Question: Based on the cash flow statement and personal balance sheet, do the Sampsons have adequate liquidity to cover their recurring cash flows and planned monthly

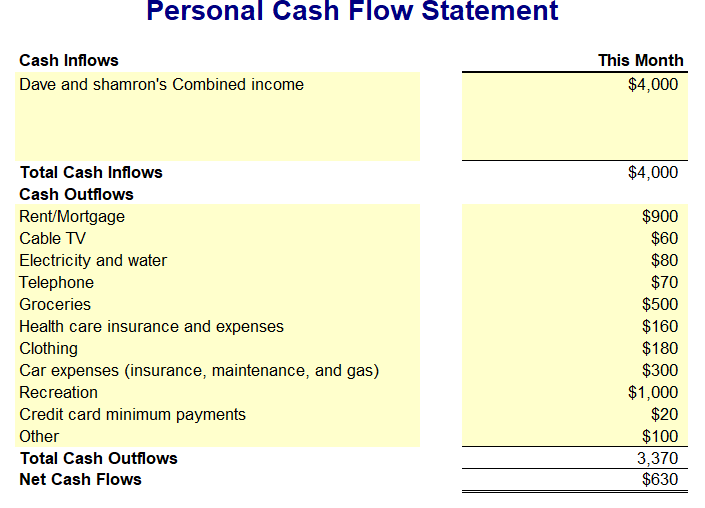

Based on the cash flow statement and personal balance sheet, do the Sampsons have adequate liquidity to cover their recurring cash flows and planned monthly savings in the long-run? If not, what level of savings should they maintain for liquidity purposes?

Based on the cash flow statement and personal balance sheet, do the Sampsons have adequate liquidity to cover their recurring cash flows and planned monthly savings in the long-run? If not, what level of savings should they maintain for liquidity purposes?

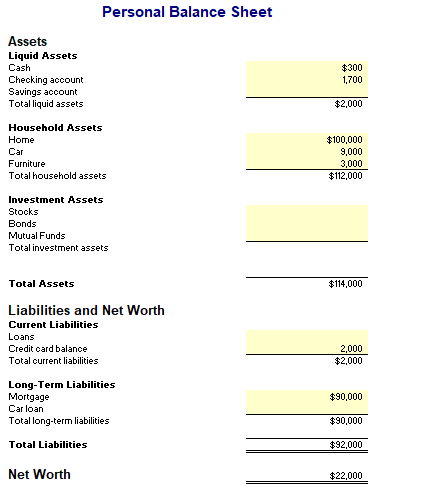

Personal Balance Sheet Assets Liquid Assets Cash Checking account Savings account Total liquid assets $300 1700 $2,000 Household Assets Home Car Furniture Total household assets $100,000 9,000 3,000 $112,000 Investment Assets Stocks Bonds Mutual Funds Total inuestment assets Total Assets $114,000 Liabilities and Net Worth Current Liabilities Loans Credit card balance Total current liabilities 2,000 $2,000 Long-Term Liabilities Mortgage Car loan Total long-term liabilities $90,000 $90,000 $32,000 Total Liabilities Net Worth $22,000 Personal Balance Sheet Assets Liquid Assets Cash Checking account Savings account Total liquid assets $300 1700 $2,000 Household Assets Home Car Furniture Total household assets $100,000 9,000 3,000 $112,000 Investment Assets Stocks Bonds Mutual Funds Total inuestment assets Total Assets $114,000 Liabilities and Net Worth Current Liabilities Loans Credit card balance Total current liabilities 2,000 $2,000 Long-Term Liabilities Mortgage Car loan Total long-term liabilities $90,000 $90,000 $32,000 Total Liabilities Net Worth $22,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts