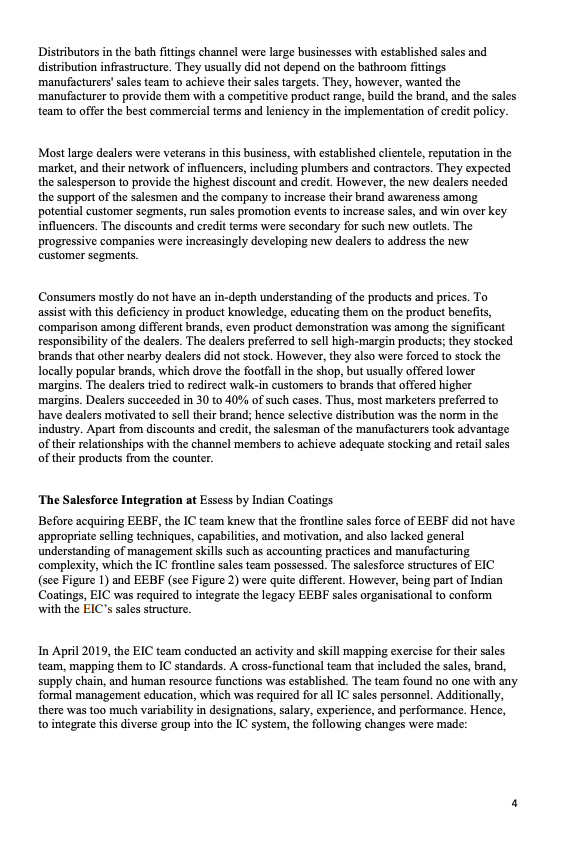

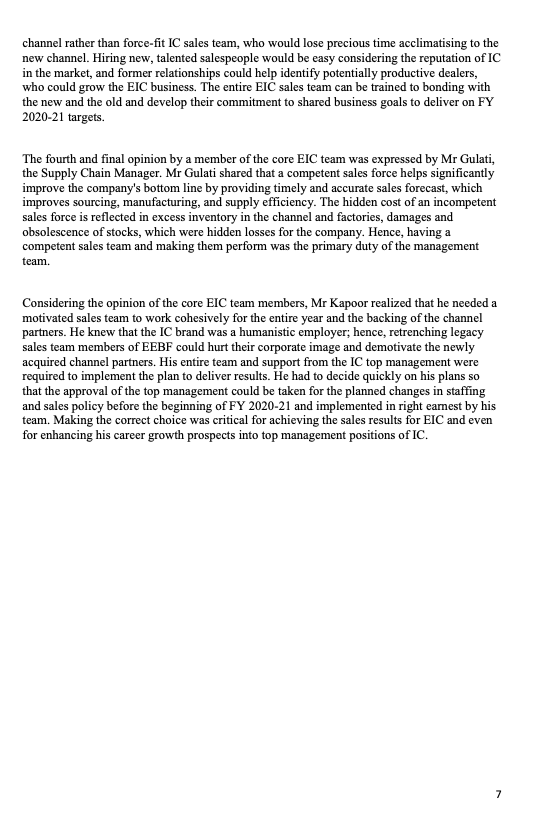

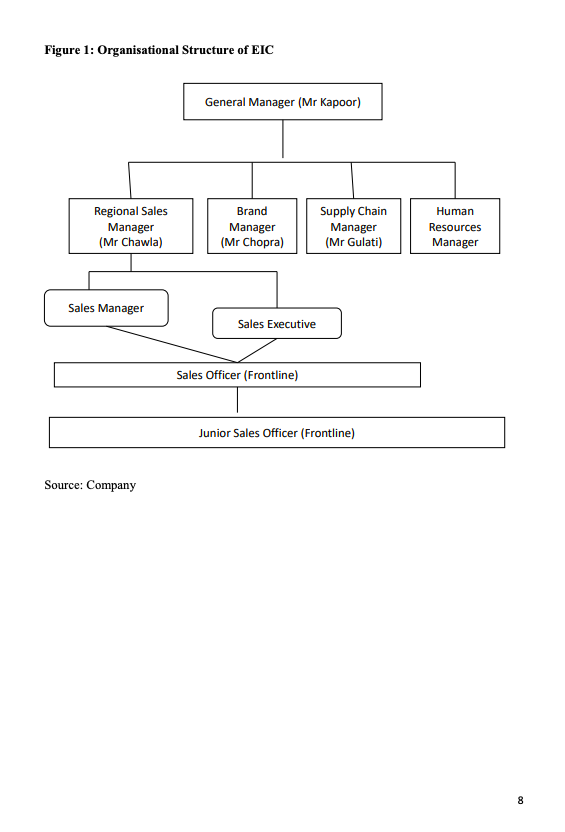

Kapoor analysed the disappointing sales results of FY 2019-20. The results could not be attributed to the company's ownership changes, management structure, and competitive actions. Some of the lost sales could be attributed to the change in management and worker acclimatising to the new category and channel dynamics. Similarly, setting initial changes in the business operations and the overall learning curve could have affected sales. However, there must have been many other factors like better control of channel partner's inventory and reduced overdue outstanding levels of dealers. Notable among them was the sales team struggling to transition from a predominantly channel push strategy followed by EEBF to a 5 consumer pull strategy that EIC gradually adopted in FY 2019-20. Still, Kapoor considered the most prominent weakness to be the legacy sales team of EIC. Thus, the professional approach and the delegation practised by the EIC management team was entirely unsuited to the working style of the current sales team. Kapoor's most critical decision was whether the legacy sales team had a realistic chance of adapting themselves entirely to the EIC standards and delivering on the desired steep sales growth in FY 2020-21? If not, what changes were required? Kapoor consulted the core team of EIC, and their opinion is outlined in the following paragraphs. First, Mr Chawla, the Regional Sales Manager, felt that the legacy team was provided sufficient training and time to adapt to the EIC sales processes. Around 20 of the team members delivered on their budgeted sales. However, even these successful team members faltered on EIC's other performance and compliance metrics related to dealer investments, consumer promotion activities, discount pay-out and credit control. Additionally, the sales performance had been progressively worsening each quarter, which reflected the inability of the team to adjust to even the gradual changes being implemented to streamline the sales to meet the IC standards. There were many reasons to believe that this non-performance was rooted in the sales force competence; thus, it was unlikely to improve significantly in the short run. The targets for FY 2020-21 were steep, and many of the salespeople did not show the potential to deliver on such targets, jeopardising the performance of EIC. There was no time to carefully analyse the performance of each team member and train them specifically. Hence, the best option was to replace the entire legacy team of EEBF with proven performers from the IC system. The new sales team from the IC system may take some time to acclimatise to the EIC context, but Mr. Chawla expected this course of action to hold the greatest probability for achieving the annual budgets. Mr Chopra pointed out that EIC had to adhere to the IC corporate brand image for the consumers and the stakeholders, including employees, distribution channel partners, shareholders, and the larger society. Indian Coatings was an employee-friendly and caring organisation, with many ongoing corporate social responsibility projects running successfully. These initiatives positively impact the consumers; hence, retrenchment of the sales team of an acquired company by EIC would be headline news, adversely affecting other businesses of IC. Consequently, Mr. Chopra recommended rigorously training the entire EIC sales team, which could also be an image enhancer. Of course, achieving the sales budgets was necessary, for which aggressive marketing and sales promotion initiatives could be budgeted for and implemented. Third, Mr Patra, the Human Resources Manager, believed that some retrenchment is necessary for weeding out non-performers from the acquired company. A performance- oriented company such as I could not have an incompetent sales force for long. For potential employees, the IC brand also needed a highly competent workforce and a performance-driven culture. Some of the legacy EEBF sales team could be developed to meet the required performance standards, but he recommended working out a golden handshake an attractive severance package for the rest. Mr Patra recommended that after an objective assessment, the non-performers could be identified and eased out of the system most humanely. It would be best to attract fresh sales talent who had experience in the bath-fittings 6 channel rather than force-fit IC sales team, who would lose precious time acclimatising to the new channel. Hiring new, talented salespeople would be easy considering the reputation of IC in the market, and former relationships could help identify potentially productive dealers, who could grow the EIC business. The entire EIC sales team can be trained to bonding with the new and the old and develop their commitment to shared business goals to deliver on FY 2020-21 targets. The fourth and final opinion by a member of the core EIC team was expressed by Mr Gulati, the Supply Chain Manager. Mr Gulati shared that a competent sales force helps significantly improve the company's bottom line by providing timely and accurate sales forecast, which improves sourcing, manufacturing, and supply efficiency. The hidden cost of an incompetent sales force is reflected in excess inventory in the channel and factories, damages and obsolescence of stocks, which were hidden losses for the company. Hence, having a competent sales team and making them perform was the primary duty of the management team. Considering the opinion of the core EIC team members, Mr Kapoor realized that he needed a motivated sales team to work cohesively for the entire year and the backing of the channel partners. He knew that the IC brand was a humanistic employer; hence, retrenching legacy sales team members of EEBF could hurt their corporate image and demotivate the newly acquired channel partners. His entire team and support from the IC top management were required to implement the plan to deliver results. He had to decide quickly on his plans so that the approval of the top management could be taken for the planned changes in staffing and sales policy before the beginning of FY 2020-21 and implemented in right eamest by his team. Making the correct choice was critical for achieving the sales results for EIC and even for enhancing his career growth prospects into top management positions of IC. 7 Figure 1: Organisational Structure of EIC General Manager (Mr Kapoor) Regional Sales Manager (Mr Chawla) Brand Manager (Mr Chopra) Supply Chain Manager (Mr Gulati) Human Resources Manager Sales Manager Sales Executive Sales Officer (Frontline) Junior Sales Officer (Frontline) Source: Company 8 Figure 2: Organisational Structure of EEBF Owner National Sales Manager State Sales Head Area Sales Manager Area Sales Executive (frontline) Senior Sales Executive (frontline) Sales Executive (frontline) Source: Company 9 Table 1: Sales Budgets and Performance of EIC in US Dollars FY 2019-20 Budget Achievement 30 30 FY 2020-21 Budget 40 15 12 18 Quarter details April - June 2020 Jul-Sept 2020 Oct-Dec 2020 Jan-March 2021 FY 2019-20 * Projected 40 32 40 25 14-16* 28 110 88-90* 126 Source: Company 10